Beefy.Finance is a new decentralized finance (DeFi) yield optimizer project that competes with Swamp.Finance and that makes it easier for users with a crypto wallet to interact with different liquidity pools.

Working as a yield optimizer (AMM) protocol, the company wants to offer the best yield returns on the Binance Smart CHain (BSC). One of the main advantages of this project is related to its transparency and easy-to-use platform. In this way, even non-crypto users could get access to DeFi benefits just by learning basic concepts of digital assets.

Disclaimer: the information shared by AltSignals and its writers should not be considered financial advice. This is for educational purposes only. We are not responsible for any investment decision you make after reading this post. Never invest more than what you are able to lose. Always contact your professional. financial advisor.

What is Beefy.Finance?

Beefy.Finance is a new Yield Optimizer and Automated Market Making project that offers services to users in the crypto market. By leveraging the power of smart contracts, they are able to offer users some of the most attractive yields in the cryptocurrency market.

This is possible by optimizing smart contracts and using optimization strategies. Users are rewarded with the highest yield on different liquidity pools (LP) and different projects. Through this innovative system, they offer a large advantage over other projects or try optimizing yield returns manually.

The project was created by a group of enthusiasts in the crypto market that very much liked the projects that appeared on the Ethereum (ETH) network offering DeFi solutions. However, the project runs on the Binance Smart Chain due to the fast and cheap transaction times. However, the platform is also working on other blockchains such as the Huobi Eco Chain (HECO) and also Avalanche.

Beefy.Finance Solutions

Yield Optimization is the main service offered by this platform. They focus on yield optimization and most of the things they do aim at making it even more efficient to use this platform. However, they are also working with liquidity pools.

Liquidity pools make it possible for users to deposit their funds and start making profits as soon as they deposit their crypto on different liquidity pools. These pools will be then using smart contracts so as for users to receive the highest possible yield on their digital assets.

At the same time, the company has its own virtual currency called $BIFI. It is worth mentioning that most of the crypto platforms that were released on the DeFi market have their own tokens. This digital asset works as the native and governance token of the Beefy.Finance ecosystem. Users that want to be part of the decisions taken by the projects.

Beefy.Finance Yields

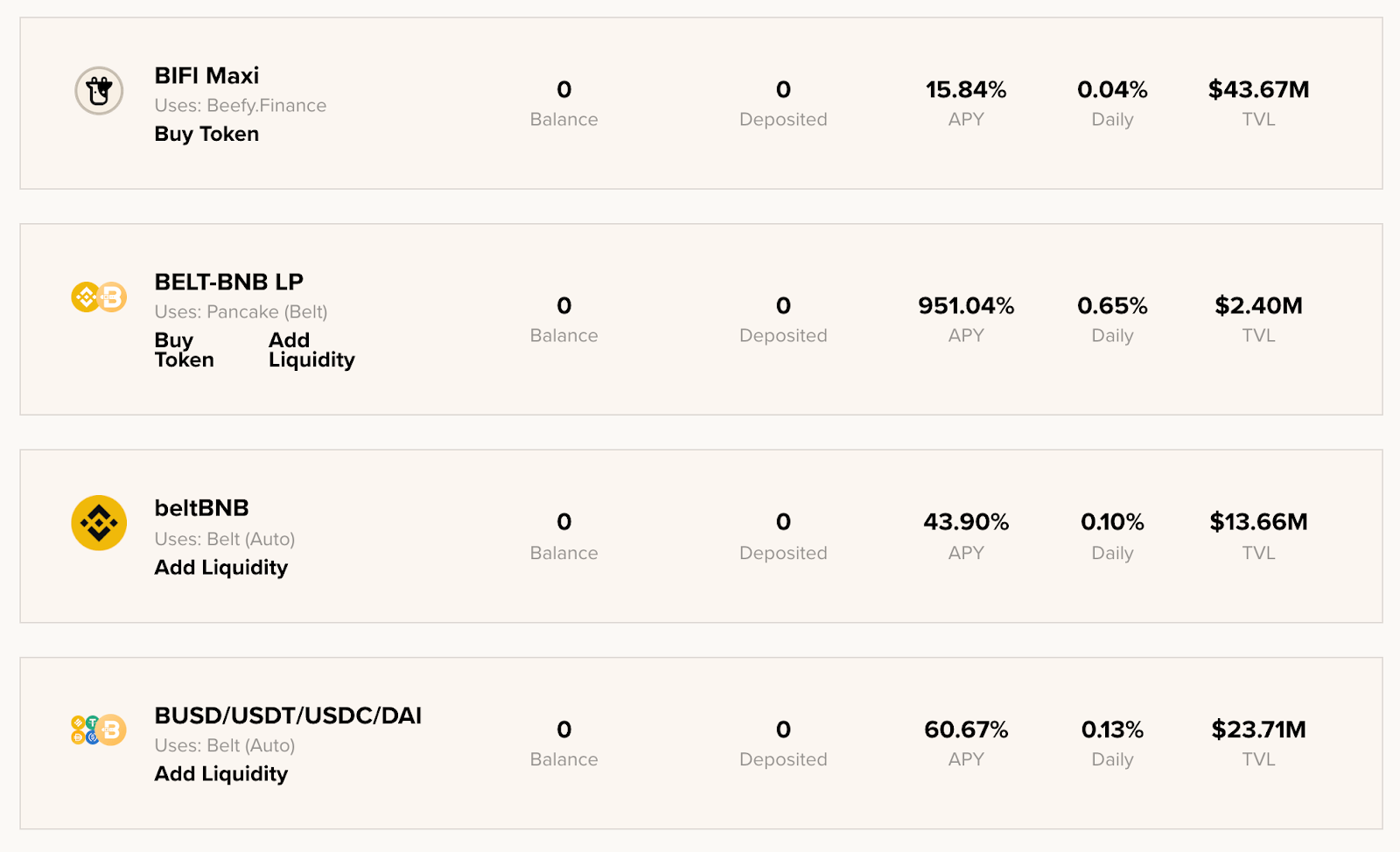

Beefy.Finance offers different yields on each of the LPs available on the platform. If you want to earn a yield on your funds, then you should check the availability of the LPs and which are their returns.

At the moment, there are different pools that offer very high rewards for users such as the BELT-BNB LP with 951% APY. This can be everything done through the Beefy.Finance platform and in just a few simple steps.

Users that add liquidity to other LP will also earn rewards. For example, the beltBNB liquidity pool gives an APY of 43.90%. However, there are many other pools available on the platform that will definitely help you to manage your funds in an efficient way.

Remember that by using smart contracts, Beefy.Finance automatically makes it possible for your funds to get into optimized yield pools.

Beefy.Finance Competitors

There are several competitors to this platform. The last months have been very interesting in terms of how many projects were released to the DeFi market. Beefy.Finance is just one of the many projects that are offering yield optimization to users.

Another project that is doing so is Swamp.Finance. This platform works in a similar way as Beefy.Finance but has a different interface and a different token called SWAMP. Both platforms are relatively new and offer very similar services.

The number of liquidity pools on both platforms is massive and this makes it possible for users to select the yield and liquidity pool they are interested in. Finally, ApeSwap or PancakeSwap are two of the largest platforms on the Binance Smart Chain platform offering AMM solutions and liquidity pools. However, Beefy.Finance is getting a space among the most used platforms right now.