For cryptocurrency enthusiasts, Tuesday marked one of the most significant days in the world of Bitcoin exchange-traded funds (ETFs). The U.S. spot Bitcoin ETFs added an impressive $524 million of net inflows, the largest daily figure since the all-time high of the cryptocurrency, which was around $126,000 on October 6.

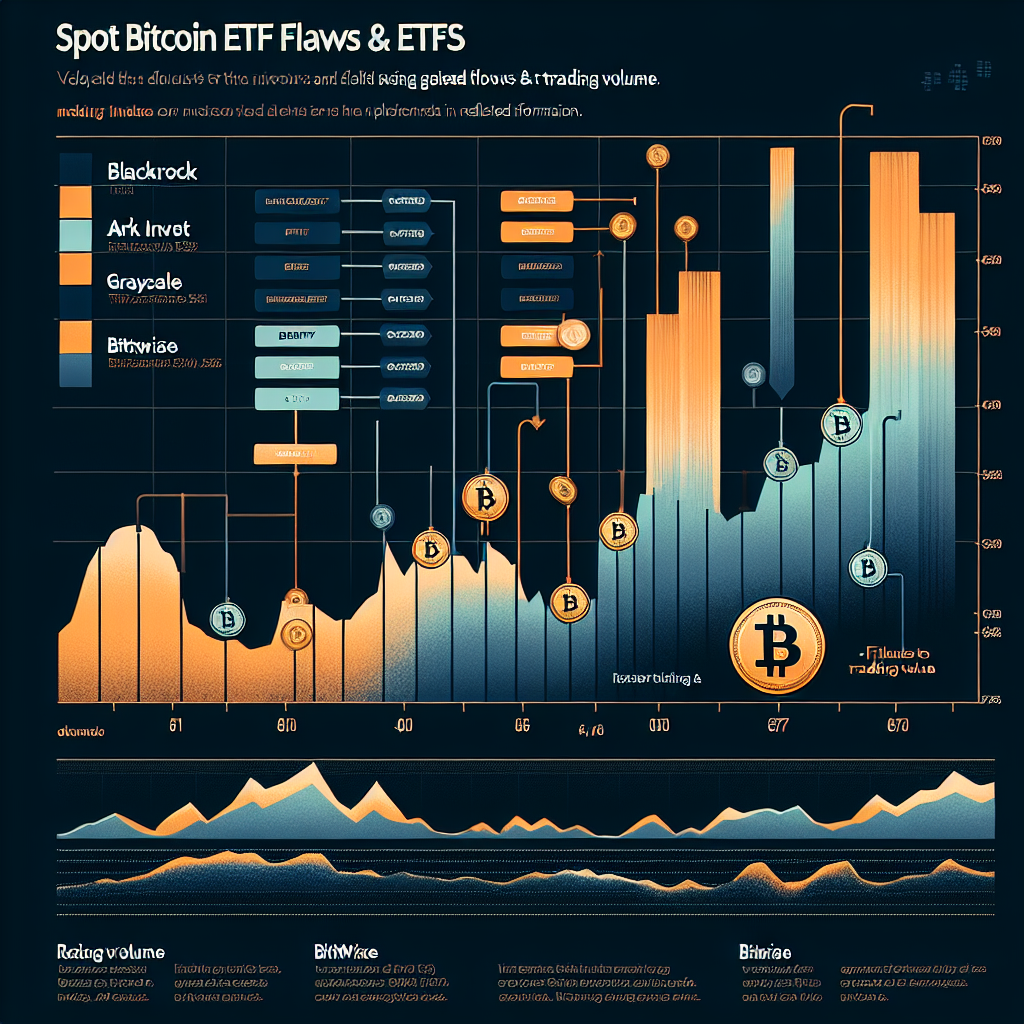

Companies under the eye of investors were major ones such as BlackRock’s IBIT, Fidelity’s FBTC, Ark Invest’s ARKB, Grayscale’s BTC, and Bitwise’s BITB. With their Bitcoin ETFs absorbing prominently in the inflow, they led the rebound force. Of that $524 million, BlackRock’s IBIT dominated with $224.2 million, followed by Fidelity’s FBTC with $165.9 million, then Ark Invest’s ARKB with $102.5 million. The rest trickled down to Grayscale’s BTC gaining $24.1 million and Bitwise’s BITB with $7.3 million respectively. The other funds saw zero flows for the entire day.

Bitcoin ETFs Milestone

Since their inception in January 2024, Bitcoin ETFs have indeed become a force to recognize in today’s investment terrain. The ETFs have drawn a staggering $60.8 billion in total net inflows. This monumental figure reveals the massive investor interest that Bitcoin has generated. The cumulative trading volume has now set sight on the $1.5 trillion milestone, marking the length and the shadow Bitcoin ETFs have cast on the investment landscape.

The influx appears to persist even though Bitcoin’s price dropped roughly 3% on Tuesday, standing at around $103,000. Following the trend, however, this foremost cryptocurrency regained its strength in early trading on Wednesday, currently trading for $104,724.

A Tempering Demand

There is convincing evidence of cooler demand, a possible consequence of a recent deleveraging event on October 10. This event has become historic in the annals of Bitcoin ETFs due to the negative effect it had on 30-day flows. The flows during this period reached a low of -29,008 BTC, marking the worst 30-day flow since March 2025 and lower than any other period in 2024.

Having said that, market experts maintain a positive outlook regardless of these outflows. According to Vetle Lunde, K33 Head of Research, “We view the recent sale pressure from ETF owners as a temporary reflection of derisking. We should expect 30-day flows to trend higher from now, with 30-day flows of -29,008 BTC marking the bottom for H2 2025.”

This optimism is echoed by BRN Head of Research Timothy Misir when he said, “While the renewed Bitcoin ETF inflows are encouraging, consistent spot flows are needed to break the $108,000 – $110,000 battleground. The longer pattern shows cautious, episodic demand.”

Altcoin ETFs’ Performance

Simultaneously, the U.S. Ethereum ETFs reported net outflows of $107.1 million on Tuesday, led by Grayscale’s ETH product, withdrawing $75.7 million. In contrast, new U.S. spot Solana ETFs showed net inflows of another $8 million on Tuesday, amassing around $350.5 million since Oct 28.

The final take is that the recently launched U.S. spot HBAR and Litecoin ETFs recorded no significant inflows for the day and have attracted only modest net inflows since their debut on October 28, per the provided data.

These happenings in the world of cryptocurrency depict the shifting investor interest that each cryptocurrency has to deal with. As the landscape continues to evolve, these trends may well continue to take different turns.