Crypto Trading Patterns And How To Spot Them

While trading cryptocurrencies, individuals will realize there are some differences with traditional markets. One of the reasons behind these differences is related to the lower liquidity the market has.Trading Bitcoin (BTC) and other cryptocurrencies could be tricky considering there are many unexpected movements in the market that can be triggered by a large buyer or seller.

While trading cryptocurrencies, individuals will realize there are some differences with traditional markets. One of the reasons behind these differences is related to the lower liquidity the market has.Trading Bitcoin (BTC) and other cryptocurrencies could be tricky considering there are many unexpected movements in the market that can be triggered by a large buyer or seller.Two of the most popular moves experienced by Bitcoin and other cryptocurrencies is the so-called Bart trading pattern and ‘the chair.’ In this article, we will make a review of these patterns, how to spot them and which could be a good strategy to reduce our risk while trading.

Crypto Trading Patterns

Trading patterns can be defined as specific movements experienced by the price of assets on a chart. These patterns have similarities in the way they are formed, how they evolve and eventually how they end.These patterns can be very useful to trade because it could help an analyst, chartist or trader to identify a specific market movement in the short, mid or long term. In general, it is possible to recognize these patterns in the same or different assets in different periods of time.Although recognizing the patterns once they happened it is an easy task, it is a very strong skill for traders to recognize them before they take place. Nonetheless, considering the cryptocurrency market is a very volatile market, it becomes highly difficult to trade some of these patterns beforehand.As mentioned before, two of the most recognized trading patterns are the so-called ‘Bart’ and ‘the chair.’

Bart Crypto Trading Pattern

The Bart cryptocurrency trading pattern became known in the crypto space for being a recurrent price performance of different crypto assets. The name of this pattern comes from the fictional character from the TV series The Simpsons.

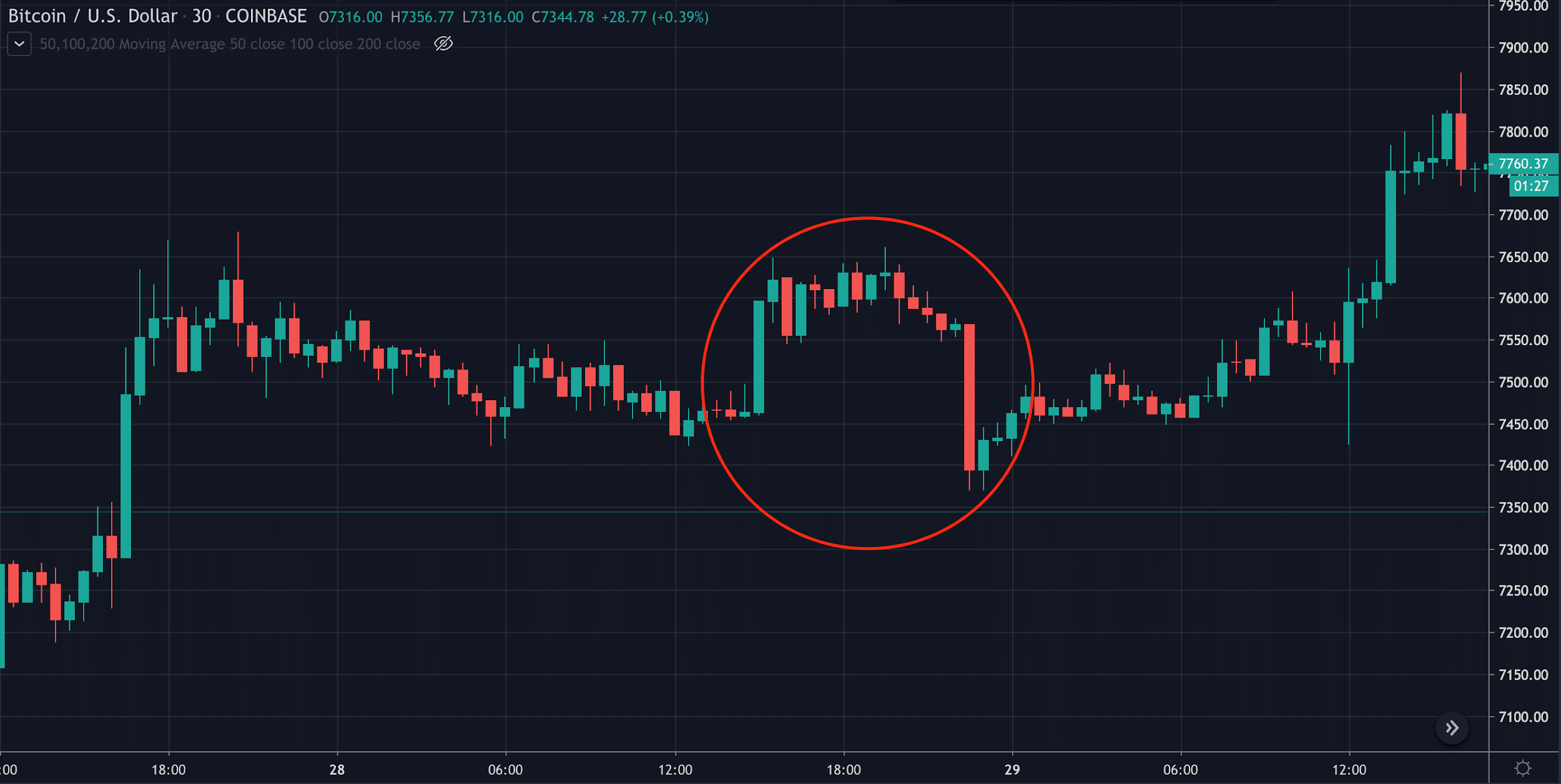

When the market operates with enough liquidity, these Bart patterns shouldn’t take place because the order books would be able to easily absorb a large market order without having a momentaneous instant impact on the price of an asset.However, Bitcoin and cryptocurrencies have inefficient markets that are not yet prepared to handle large market orders. Indeed, whales (traders with large amounts of funds) tend to place massive market orders that eventually make the price of an asset to surge several percentage points in a few minutes.Nonetheless, this is almost obviously not a genuine price increase. The order book losses its liquidity but after a few hours, the market tends to put the price down as fast as it went up. This happens because traders recognize the market order placed by the whale artificially affected prices and the order book does not get filled with new orders.This generates the Bart pattern that can be seen in the image above. These patterns tend to be formed in just a few minutes or hours rather than days.

The Chair Crypto Trading Pattern

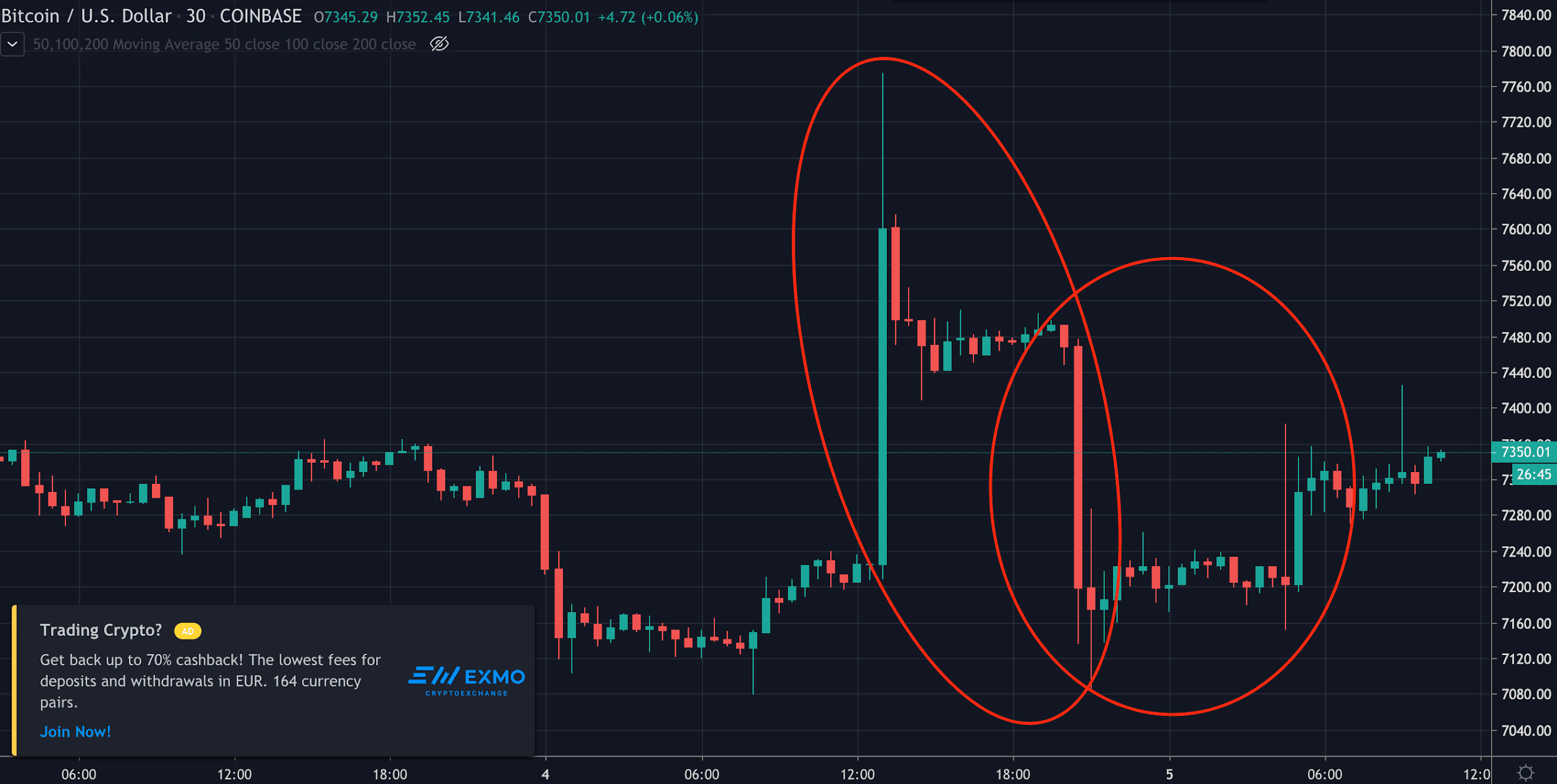

Another funny and weird crypto trading pattern is the one dubbed ‘the Chair.’ This trading pattern looks similar to a Bart pattern but it has an additional feature.A large whale makes a market order in which the price of an asset surges in just a few minutes. After this takes place, the candlestick chart generates an upper shadow that can be almost as long as the candlestick itself.Nevertheless, the market retraces around 50% immediately after, where it will be traded for some minutes up to a few hours. As in the Bart pattern, the order book does not get filled with new orders prices fall to where they were before the whale placed the market order. This completes a 100% retracement from the top of the candlestick.https://twitter.com/krugermacro/status/1202332469560778752?s=20

In the image uploaded above, it is possible to see a chair pattern combined immediately after with an inverted Bart pattern.If the market would have higher liquidity, these patterns would not be so common and they may not even appear at all.

Conclusion

Cryptocurrency traders should be conscious that the crypto market is still inefficient. Liquidity is very important in order for users to be able to trade without having to face massive price increases or drops.However, knowing how to spot one of these patterns once it takes place, could help individuals trade the market profitably in many occasions.If you want to receive advanced trading signals, you can visit AltSignals and receive trade calls for both crypto and forex. In this way, you will have new tools to increase your profits while trading in the cryptocurrency market.

We are a large scale cryptocurrency community

providing you with access to some of the most exclusive, game changing cryptocurrency signals, newsletters, magazines, trading indicators, tools and more.