Top 4 indicators to trade cryptocurrencies

AltSignals Indicator

The AltSignals indicator is one of the most accurate that we can add to our charts since instead of determining an exact point or level to buy/sell a cryptocurrency, it indicates the moment when it enters the bullish or bearish phase. Knowing that the price will fall or rise from a specific point allows us to take advantage of the maximum and minimum points of the chart to be able to correctly position our positions. This indicator is highly respected and has a high hit rate, so it is never a bad idea to buy it. The AltSignals indicator has its well-deserved position among the top 4 indicators to trade cryptocurrencies.Relative Strength Index (RSI)

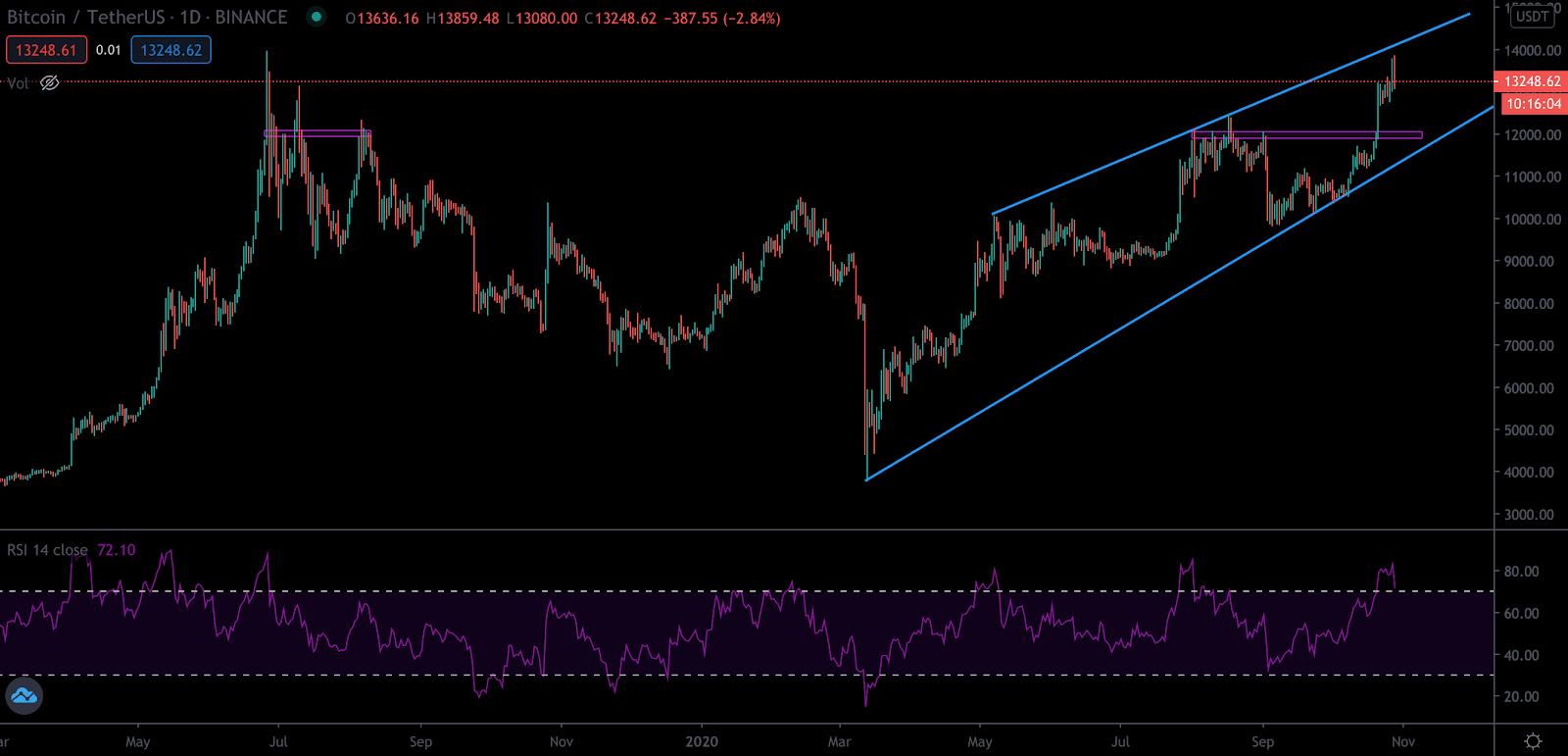

The RSI is one of the oldest indicators as it was created by Welles Wilder more than 40 years ago. This indicator is perfect to take advantage of movements that will always be present in the market, as in the case of pullbacks. The RSI determines when the price of a digital asset is far from its original level, so traders can choose an entry point when the price is about to undergo a correction. Considering that prices in the crypto market (and basically all other markets) suffer pullbacks after a bullish or bearish phase begins, the RSI can be very useful. The scale of this indicator goes from 0 to 100 and if the asset is below 30, it is being oversold and if it is above 70 it is overbought.

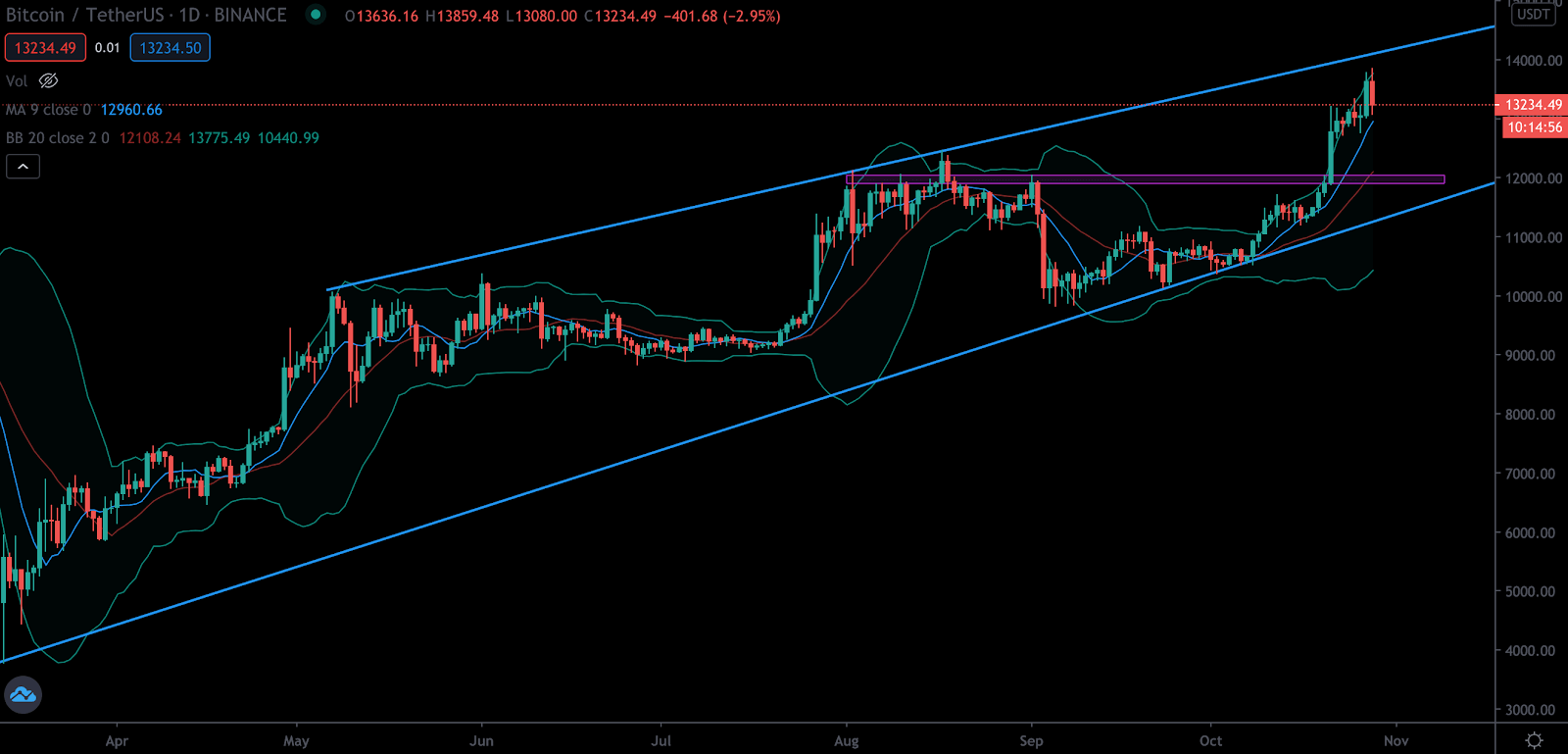

Bollinger Bands

It is an indicator created by John Bollinger in the 80’s and indicates an estimated price range throughout its journey. We can think of Bollinger Bands as an oscillating meter that indicates high / low volatility in a range or even if the market is facing overbought/oversold conditions. There is an upper band, a moving average and a lower band that estimate the possible price movement in any timeframe according to fluctuations.

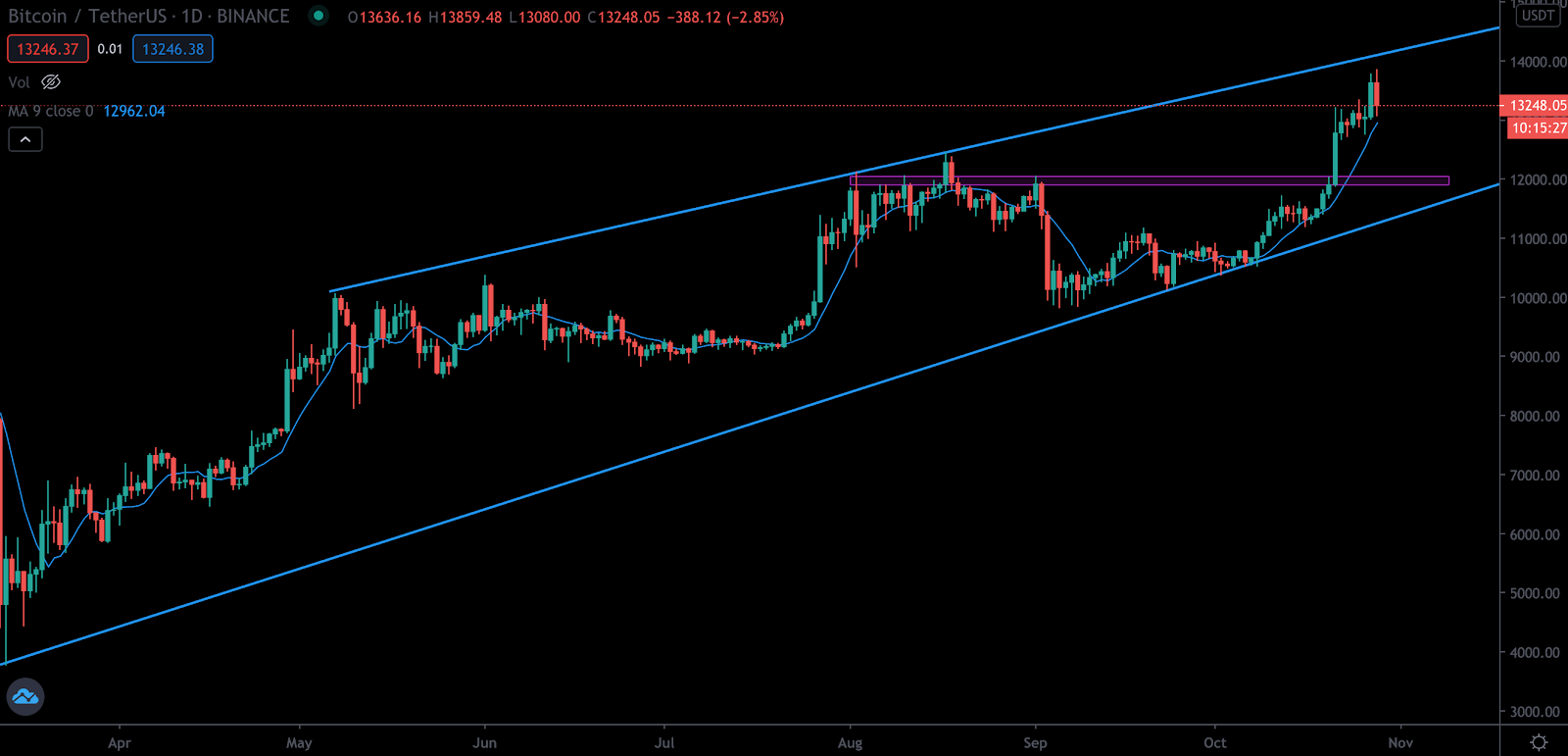

Moving Averages

In these top 4 indicators to trade cryptocurrencies, Moving Averages could not be missing, which can be defined as lines that, after having calculated the price path for a certain time, indicate the possible next price movement and even works as support and resistance levels. Moving Averages will be used depending on the trader’s strategy based on short or long term plans.