Dogecoin’s Intense Overnight Sell-off

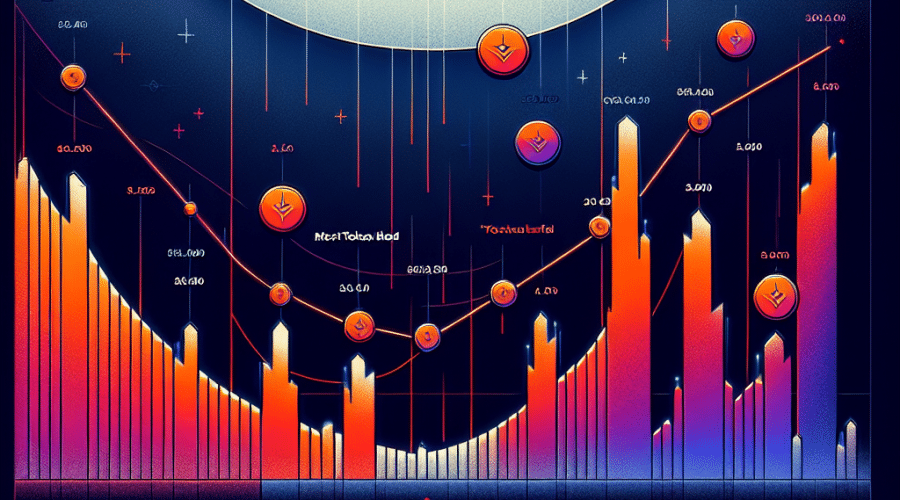

Having recently faced an intense overnight sell-off, Dogecoin slid from $0.27 to $0.25 during the session of September 21-22. This sell-off was spearheaded by institutional traders who downsized their positions at an unprecedented rate, with trading volumes reaching over 2.15 billion tokens. This midnight flurry of activity was potent enough to slice through previous support levels and establish brand new zones of resistance in the Dogecoin market.

Facing these drastic shifts, Dogecoin traders have now found themselves in a state of consolidation around the $0.25 mark. This has left them eagerly tracking the potential signs of recovery or a further slide.

All About the Numbers

In the 24-hour period that came to end on September 22 at 02:00, Dogecoin’s price fell by as much as 7%. It stepped back from the previous value of $0.27 to end the day at $0.25. Trading during midnight recorded a significant dramatic plunge from $0.26 down to $0.25. This was based on an eye-watering volume of about 2.15 billion, remarkably overpowering the typical 24-hour average volume of 344.8 million.

The range at which DOGE fluctuated was between $0.27 (at its peak) and $0.25 (at its lowest). This showed a variation of $0.02, around an 8% difference. Following recurrent rejections, a solid resistance was outlined near the $0.27 mark.

Institutional Support and Trading Patterns

In terms of institutional support, there were notable signs around the $0.25 threshold; with sustained attempts at recovery helping to keep Dogecoin well anchored above this level.

During the final hour recorded between 01:14 to 02:13, Dogecoin experienced a bounce within a rather tight span between $0.25 to $0.25. This was marked by relative accumulation patterns that exhibited spikes at precisely 01:25 and 02:03. The colossal volume of 2.15B tokens traded during the midnight dump session points towards a substantial degree of institutional activity.

Resistance, Support and Projections

Key resistance is held up at the $0.27 mark, with the next upside tests anticipated at the $0.28 to $0.30 range, should buying resume. According to the analysts, 1-2 pattern formation, often preceding Dogecoin breakouts at instances above $0.28 to $0.30, has been flagged.

A strong support has been found at the $0.25 level for now, but a break through this level runs the risk of accelerating decline towards $0.23. This lack of support may be an indicator of an emergent downward slide.

Meanwhile, the volume spikes that have been noticed during attempts at recovery may signal an emerging interest in bottoming out the market.

What Traders Are Cruising For

Traders are now fixated on whether the $0.25 mark can stand firm as a durable support line, following reports of record liquidation flows. Those traders backed by institutional support are critically watching the recovery around the bands of $0.28 to $0.30 resistance.

Traders are also consistently looking out for decisive trading volumes in the forthcoming sessions. This will confirm whether accumulation or more distribution will be the dominant force in the market. Another eye is kept on the broader sentiment roiling from constant delays associated with ETFs and the overall regulatory uncertainty.

This significant downturn in the fortunes of Dogecoin is a high-stakes game for traders, institutional investors, and the wider market alike. With traders and investors alike hoping for a rebound, the coming weeks and months will undoubtedly provide an exciting narrative for the virtual currency’s trajectory.

.27 to

.27 to