Bitcoin Skyrockets to Unprecedented Heights

In the ever-oscillating world of cryptocurrencies, another milestone has been reached as Bitcoin, the premier cryptocurrency, spiked to a monumental high of over $112,000 recently. This follows a series of attempts to breach the $110,000 mark, a feat which occurred for the first time since May, cementing a new high-water mark for the digital asset.

Bitcoin’s Performance Over the Year

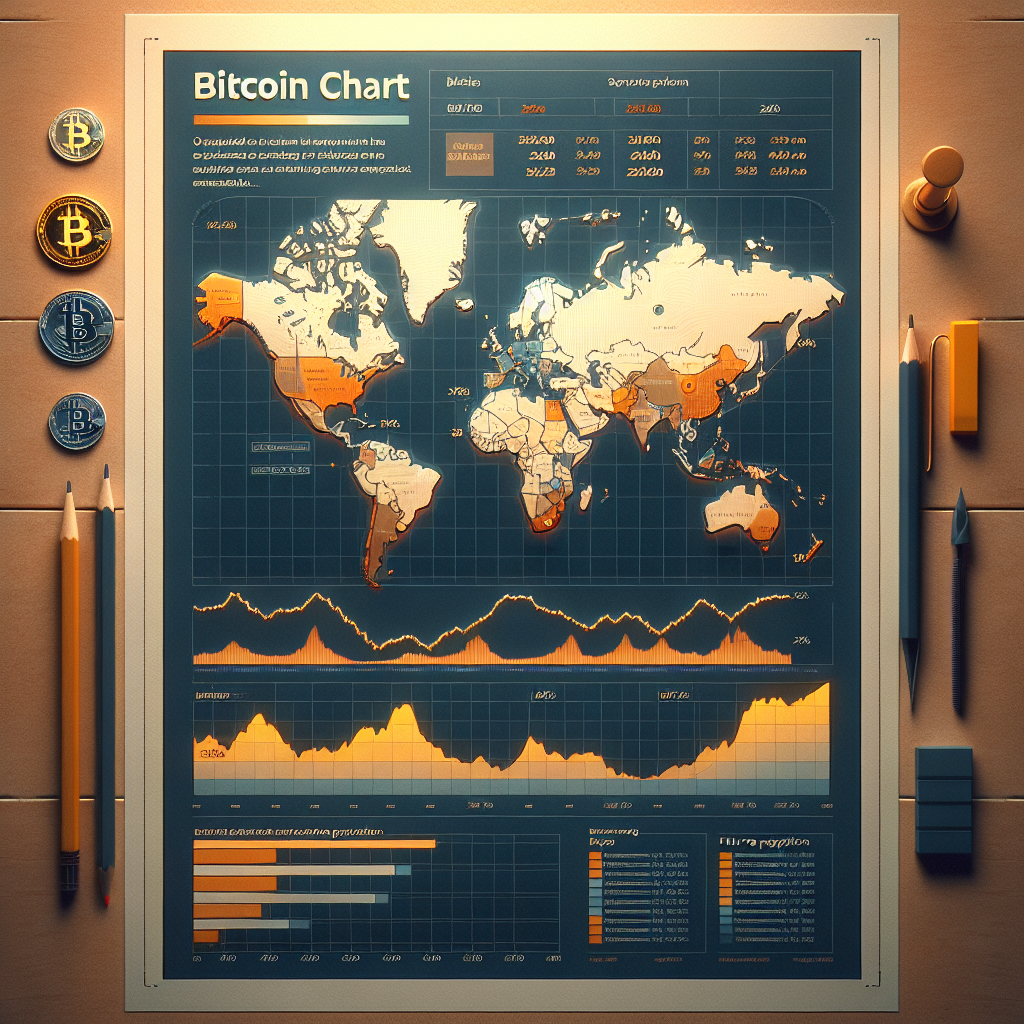

Analysing Bitcoin’s year-to-date progress, the currency has increased by approximately 20% since January. It’s worth mentioning that the cryptocurrency had suffered a setback in late June when it dipped below the $100,000 threshold. Nevertheless, displaying its innate resilience, Bitcoin managed to rebound quickly, with its price consistently hovering around the $111,000 mark after a brief surge above the $112,000 level.

Liquidation of Bitcoin Short Positions

Coinciding with Bitcoin’s historic high, data from Coinglass indicates an intriguing development involving the cryptocurrency’s short positions. The digital currency exchange platform reported nearly $340 million in liquidations of Bitcoin short positions across various exchanges in a four-hour timeframe around the establishment of the new peak.

Bitcoin as a Reserve Asset

Industry experts predict an ongoing trend towards accepting Bitcoin as a reserve asset as we head into the second half of the decade. According to these forecasts, Bitcoin will cease being a speculative commodity and establish itself further as an asset held by companies to mitigate exchange rate risk. This growing acceptance by companies is expected to fuel its rise.

Adding more sparks to the adoption fire, many Bitcoin holders are eagerly anticipating the U.S government setting up a strategic Bitcoin reserve. Although the odds for this governmental sanction have decreased considerably this year, a small glimmer of hope prevails in the crypto community. Establishing a strategic reserve would provide an added layer of legitimacy and acceptance to Bitcoin as a mainstream financial asset.

Bitcoin and the Stock Market

Coinbase Global and Bitcoin treasury company, Strategy, other noteworthy players in the Bitcoin market, also experienced a significant increase in their stock price, reflecting about a 5% rise. This surge in Bitcoin-related stocks reinforces the well-established correlation between Bitcoin prices and broader market trends. Interestingly, this was a day when the stock market in general, and the tech-oriented Nasdaq Composite in particular, showed substantial growth, hitting new highs.

Looking into the Future

The leap in Bitcoin’s value and its strong recovery from recent setbacks highlight the robust charm the cryptocurrency holds for investors worldwide. Riding on the waves of its strong performance this year and the growing adoption of cryptocurrencies as a reserve asset by companies, Bitcoin’s future looks promising. Though prone to volatility and regulatory uncertainties, as long as believers in the power of decentralisation back Bitcoin, its journey towards defining a new order of financial systems seems inevitable.