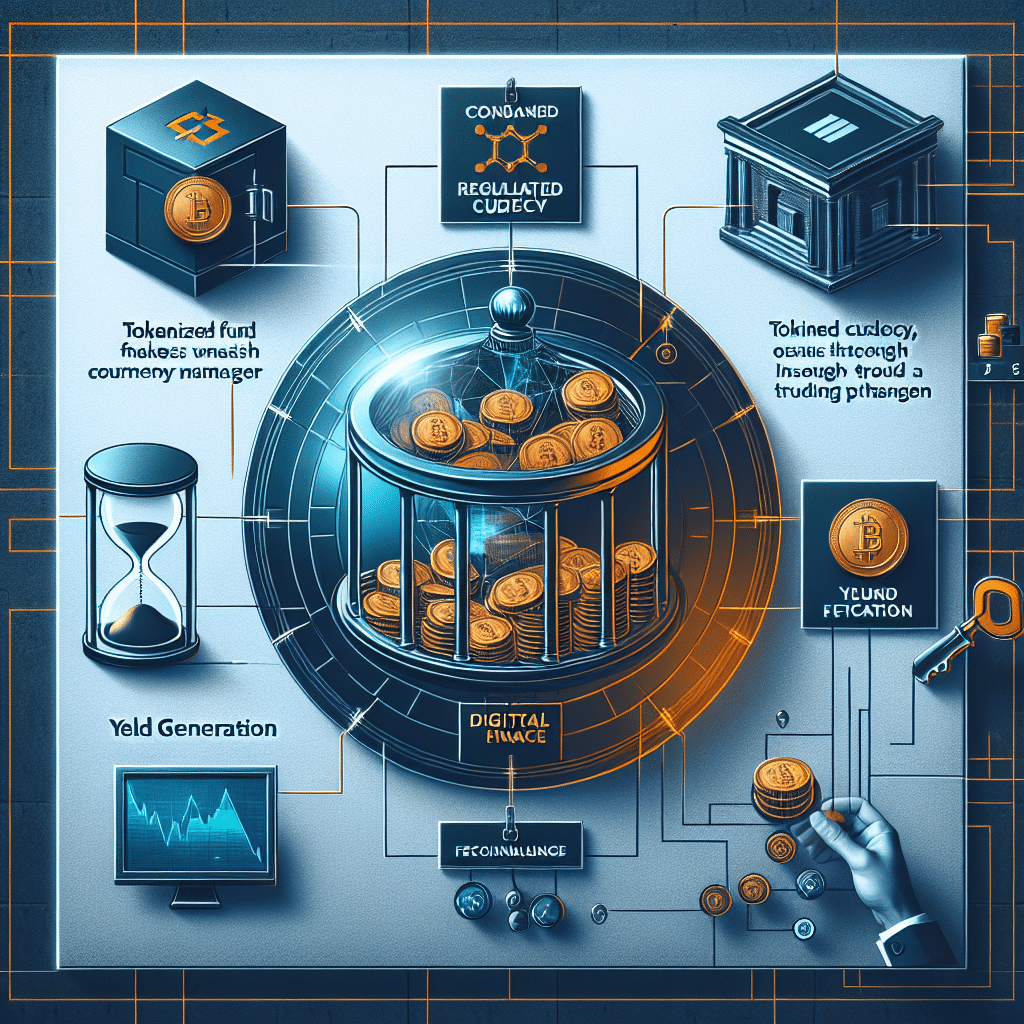

In a groundbreaking move setting a unique precedent in the world of digital finance, renowned asset manager Franklin Templeton has joined forces with Binance, the globe’s premier crypto exchange system, to unveil an innovative concept. This initiative enables institutions to use tokenized money market funds (MMFs) as collateral when trading on Binance.

Partnership Scope

The exchange system still leads the world in daily trading volume, and its partnership with Franklin Templeton, itself charged with overseeing approximately $1.6 trillion in assets, speaks volumes. As part of this collaboration, eligible clients can utilize tokenized fund shares. These are issued via Franklin Templeton’s Benji Technology Platform, which acts as collateral.

Benji embodies the firm’s innovative, blockchain-based technology stack. It serves as a proprietary asset assisting in the firms client proceedings, playing a critical role in the successful execution of this action. This technology allows the value of assets to remain, mirrored internally within Binance’s trading system, whilst being kept away from regulated custody exchange.

The Role of Custody Systems

Security is vital when dealing with vast sums of money and significant asset transfers. Therefore, custody and settlement are facilitated by Ceffu, Binance’s trusted institutional custody ally, ensuring the smooth executions of these operations.

This unique setup is aimed at lowering the risk to institutions while simultaneously enabling them to continue generating yield from their assets. The rising trend amongst firms offering yield serves a dual purpose. It is an effective competitive strategy, of course, but also signals the rapid shift of financial operations towards on-chain platforms.

Bigger Picture

Franklin Templeton’s Roger Bayston, Head of Digital Assets, notes the strategic importance of making digital finance more accessible. He discusses the inception of the off-exchange collateral program, which allows clients to put their assets to work in regulated custody, all the while earning yield in novel ways. In his words, Benji’s design was meant for this future, working with partners like Binance in delivering it at scale

Franklin Templeton’s Broader Vision

This launch comes as a notable part of Franklin Templeton’s more extensive plan to integrate MMFs into blockchain-based finance. The firm began its journey by maintaining total regulatory compliance and has since spearheaded the initiative to update two institutional funds. The idea was to support stablecoin reserves and enable distribution through blockchain systems.

Sustained Expansion of the Benji Platform

Franklin Templeton’s approach continues to evolve, as exemplified by the expansion of the Benji platform across public blockchains. September 2025 marked a significant step in this process when Franklin Templeton expanded Benji to include the BNB Chain. This expansion included pre-existing deployments on major platforms such as Ethereum, Arbitrum, Solana, and Stellar.

In the volatile world of digital currency, Binance’s native token BNB had a minor slip, showing a drop of about 2.5% on the day. At the moment, it’s exchanged at a rate of $622 according to data from CoinGecko.

In summary, the partnership between Franklin Templeton and Binance represents a significant step for institutions and the utilization of digital finance. Through their strategic collaboration, they have created an inclusive and effective system that allows firms to continue to earn whilst maintaining the utmost security for their assets.