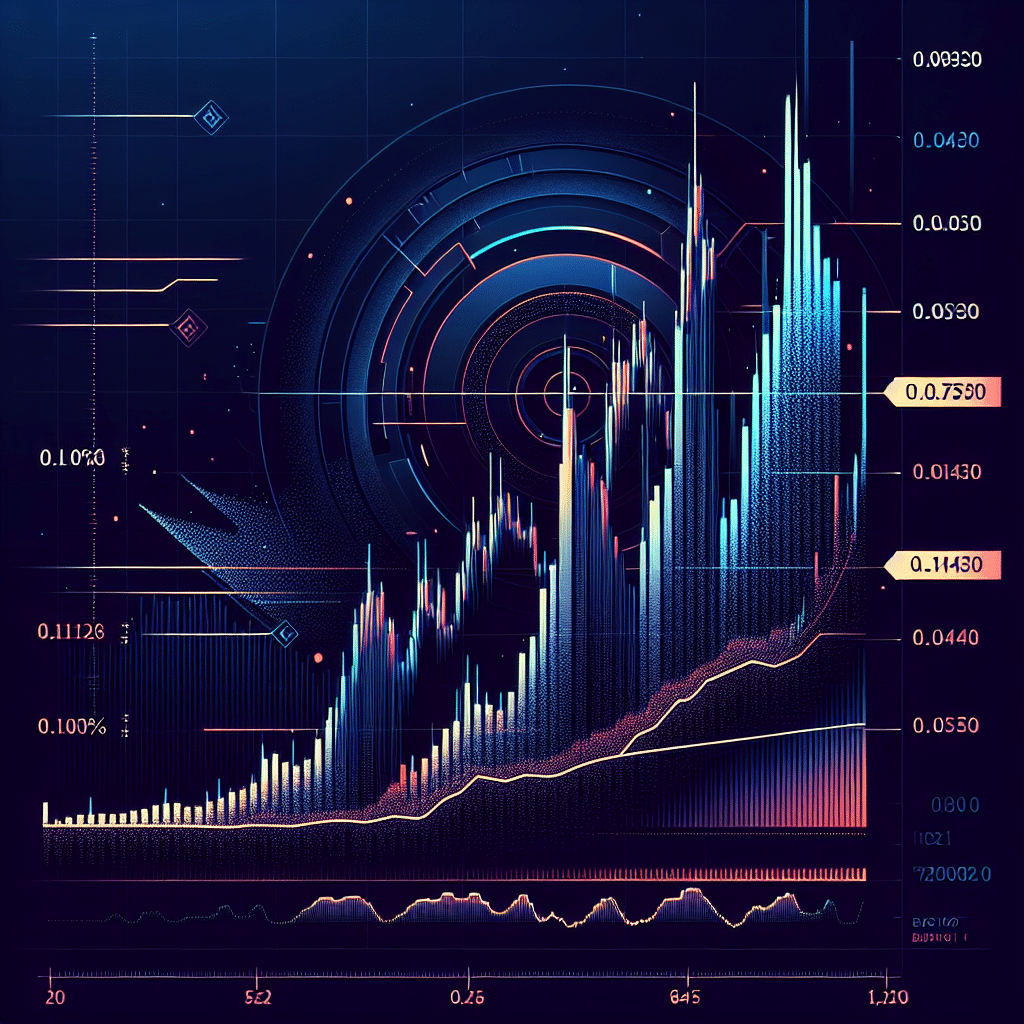

The cryptocurrency FLOKI has recently been on the radar of many due to its impressive performance in the trading markets. The coin experienced a growth of 10.75%, significantly rebounding from a critical support level. With a bullish trend already in effect, the focus has now shifted towards a major resistance level. If overcome, this level may instigate a further 22 percent surge.

Being part of the latest trading buzz, FLOKI coin demonstrated a robust performance by gaining a substantial 10.75% in the recent trading sessions. This striking increase followed the successful reoccupation of a high time zone support area, all the while maintaining an optimistic market structure.

Though the broader trend suggests a potential for more gains, the subsequent phase of the rally hinges on a vital technical resistance level. A breach in this level may spark a commanding move towards the upper limit of the current trading channel.

Decoding the key technical aspects

- Recovery of Support: FLOKI coin rebounded from 0.9030 sats, a significant zone that aligns with the 0.618 Fibonacci and channel low.

- Impending Major Resistance: The next strategic level is at 0.1144 sats; passing this resistance might fuel a 22% surge in the market.

- Formation of Apex Zone: The convergence of the 21 EMA (Exponential Moving Average) and resistance suggests a potential imminent breakout.

The positive shift was initiated when FLOKI maintained the 0.9030 satoshi level, which coincides with both the 0.618 Fibonacci retracement and the lower boundary of a parallel channel. These successful tests essentially validated this zone as a support level and a launchpad, propelling the price towards the current resistance at 0.1144 sats.

This resistance level is vital in FLOKI’s optimistic setup as it is not only a horizontal high time frame resistance, but also coincides with the midpoint of the channel, a level that often dictates trend continuation or rejection in range-bound markets. A confirmed breakthrough and subsequent closure above this midpoint would considerably increase the likelihood of a continuation move towards the channel’s peak which implies a potential 22 percent upside.

Adding to the momentum, the 21-period moving average gradually moves into the price range, acting as dynamic support. With this moving average converging with horizontal resistance, FLOKI has started trading within an apex zone, a compression zone notorious for accumulating volatility before a substantial resolution.

For now, the lower timeframe structure remains optimistic. The more frequently the price tests resistance while retaining higher lows, the stronger the base for a possible breakout becomes. This is particularly true if accompanied by rising volumes. A successful breakout would face minimal immediate resistance, thereby improving the chances of an expedient push towards the channel’s peak.

Anticipated trajectory of forthcoming price action

If FLOKI steadily retains its optimistic structure in the lower timeframes and manages to surpass 0.1144 sats with sound volume confirmation, the upcoming rational target is the channel peak, signifying a potential gain of over 22 percent. As momentum builds, it is anticipated that a surge might unfold in the near future.