The month of June has undoubtedly been the scene of relative highs in favor of Bitcoin, demonstrating a unique uptrend driven by a series of special factors, among which include Asian markets and the launch of Libra, the project for the Facebook cryptocurrency. Beyond the obvious injections of capital, the price of the BTC is about to meet new heights thanks to a series of announcements and inclusions to the market, so it is safe to say that we are still in good time to acquire tokens.

The rebound in bitcoin market prices has been the subject of analysis by analysts and investors, some of whom have offered their predictions about this upward movement in the price of the pioneer cryptocurrency. They offer their opinions on what the new price for bitcoin could be in the remainder of 2019 and beyond. It should be noted that their opinions are based on experience and selective knowledge on the subject, so the following statements have solid foundations.

We will review some of the predictions about the Bitcoin price given by four expert analysts, among which are Michael Novogratz (founder and CEO of Galaxy Digital), Anthony Pompiliano (founder of Morgan Creek Digital Assets), Naeem Aslam (Chief Market Analyst) and Alex Kruger (Financial Markets and Crypto expert).

Michael Novogratz explains about stability between $10,000 and $14,000

In this opportunity, the CEO of Galaxy Digital Holdings, said that part of the momentum that the price of bitcoin has had to do with the announcement of Libra, the cryptocurrency of Facebook, which will serve as a bridge to attract this public that has not yet entered the world of Bitcoin and Blockchain. There are investment options both for being the first digital asset and for getting involved in the market, since Libra is a stablecoin, it could represent a form of savings when making profits in BTC. During his participation in the Squawk Box, Novogratz talks about the importance of one of the largest companies in the world having decided to believe in cryptocurrencies.

In addition to his opinions regarding the impact that Libra can have on the market, Novogratz also referred to the growth of the volume of exchange of Bitcoins in the Asian market, with special emphasis on China and its direct impact on the bullish rally.

Novogratz stated:

“A lot of the volumes of what is happening in Bitcoin and other currencies are coming out of Asia”

Keeping this in mind, the executive of Galaxy Digital predicted that the price of BTC will range between USD 10 thousand and 14 thousand for the remainder of the year, achieving new stability in these levels.

Pompiliano prepares for the trip to $100.000

After the rise of the market during the second quarter of 2019, the co-founder of Morgan Greek, Anthony Pompiliano, is very sure of the trip towards USD 100,000 and gives the deadline for this event on December 31, 2021. This executive had already made before accurate predictions, by pointing in August 2018 when the price of BTC was at USD 6,770, that bitcoin was going to fall to USD 3,000, before rebounding to higher values.

Pompiliano said that his prediction of a 50% drop in the price of bitcoin was received with much skepticism, but finally it turned out to be accurate, since Bitcoin actually proceeded to fall below USD 3,200 in December 2018, before recovering and firing more beyond a price of USD 10.000.

After recalling this event last year, the executive confirmed his position: the bitcoin will have a price of USD 100 thousand before the end of 2021.

“My current level of confidence that this happens is around 70-75%,” said Pompiliano.

Naeem Aslam believes that Bitcoin will exceed USD 50,000 once it breaks the 20,000 barrier

Aslam tells us about the next bullish trend will take Bitcoin up to this price, as long as the highest prices already reached (USD 20.000) are exceeded and it manages to stabilize above USD 50.000, so that the price of USD 100.000could be achieved and perhaps overcome. The psychological barrier of the 20K is a delicate obstacle to overcome, but it becomes simpler once we are objective and we understand that it is about money and mathematics.

Aslam said during an interview strongly believe that the next upward race oscillates between USD 60,000 and 100,000, speaking in the long term, but did not specify a date or an exact period of time for these levels. Recently, the analyst said that the price of each bitcoin would soon exceed USD 11 thousand, which happened shortly after.

Max Keizer, a journalist and analyst at Russia Today, has been extremely supportive of Bitcoin and its growth, in keeping with this theory. Keizer also argues that bitcoin will surpass all other investment markets in the next 15 years, this is because the millennials are moving from investing in traditional assets, to entering into bitcoin and other cryptocurrencies.

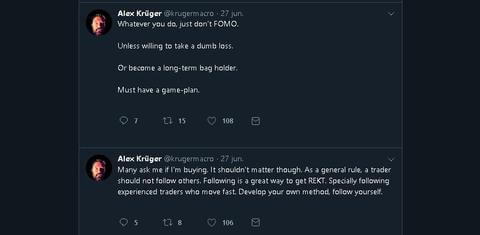

Alex Kruger warns about the dangers of falling under FOMO influence

The Argentine analyst, Alex Kruger, said that many people have been constantly asking for their advice and position regarding this Bitcoin uptrend. Kruger decided to save predictions for an exact price by the end of 2019; however, he took the opportunity to send advice through his Twitter account to current investors; No trader should follow the strategy of others when investing.

This is especially relevant when dealing with specialized and experienced traders since their movements are faster than those of a common trader. Traders must ensure they do not fall prey to the FOMO (Fear Of Missing Out), that is, they should not be afraid to stay out of the bullish rally and buy bitcoin in a hurry.

In addition, Kruger pointed out that the perfect moment to buy is when prices collide with a well-identified uptrend, or when prices rise after consolidation at key levels. According to him, this type of strategy implies an important level of aggressiveness, to take quick profits, taking advantage of the highest price levels.

Currently, each bitcoin has a price of USD 10,300, with a dominance of 60.8% with respect to the rest of the cryptocurrencies of the market. Between the end of May and the beginning of June 2019 the cryptocurrency had an appreciation of 29%, from USD 8,753 on May 27 to more than 11,200 current. These predictions are not 100% accurate until they prove to be true, however, they confirm continuity in the current bull trend that the market has been experiencing for a couple of months.