Witnessing a slump for two weeks straight, the price of Ethereum reached a significant level of support at $4,000. This downturn was concurrent with a leap in the exchange-traded fund outflows. Deutsche Bank reports that Ethereum’s value has been affected by multiple factors such as institutional demand being on the decline and record-high ETF redemptions.

Repercussions of the Ethereum Slide

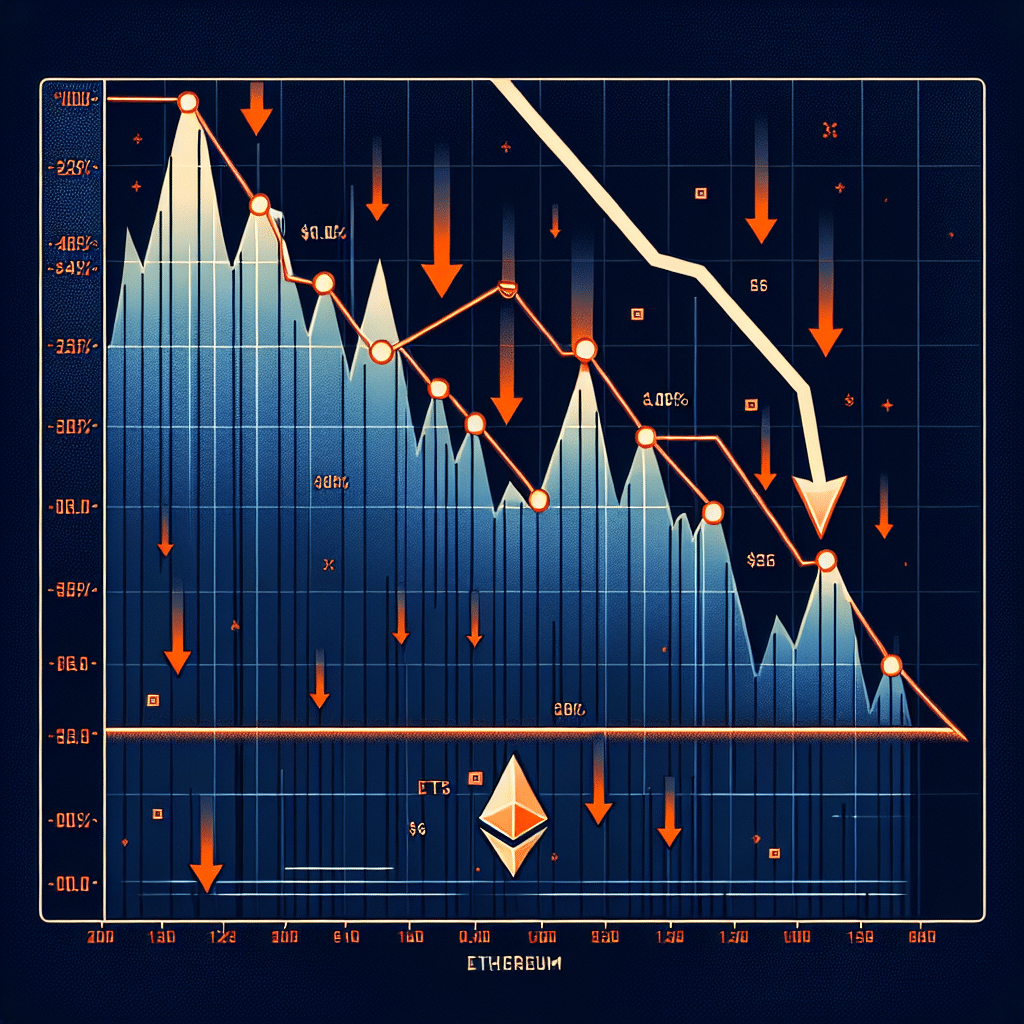

The continuous decrease in Ethereum’s price over a fortnight has led the cryptocurrency to return to the vital support point of $4,000. A growing negative sentiment among investors and record-high redemptions of ETFs are said to be the main causes of this drop. This week alone, U.S. listed Ethereum funds have experienced a loss of nearly $800 million in assets. This substantial reduction in assets, the largest witnessed till date, has nullified any positive inflows that were seen at the beginning of September.

Institutional Sentiment Shifts

Despite $26 billion, constituting 5.37% of the total amount of Ethereum in circulation, still being preserved in the Ethereum ETFs, the recent pullback has unveiled how quickly the attitude of institutional investors towards the world’s second most valued cryptocurrency can flip.

Fall of Ethereum in line with Rise of ETH ETF Outflows

The most recent records show a significant decrease in the Ethereum token’s value which is trading at a critical support level of $4,000 from its earlier peak high of $4,920 within the year. However, on a brighter note, it is still high by 190% from its April low of $1,377. This lowering of the Ethereum price occurred parallel to the slowing of demand from American institutional investors and a rise in liquidations.

Outflows from ETH ETFs

According to data, Ethereum Exchange Traded Funds or ETFs have registered a historic outflow of a total of $795 million, completely shattering the previous records seen in September when there were assets worth over $787 million diminished.

Implications for Future Ethereum Funds

Despite the past two weeks witnessing an inflow of $556 million and $637 million respectively, the latest trends indicate a falling growth momentum among the American institutions. Currently, Ethereum funds have a total of $26 billion in assets, which equals to 5.37% of the total supply.

Impact of Liquidations and Macro Factors

On top of these problems, Ethereum price also dipped this week in response to a massive $1.5 billion in liquidations. These liquidations were observed as exchanges such as Binance and OKX halted leveraged bullish trades when the price crashed. Additionally, macro factors like ongoing inflation, causing concerns over the continual reduction of interest rates by the Federal Reserve, also contribute to the Ethereum price crash.

Technical Analysis of Ethereum Price

Ethereum’s weekly price chart presents that the ETH price receded from the YTD peak of $4,918 to this week’s low of $3,825. However, in a positive light, the current level of Ethereum is along the highest point witnessed in March, May, and November of last year, forming a break-and-retest pattern, which is typically a sign of continuous growth.

In spite of the current market conditions, Ethereum has managed to stay above the 50-week and 100-week Exponential Moving Averages. Therefore, as long as Ethereum remains above the support at $4,000, the outlook remains optimistic. The ETH is expected to retest the all-time high and might even make its way towards $5,000.