With the growth of virtual currencies and financial markets, we have seen new investment tools being created on a regular basis. That means that nowadays, cryptocurrency investors can easily trade crypto derivatives, including perpetual contracts. Nevertheless, not everyone knows what crypto derivatives are and how they have an impact on investors’ portfolios.

Currently, there is a large variety of cryptocurrency derivatives in the market. Many of them offer different solutions to investors. Thanks to these derivatives, cryptocurrency traders and professional investors are able to diversify their portfolios and create more diversified trading strategies.

In this blog post, we are going to share with you all the information that you should have about cryptocurrency perpetual contracts. Moreover, we will tell you which are the risks of trading with perpetual contracts and why you should pay close attention to them in the coming years.

Disclaimer: the information shared by AltSignals and its writers should not be considered financial advice. This is for educational purposes only. We are not responsible for any investment decision you make after reading this post. Never invest more than what you are able to lose. Always contact your professional financial advisor.

What are Cryptocurrency Derivatives?

Let’s start with what we consider to be the basics of perpetual contracts: crypto derivatives. We cannot talk about cryptocurrency perpetual contracts without understanding what cryptocurrency derivatives are.

Derivatives in the financial markets are financial contracts that have their price derived from an underlying asset. In the example of perpetual contracts, we will be talking about these investment contracts that derive their price from different virtual currencies. For example, we could be transacting Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC) and many other contracts in the market.

These contracts can be signed between two parties and give the possibility to buy or sell an underlying asset. However, derivatives can be settled in cash or using the underlying asset. In general, most cryptocurrency trading platforms settle them in cash.

There are many different types of cryptocurrency derivatives, including options, futures, forward and other types of contracts. Moreover, you can also find swaps and warrants. Perpetual contracts are just one of the many types of derivatives that investors can find in the market.

Rather than handling the underlying digital asset directly, investors will focus on trading these contracts. They might have some advanced solutions that would let them execute their advanced trading solutions in the market.

In some cases, cryptocurrency derivatives can be used to hedge against possible volatility in the market. In other cases, the goal is to get a larger exposure to specific trades, if we consider that they could move in a specific direction. There are different reasons why investors would like to trade using derivatives. Perpetual contracts are one of the best options for investors in the market right now.

What are Cryptocurrency Perpetual Contracts?

So what are cryptocurrency perpetual contracts? Let’s get into the details of what crypto perpetual contracts are and how they work. Perpetual contracts are derivatives that have their value determined by an underlying cryptocurrency. We can have perpetual contracts for Bitcoin, Litecoin, Ethereum or any other cryptocurrency.

Perpetual contracts are considered to be among the best types of contracts in the market for different reasons. One of these reasons is that compared to futures or options that have a maturity date, these contracts can be open indefinitely as long as the investor pays a maintenance fee.

Usually, this maintenance fee is associated with the funds that they borrow in order to short or long an asset. The larger the position and the leverage, the larger the payment that they will have to make on a regular basis to keep the position open.

As we mentioned before, perpetual contracts let investors hold a position without having to be worried about the expiration date of this position. That’s why they are called perpetual because they can be opened as long as the investor pays the fee to keep the position open.

Another thing that we should take into consideration when we talk about perpetual contracts is related to the fact that they trade very close to the index price. That means that they are usually very close to the market price of the underlying asset due to the funding rates that apply to these contracts.

Thanks to the expansion of these contracts, it is now possible to have very large volumes in the derivatives market when they are compared to traditional spot markets. This is because they have allowed traders to use leverage and trade with a margin when in the spot market that was something impossible to do.

Additionally, investors can also short the market without having the underlying asset and keep this position for as long as they desire. These are some of the reasons why traders prefer to use perpetual contracts and not in the spot market. But of course, there are some risks that we will discuss in the next section of this post.

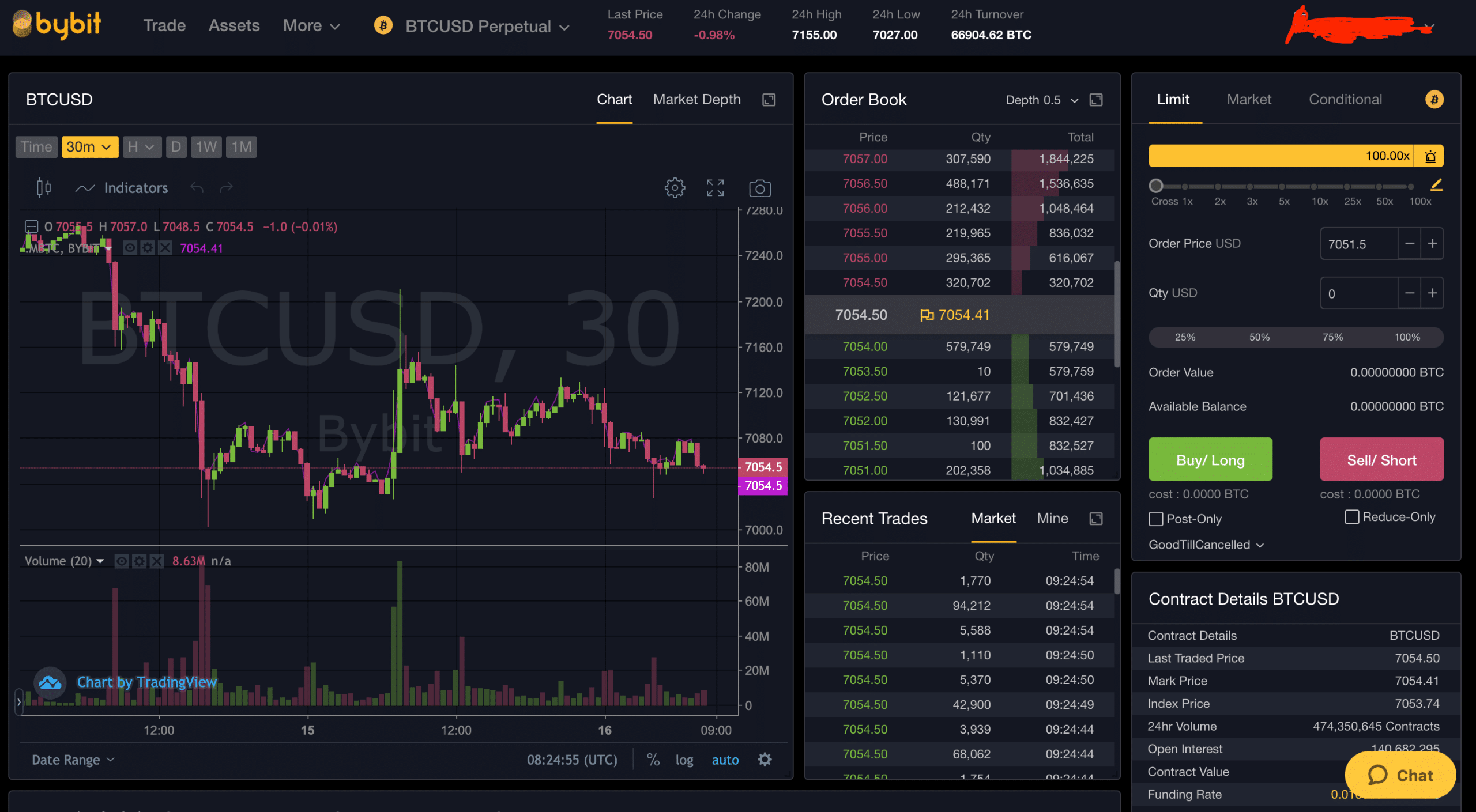

Where to Trade Cryptocurrency Perpetual Contracts?

The easiest way to trade cryptocurrency perpetual contracts is by using a cryptocurrency exchange. There are many different platforms out there that let investors trade perpetual contracts. These trading platforms are crypto exchanges that were first offering spot trading and then started offering new solutions such as futures and derivatives trading or staking, among other things.

Cryptocurrency exchanges are very easy to use. They let you create an account in seconds and start trading directly on their platform. You are able to deposit funds using fiat currencies and also other digital assets. Most cryptocurrency trading platforms are offering different deposit methods, including debit and credit cards, bank transfers and more.

Another way to trade cryptocurrency perpetual contracts is by using traditional brokers. Some companies and financial trading platforms are already letting users trade derivatives and perpetual contracts. It is up to you to decide which platform you use and which of them will offer you the best solutions.

In the future, there could be new trading platforms available that will let you trade perpetual contracts and other derivatives. You should always make sure that the platform that you choose offers you all the solutions you are looking for in a trading platform.

Pros and Cons of Cryptocurrency Perpetual Contracts

Before we decide to start trading with a specific investment tool or instrument, we should know that there are some advantages and disadvantages that could have an impact on how we trade. We should not start using perpetual contracts or any other type of derivative in the crypto market before understanding and knowing how they work.

This is a list of some of the pros and cons of cryptocurrency perpetual contracts. But you can always have more advantages and disadvantages that we did not consider in this post.

Pros of Cryptocurrency Perpetual Contracts

- They are one of the best ways for advanced traders to diversify their portfolios

- Investors can use leverage to gain a larger exposure when trading

- Traders can keep these positions open for as long as they want (no expiry date)

- These positions allow users to trade with leverage

- Perpetual contracts can have even larger liquidity and trading volume than spot markets

- There is a wide range of contracts available (ETH, BTC, LTC, etc)

- Several exchanges and brokers are already offering perpetual contracts

Cons of Cryptocurrency Perpetual Contracts

- Traders can get liquidated very fast if they use large leverage

- You are not trading the underlying asset (you are trading contracts)

- Investors have to pay for maintaining their positions open (which can be costly)

Risks of Trading Cryptocurrency Perpetual Contracts

The abovementioned cons of cryptocurrency perpetual contracts lead us to understand the risks that we could face while trading these types of derivatives. We know that perpetual contracts can be an excellent tool for investors that want to increase their exposure to certain trades and that want to short the cryptocurrency market. However, there are many risks that we should consider before we start trading in the market.

Some of these risks are related to leverage trading, costly funding, and low liquidity. Starting with leverage trading, investors can borrow funds and use them to have a larger exposure to a specific trade. For example, if you are trading with $100, then you can borrow up to $10,000. If the market goes in the expected direction and you close your trade with a 10% profit, then you will be rewarded 10% on the $10,000 and not on the initial $100.

As soon as you close the trade, you pay the funding fee (the interest rate that you pay to borrow funds for some hours) and the borrowed capital ($9,900). In this way, you are able to increase your profits if you make the right trade. Now, there are some risks to this type of trading. For example, if the market moves in the contrary direction, then a 100x leverage means that you will get liquidated if the market moves less than 1%. If you do not have enough margin to keep the position open, you will get liquidated.

That means that you have to follow the market very carefully and avoid getting liquidated if things don’t go as expected. The only issue with the crypto market is that it is very volatile, meaning that you can get liquidated before you even try adding funds to keep your position open.

Finally, liquidity is also something that you should consider. If you are a large trader, you want to make sure that liquidity is enough for you not to move the market. This might happen for smaller trading pairs or if you have extremely large positions in small derivatives exchanges. If you stick to Binance and other large trading platforms, you should not encounter liquidity problems.