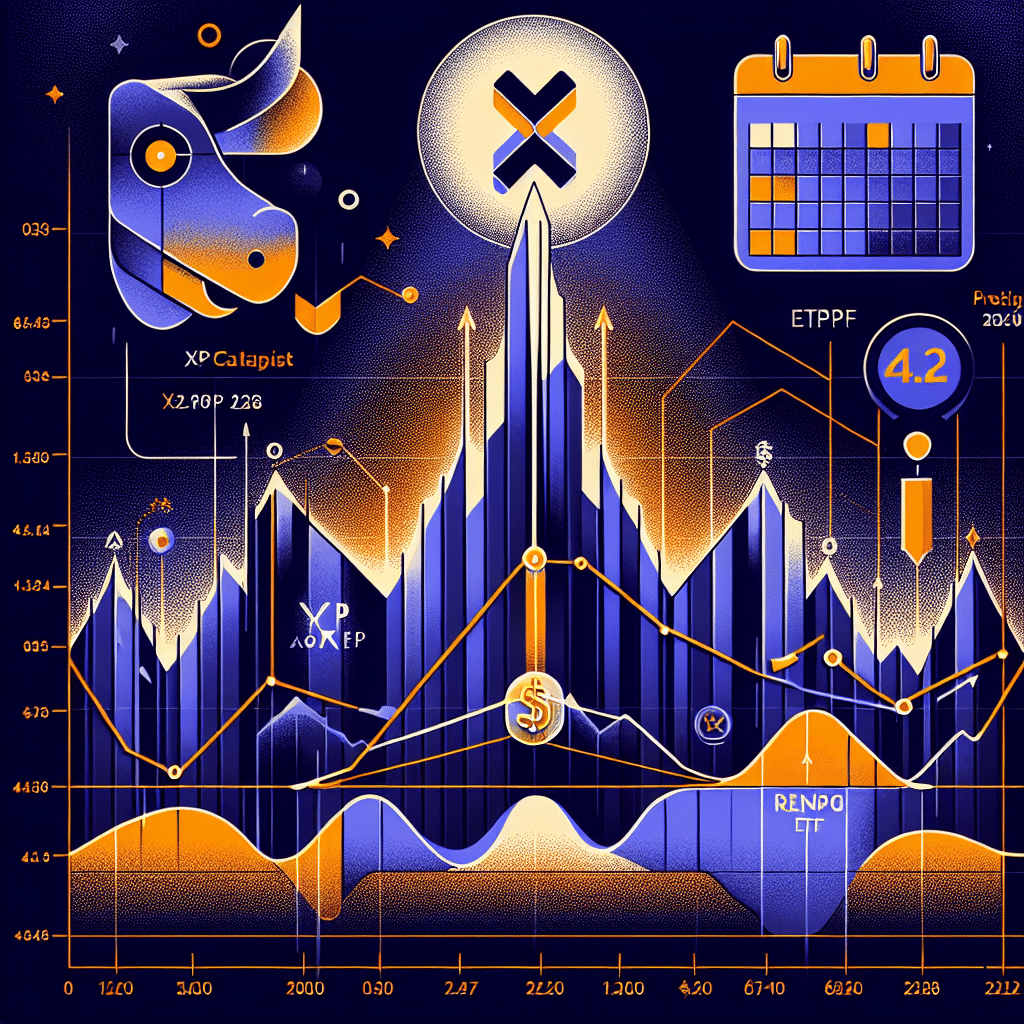

XRP Financial Forecast: Potential for Recovery Despite Bear Market

After suffering a dramatic 22% drop from its peak this year, XRP, a prominent cryptocurrency, continues to navigate turbulent waters in a bear market. Despite the downturn, several indicators suggest a possible resurgence. The currency’s strong technical features, paired with the approaching deadlines for Exchange-Traded Funds (ETFs), point to a potential revival in its fortunes.

Technical Indications Suggest a Price Upsurge for XRP

The detailed analyses of the currency’s standing in the marketplace reveal encouraging signs. Ripple’s XRP appears to be gearing up for a significant breakthrough. This is indicated by the formation of a falling wedge, a pattern well-recognized among traders for its bullish implications. Moreover, there’s mounting evidence suggesting a surge towards the impressive $4.2 mark.

In addition, the Murrey Math Lines (MML) tool, a popular instrument designed to identify potential resistance and support levels, hints at a positive trend. By breaking down the price evolution into an eight-part grid or octave, the MML tool offers valuable insights into price movements. Interestingly, XRP has established itself at a robust pivot reverse level of the MML – a spot renowned for bouncing back.

Potential Rebound Indicators

The confluence of several factors signals a strong possibility of a sharp rebound. The cryptocurrency has settled at the strong pivot and reverse level, known for its rebound potential. More crucially, this position aligns with a double-bottom pattern at $2.7167 and falls in line with the falling wedge pattern. These elements combined cast light on the potential for a vigorous recovery.

Assuming a successful breakout, the first target level one might expect is the year-to-date peak of $3.6512, marking a considerable 30% rise above the present level. Guided by the Murrey Math Lines’ indications, an ultimate bounce back to the overshoot at $4.29 seems feasible. This figure signifies an impressive increase of about 55% from the prevailing level. On the downside, a slump below the final support point at $2.34 would refute these optimistic predictions.

Upcoming ETF Approvals: A Catalyst for Growth

The primary stimulant expected to influence the XRP price forecast is the impending deadlines for XRP ETFs. Significant milestones are due to be met in October and data from Polymarket suggests the likelihood of approval is astonishingly high at over 88%. Consequently, one might anticipate investors to acquire the currency in anticipation of the approvals, as they envisage strong inflows as a result.

Further evidence that supports this line of thinking can be seen in the futures market. The open interest for CME contracts has seen a significant increase in recent weeks. Notably, existing Bitcoin (BTC) and Ethereum (ETH) ETFs have witnessed substantial inflows over the past year, indicating a robust demand for these commodities and a positive outlook for XRP by extension.