The Hyperliquid Whale: Doubling Down on Billion-Dollar Bitcoin Shorts

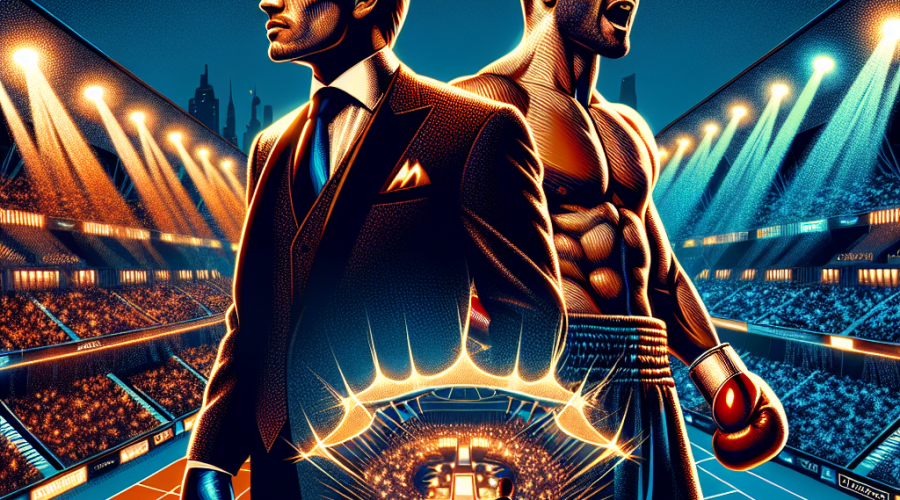

In the ever-volatile world of cryptocurrency trading, whales—investors or entities with extremely large holdings—often set market narratives with their bold moves. The latest headline grabber is a mysterious trader on Hyperliquid, an increasingly popular crypto derivatives platform, who recently banked $192 million from shorting the market and has now doubled down on another massive short bet. This new position, currently valued at nearly half a billion dollars, is sending ripples—and plenty of speculation—through the digital assets community.

Massive Bets Amid High Volatility

According to data from Hypurrscan, Hyperliquid’s block explorer, this whale now holds a short position worth approximately $496 million. The position is levered 10x, with a Bitcoin liquidation price of $124,270—well above current market prices, but close enough to be at significant risk if the markets rally or spike on surprising news. The Bitcoin price at the time of the report hovered near $112,090, signifying the position could withstand some price volatility but remains vulnerable to a short squeeze.

What makes this development even more staggering is the speed and scale at which the position was accumulated. Just a day earlier, the same wallet upped its bets dramatically by opening a $163 million position before ballooning to nearly $500 million. This move represents unwavering conviction and perhaps insider knowledge, as it comes on the heels of an impressive $192 million in profit from a previous short play.

Timing Raises Eyebrows and Speculation

The timing of the whale’s trades has raised suspicion and become the focus of heated debate among traders and analysts. Less than an hour before a surprise announcement by US President Donald Trump imposing new tariffs—news which promptly triggered a steep crypto market sell-off—the whale opened their latest short on Bitcoin. Such prescient timing prompted many in the crypto community to speculate on the possibility of insider information, with the wallet quickly being dubbed the “insider whale.”

This isn’t the first time the trader’s moves closely aligned with major market-moving news. In the previous week, the whale had already made headlines by opening $900 million worth of short positions spread across Bitcoin and Ethereum. Their ability to both predict and profit from market crashes is fanning rumors of a possible insider or at least someone with exceptional macroeconomic awareness.

The Whale’s Crypto Holdings and Market Influence

The entity behind these trades is not new to high stakes. Two months ago, blockchain watchers spotted the same wallet holding approximately $11 billion worth of Bitcoin. Such enormous holdings not only reflect an investor with immense resources but also grant the ability to sway market sentiment and potentially even short-term price action.

With the ability to deploy hundreds of millions of dollars in leveraged positions in a matter of hours, this trader’s activity becomes a critical signal for both retail and institutional investors. Many traders now closely watch the whale’s on-chain movements for clues on broader market direction.

Hypurrscan’s Data Illuminates the Moves

Hyperliquid’s block explorer, Hypurrscan, provides the crypto community with an unprecedented real-time view into large leveraged positions. According to recent data, the whale’s Bitcoin short was established at a liquidation price of $124,270. This position size and leverage mean a relatively small upward swing in Bitcoin’s price could trigger massive liquidations, risking both the whale’s capital and potentially creating further market volatility as collateral is sold off to cover lost positions.

Traders across social platforms and professional analysis groups have taken to plotting the whale’s strategy in hopes of uncovering underlying market trends. Some speculate the whale anticipates continued macroeconomic uncertainty or regulatory pressures, while others believe they are simply capitalizing on heightened near-term volatility.

Who Is the Whale? Unmasking the Mystery

The biggest question in the crypto trading world right now is: Who controls this wallet? Thus far, no definitive identity has been confirmed. Over the weekend, blockchain sleuths began pointing to Garrett Jin, the former CEO of BitForex, a now-defunct crypto exchange, as a possible owner of the wallet.

The theory gained momentum when prominent crypto researcher Eye released detailed threads suggesting the wallet’s ties to Jin, prompting Binance CEO “CZ” to share the allegation and call for further investigation. However, respected crypto detective ZachXBT later offered a different perspective, indicating the wallet might be controlled by an associate or client of Jin, rather than Jin himself.

Garrett Jin added more intrigue to the saga by publicly responding to CZ’s posts. Jin denied having any connection to Trump or his family and rejected any notion of insider trading. He added in another post, “the fund isn’t mine — it’s my clients’. We run nodes and provide in-house insights for them.” This statement, while denying direct ownership, admits a relationship with the involved funds, implying a possible consulting, advisory, or custodial role.

Community Reaction and Insider Speculation

The whale’s high-octane trading strategy and its apparent correlation with geopolitical events have left the crypto community divided. On platforms like X (formerly Twitter), Telegram, and Discord, some traders see the moves as evidence of deep market insight or collaboration with major players, while others suspect unethical access to private information.

The term “insider whale” has circulated widely, fueling additional suspicion and generating threads analyzing every blockchain transaction in detail. For many market watchers, the situation exemplifies both the benefits and risks of the transparency provided by blockchain technology: everyone can see the transactions, but the backstory is not always clear.

Broader Implications for the Crypto Market

The ongoing saga of the Hyperliquid whale brings into focus critical questions about the current state of the cryptocurrency market, especially as the asset class matures. Large, sudden positions have the potential to set off cascades of liquidations or to signal future volatility—making the space more difficult to navigate for retail traders.

Additionally, the possibility that large investors may possess knowledge of macroeconomic events before the general public introduces concerns about fairness and equal access to information. Although Jin denied any direct link to insider trading, the repeated alignment between high-profile events and the whale’s trades highlights the need for robust surveillance and regulatory oversight in crypto markets.

The transparency of on-chain data offers some measure of protection and has enabled community-driven investigations to flourish. Projects like Hypurrscan arm the public with the tools necessary to hold even anonymous whales accountable to some degree, marking a significant change from the opaque trading desks of traditional finance.

The Psychology Behind the Whale’s Strategy

Taking massive leveraged short positions after a major win is high-risk, high-reward behavior that could be part of a larger, multi-layered play. Some analysts theorize the whale may be “averaging in,” anticipating additional downward market sentiment from regulatory, geopolitical, or macroeconomic pressures. Others believe the whale’s outsized influence could itself exacerbate volatility, potentially triggering a cascade of follow-on trades from smaller investors mimicking the whale’s moves.

This dynamic often results in a feedback loop: the more attention a whale attracts, the more their trades are analyzed (and sometimes copied), leading to greater volatility and, paradoxically, more opportunity for sophisticated players to profit from herding behavior in the market.

Looking Ahead: Will the Bet Pay Off?

With nearly half a billion dollars riding on Bitcoin’s decline, the outcome of this bet will be pivotal. If the market continues to decline, the whale stands to reap another massive profit and cement their reputation as one of the shrewdest traders in crypto history. Conversely, if Bitcoin stages a rally and tests the liquidation price of $124,270, this position could unwind spectacularly, resulting in hundreds of millions in losses and potentially catalyzing a broader short squeeze.

The entire market will be watching the volatility unfold in the days to come. For now, the Hyperliquid whale remains anonymous but ever-present—a symbol of both excitement and anxiety at the intersection of technology, finance, and secrecy. One thing is certain: their trades are likely to be a bellwether for the crypto industry’s ongoing evolution, and anyone participating in digital assets ignores such signals at their own peril.