Trade volume of Bitmex triples that of Binance in BTC price rally

During the last weeks the market has witnessed the highest levels since the last upward trend that took place 2 years ago, reaching the highest prices of cryptocurrencies this last weekend, in which the Bitcoin reached its peak for 16 months. Binance represents one of the leaders of marketing at the level of exchanges, however, Bitmex has managed to triple its market volume in the last period.

Trade volume of Bitmex triples that of Binance in BTC price rally

During the last weeks the market has witnessed the highest levels since the last upward trend that took place 2 years ago, reaching the highest prices of cryptocurrencies this last weekend, in which the Bitcoin reached its peak for 16 months. Binance represents one of the leaders of marketing at the level of exchanges, however, Bitmex has managed to triple its market volume in the last period.

Recently, cryptocurrency trade has increased by 57% and 80% in the first five exchange houses, through a rally that managed to bring the market to numbers like USD 370 billion. After this record, one of the high-reputation exchanges in Bitcoin futures trading, Bitmex, has managed to reach the first place in the list of CoinMarketCap by volume negotiated, tripling Binance, who would have been his most arduous rival.

We could just appreciate the rise in the price of BTC to $13,800, which greatly increased the volume traded of the tokens in BitMEX, from this way more than $ 5,400 million in a single day during last Monday, to $ 9,900 in the same time frame. It is estimated that the growth has been 80.49%.

BitMEX currently has trade figures that triple those of Binance, who has been ranked second in CoinMarketCap. It is registering negotiated volumes of $3,578 million, showing a brand of 73.06%. The exchange, led by Changpeng Zhao has carried out a serious and committed management, which managed to preserve user funds during the popular hacking registered by 7,000 BTC.

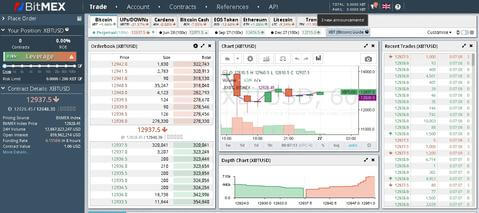

It should be noted that BitMEX is a Bitcoin derivatives platform. Unlike exchange houses like Binance, where trading is done directly with cryptocurrencies, BitMEX users invest in collateralized contracts at the bitcoin price.

On Saturday, June 22, BitMEX recorded its maximum trading volume in one day. According to some media, at some time that day exceeded USD 10,600 million. TradingView data indicate that the record was fixed USD 8,690 million negotiated.

The fact was commented on Twitter by analyst Joe McCann, founder, and president of NodeSource, who called attention to the fact that the record was reached on a Saturday. Recall that the global stock markets are closed on weekends, while Bitcoin trade is exercised every day of the year, uninterrupted.

The increase in the volume of Bitmex trading occurred in the context of the start of a rally in Bitcoin prices, took its value above USD 11,000, this Saturday. The price run of BTC has been sustained so far this week, launching its maximum value up to USD 13.800, the price reached for the last time in mid-January 2018. The appreciation of the cryptocurrency is 13, 44% in the last 24 hours.

According to the data available from Bitmex, the previous maximum trading volume occurred on May 11, 2019, when USD 7,858 million in derivatives of BTC were moved.

Another analyst of the cryptocurrency market, Alex Kruger, reported through his Twitter account that the trading margin of the Bitmex financing margin reached 0.2965%. Kruger found that these values only observed 10% of the time during 2017 and at no time in 2018. According to his calculations, the annual rate of BitMEX is equivalent to 325%.

The comments of some Twitter users about Bitmex’s new historical highs reflect optimism in the face of Bitcoin’s bull market. However, others believe that the volume movements of Bitmex are not real, and should not be included in a realistic analysis of the cryptocurrency market.

Similarly, figures from the “10 reals” of Messari, where an index based on the 10 exchange houses with proven volume is created, show a bitcoin capitalization of USD3,174 million. This figure was at the beginning of June at around USD 500 million, which could indicate the entry of operators who expect bitcoin’s momentum to continue in the coming months.

The list keeps moving

OKEx and HuobiGlobal have also managed to build an impressive market volume, reaching $ 54,817,370,506 and $ 42,690,684,507 in a month, respectively. This increase represents a 99.18% increase in OKEx, while HuobiGlobal presents 113.16%, surpassed by platforms such as CoinTiger (151.39%), and CoinbasePRO (197.33%) in terms of trading levels.

The community is attentive to the level of capital handled by each company, a factor that can be reflected in their platforms. In the case of BitMEX, there has been an increase in the number of professional traders who decide to deposit their investments in the exchange, which find the various trade options available on the portal very useful. The future will tell the progress of its competitiveness with Binance.

We are a large scale cryptocurrency community

providing you with access to some of the most exclusive, game changing cryptocurrency signals, newsletters, magazines, trading indicators, tools and more.