ByBit Cryptocurrency Exchange Guide – Tutorial On How To Trade With Leverage

Traders are always searching for new ways of expanding their trading strategies and making them more profitable. At the end of the day, no matter which strategy you are following, matters that we remain profitable and that these profits grow over time by making improvements where needed.

ByBit Cryptocurrency Exchange Guide – Tutorial On How To Trade With Leverage

Traders are always searching for new ways of expanding their trading strategies and making them more profitable. At the end of the day, no matter which strategy you are following, matters that we remain profitable and that these profits grow over time by making improvements where needed.Trading in traditional spot exchanges can be useful when we are starting to make our first trades and when we prefer to have less exposure to risky strategies. However, it is also possible to increase our profits with margin trading.There are different cryptocurrency exchanges in the market that are offering users the possibility to trade with leverage and improve their trading strategies and increase their profits. One of these crypto exchanges is ByBit that is offering clients a user-friendly experience to start trading with leverage.

Disclaimer: Before starting this article we inform that trading with leverage is highly risky and only traders with the necessary experience will be able to do so profitably. Never invest more than what you are able to lose. You can always read our full guide about BitMEX and how to trade with leverage.

ByBit Introduction

The cryptocurrency exchange ByBit is becoming a very useful platform for traders to handle their cryptocurrencies. Surprisingly, the platform does not only offer support to Bitcoin but also to other altcoins in the market.This exchange is very similar to BitMEX and it is usually considered an alternative to it considering it was able to gain exposure to investors, create liquidity for a highly requested market and offer a stable platform for trading cryptocurrencies.One of the best things about ByBit is that it has an improved trading system that reduces the system overloads that users could experience while trading with BitMex. It is worth mentioning that users in the United States are not allowed to participate in this platform.

What is Margin Trading?

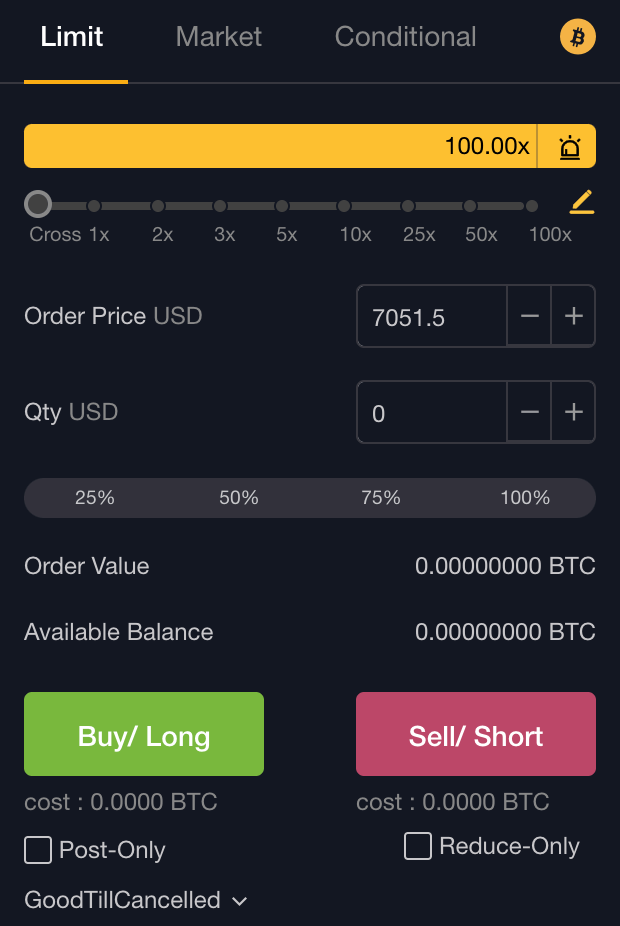

Margin trading is a trading strategy in which users handle borrowed funds in order to have larger returns while making a specific trade. Margin trading is usually used by trading experts that want to increase their profits. As mentioned before, margin trading is risky and just experienced traders are able to recognize where to enter and exit a trade, how much leverage to use and for how long.It is possible for traders to use leverage between 2:1 or 100:1. Some services offer customers higher leverage that could be up to 200:1, which is highly risky. If you start trading with 1 BTC and you use 2:1 leverage, you will have the chance to trade with 2 BTC. Once the trade is closed, you will give back the funds to the party that gave them to you, you pay the trading fees and the profits remain in your account.Users’ assets will be working as collateral for the borrowed funds. This is certainly important considering this would be your threshold while trading with leverage. The position you opened could get liquidated if the market crosses this specific threshold. This threshold is known as the liquidation price for your order.Some of the virtual currencies offered by ByBit include Bitcoin, EOS, XRP, and Ethereum (ETH). In the future, new cryptocurrencies could be added to the exchange. Users that want to trade with leverage will be able to do so up to 100x with BTC/USD, and 50x with the remaining trading pairs (ETH/USD, EOS/USD and XRP/USD).

Understanding Order Types On The ByBit Exchange

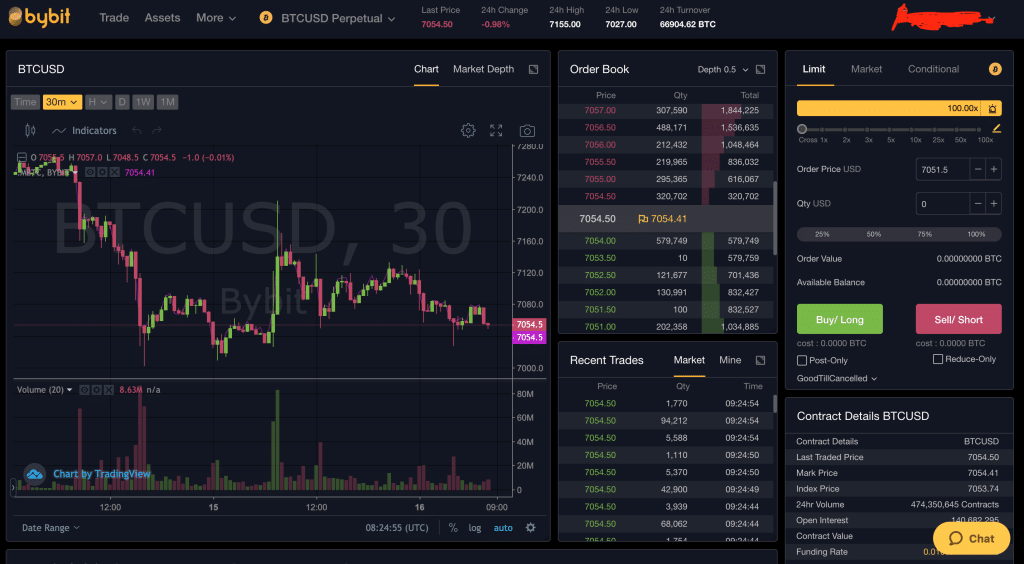

While trading with ByBit, users will have a large number of options and order types. That means that according to their trading strategy they will be using different orders.The two most common orders are market and limit orders.Market (taker) Order:Market orders are those orders that allow users to enter or leave the market at a specific moment at the current price traded by individuals. It gets executed immediately, making it easier for individuals to exchange their funds. In general, market orders have higher fees than limit orders. These orders have a fee of 0.0750% for all the trading pairs in the ByBit exchange.Limit Order:These are very similar to market orders with a very important difference, these orders increase liquidity. When a user generates a limit order, the order book registers it and allows market takers to acquire or sell cryptocurrencies at the price specified by the trader. The order will remain in the order book until the price reaches that level. These orders have a fee of -0.0250% for all the trading pairs in the ByBit exchange.Conditional Order:These orders allow traders to create a conditional market strategy. That means that the order (can be a limit or a market order) will get executed only if the market meets specific conditions established by the trader.

Long and Short Positions

Users can easily open long and short positions while trading using ByBit. This is going to be determined on the sentiment on the market and the overall trend of a specific trading pair. For example, if a specific asset is moving in an upward trend the best thing would be to open a long position. However, if the asset is trending downwards, a short position would suit better.Basically, long positions bet the price of the asset will trend upwards, while a short position is a bet on the price moving down.

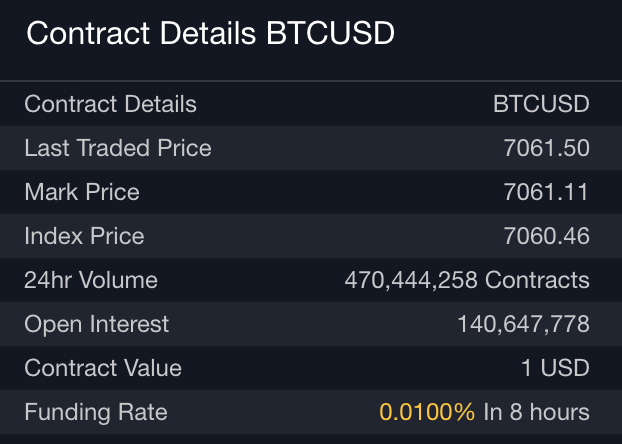

The common thing that these two positions have, is the fact that users’ balances will be used as collateral for the funds that were borrowed while trading with leverage. Once the trader is closed with profits, the borrowed funds are returned, the collateral comes back to your account and some fees will be discounted from your account.Things look different if you get liquidated. That means that the collateral you used will be used to pay the funds borrowed and the fees involved in the trade. A trade gets liquidated when the collateral is not enough to resist a large price swing on the contrary direction of your trade.It is worth mentioning that the funding rate for all the trading pair is 0.01% every 8 hours.

Stop Loss and Take Profit

While trading both on ByBit and BitMex, it is certainly important to understand how to use the stop loss and take profit functions.While using stop loss we will be sure that we will not be liquidated, meaning we will be reducing our losses in case the market moves on the contrary direction we were waiting. If we get liquidated, our collateral will be used to pay to the borrower, which will be a massive loss for us.The stop loss should be placed between the liquidation price and the price the asset is currently being traded. The closer the stop loss order to the current market price, the lower volatility our position would resist.A take profit order would allow us to close a trade if we are profitable. It is possible to select the percentage we decide to place the take profit order. Once the price reaches that level, our position will be profitably closed and our funds will appear in our account.

Bitcoin Vs Altcoins ByBit Margin Trading Strategy

ByBit gives us the possibility to trade Bitcoin and other cryptocurrencies. It is possible to create different trading strategies according to market conditions. In some cases, it would be useful to open a position in Bitcoin markets and in other cases, it may be more profitable to do so with altcoin markets.It is always important to follow which is Bitcoin’s trend considering that in many cases it is the market leader. If Bitcoin grows or falls, altcoins tend to follow but usually in greater magnitudes due to their lower liquidity.At the same time, traders should understand whether the market is moving in tandem or if there are some cryptocurrencies moving independently.

For example, it might be possible for Bitcoin to grow and altcoins to fall. In this case, it would certainly be profitable to open long positions on Bitcoin and short positions on altcoins. The earlier you enter the trade, the larger the potential profits you can have. However, risks are also greater considering the trend may require some time before confirming it is moving into the right direction. There are several trading strategies that you will be able to develop in the future and that will help you trade profitably. With the crypto and FX trading signals provided by AltSignals, you will have the possibility to confirm the strategies you had were in the correct direction. If you are a novice trader, the AltSignals trading signals will help you start creating your own profitable strategy to handle cryptocurrencies and trade with leverage.

How To Handle Risk While Trading On ByBit With Leverage?

If you are trading with leverage through ByBit, you will also want to regulate the exposure that you have to risk. This is certainly important if you are a novice trader.

- If you are a novice trader and you are just starting to trade cryptocurrencies, the best thing you can do is to start trading in traditional spot exchanges such as Binance. This would allow you to learn how the market moves, how a trading exchange works and you will eventually become familiarized with the whole system.

- If you are a novice trader and you want to trade with margin, you can always start with small amounts. This would reduce your exposure to the market and reduce the risk you are currently handling.

- Start trading with limit orders rather than market orders. That would make it easier for you to handle fees considering they tend to be smaller than with market orders. If you open a position, then you have higher possibilities of being profitable.

- Trade with low leverage when you are not yet confident about the positions you open. When you are still learning and testing the platform, try reducing the leverage you use on your position, this would also help you to lower your risk and funds that are at stake.

- Try closing the trade even with a low profit rather than waiting for a longer period of time. It is sometimes better to close a deal with a small profit that taking the risk to increase them. You should always evaluate this situation and decide what to do according to the market.

- Learn how to use other crypto platforms that do not use leverage. This would also help you to understand how market and limit orders work, how markets move and many other things that would make it easier for you to trade using the ByBit exchange.

- Always use the stop loss function that will help you reduce the risk you have while trading cryptocurrencies with leverage. Although you will still lose money if the trade doesn’t go in the direction you were searching for, we will not be liquidated, which will end up increasing the funds you lose.

If you are not comfortable with the tips presented here, you can always try trading in other exchanges that do not have leverage and where you can handle small amounts of funds so you will be able to learn the basics of the cryptocurrency market.

Perpetual Contracts on the ByBit Exchange

Perpetual contracts on the ByBit exchange do not have an expiry date, unlike futures trading. Users can hold on to the contracts as long as they want. Moreover, the perpetual contracts are always anchored to the Spot price.Users should know that perpetual contracts at the exchange use an Auto Deleveraging (ADL) system as a contract loss mechanism that protects traders from being affected by large losses caused by risky traders.Furthermore, the exchange can handle 100,000 transactions per second and each matching is completed within 10 microseconds. The exchange is also not affected by server downtimes and its functionalities and availability are up 99.99% of the time.

Conclusion

ByBit is a cryptocurrency exchange that would allow you to trade with leverage different cryptocurrency pairs. The platform is very similar to the trading platform provided by BitMex, however, there are some differences between these two. One of the positive things of ByBit is the fact that it has an improved trading system that tends not to affect users trading and it is able to process 100,000 trades per second.At the same time, the platform will help you have a larger exposure to the cryptocurrency market and to specific trading pairs that include cryptocurrencies such as Bitcoin, EOS, XRP and Ethereum. In the future, new trading pairs could be added to offer solutions to a larger number of users in the crypto space.You can also read our full guide about the Binance exchange and how to trade with and without leverage.

Trade Like a King With AltSignals

Are you a novice trader and you’d like to improve your trading skills? Are you a trading expert and you want to confirm your moves are accurate? AltSignals is the right tool for you. With AltSignals you will receive one of the most accurate trading signals in the market. Check it out and don’t miss a trade anymore.

Disclaimer: The information presented by AltSignals and its writers is for informational purposes only. It should not be considered legal or financial advice. AltSignals and its writers are not financial advisers. You should consult with a financial professional to determine what may be best for your individual needs.AltSignals and its writers do not make any guarantees or other promises as to any results that may be obtained from using their content. No one should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence.Please always invest within your means and do so responsibly.

We are a large scale cryptocurrency community

providing you with access to some of the most exclusive, game changing cryptocurrency signals, newsletters, magazines, trading indicators, tools and more.