Cryptocurrency and traditional traders tend to follow a wide range of trading indicators that allow them to improve their trading strategies and enter or leave the market at the time they consider it is convenient. However, there are several indicators that are a must-have for traders. One of these indicators is the MACD.

In this article, we will be sharing with you how to use the MACD indicator and why it is important to have it in our charts. This is going to be a basic guide for users that want to understand what they see when they activate the MACD or for beginners that are starting to trade in the space.

Disclaimer: All the information provided by AltSignals and its writers shouldn’t be taken as financial advice. The article has been created for educational purposes. Never invest more than what you are able to lose and only ask for advice to your personal financial advisor.

What is the MACD Trading Indicator?

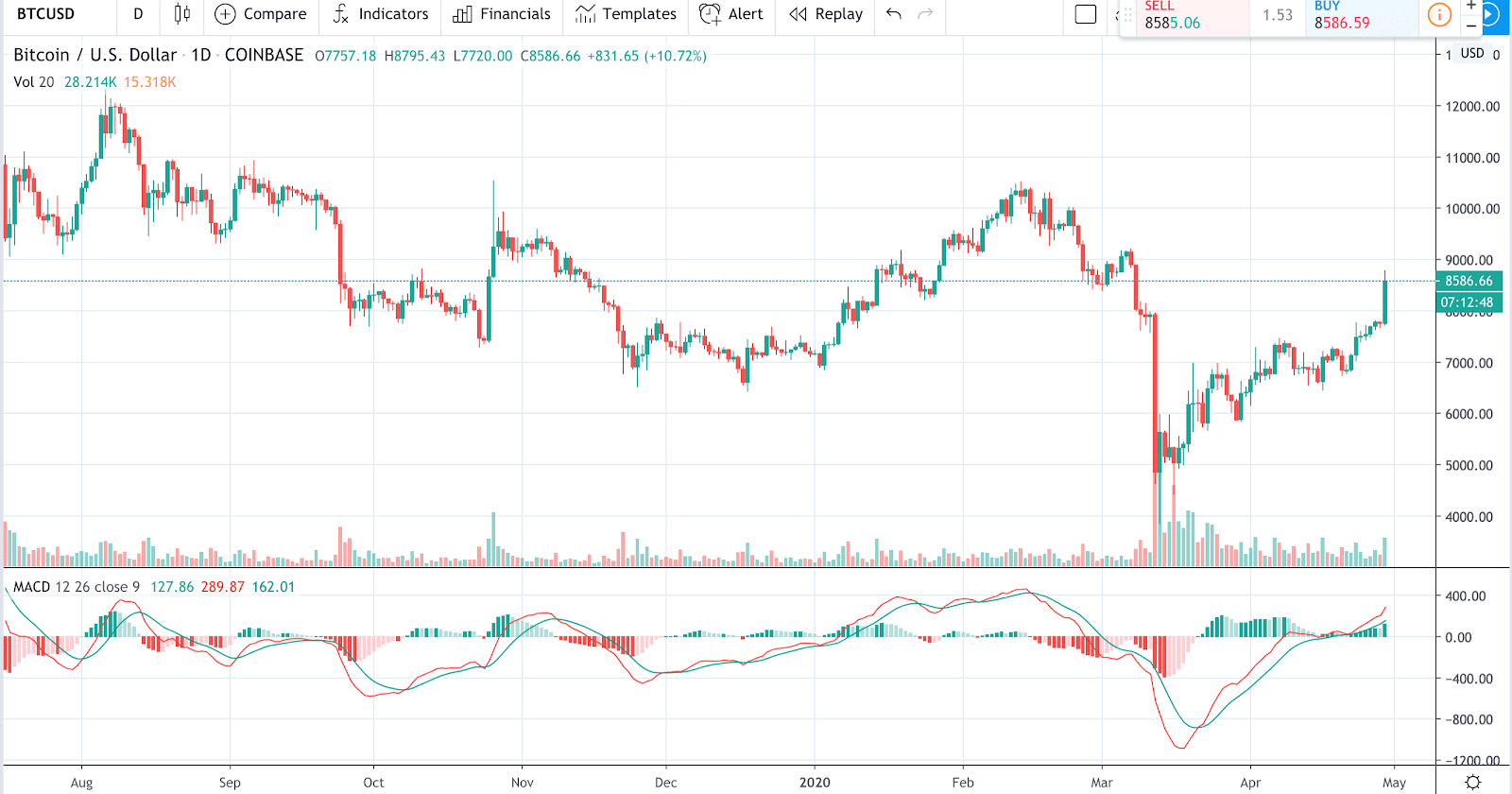

The MACD indicator stands for Moving Average Convergence Divergence and it has become a very important tool for traders. We can usually use the MACD 9, 12 and 26 in our charts to have clear data about the charts we are trading.

The indicator can be used to get information about the general trend of the market and also as a tool that would mark entry and exit points in the market.

In the image below you can see how the MACD looks ina BTC/USDT chart with the aforementioned 12, 26 and 9 configurations.

In the following sections, we will be sharing with you how to understand the buying and exit points and how to read the charts to understand when the market is moving upwards or downwards.

MACD Buy and Sell Signals

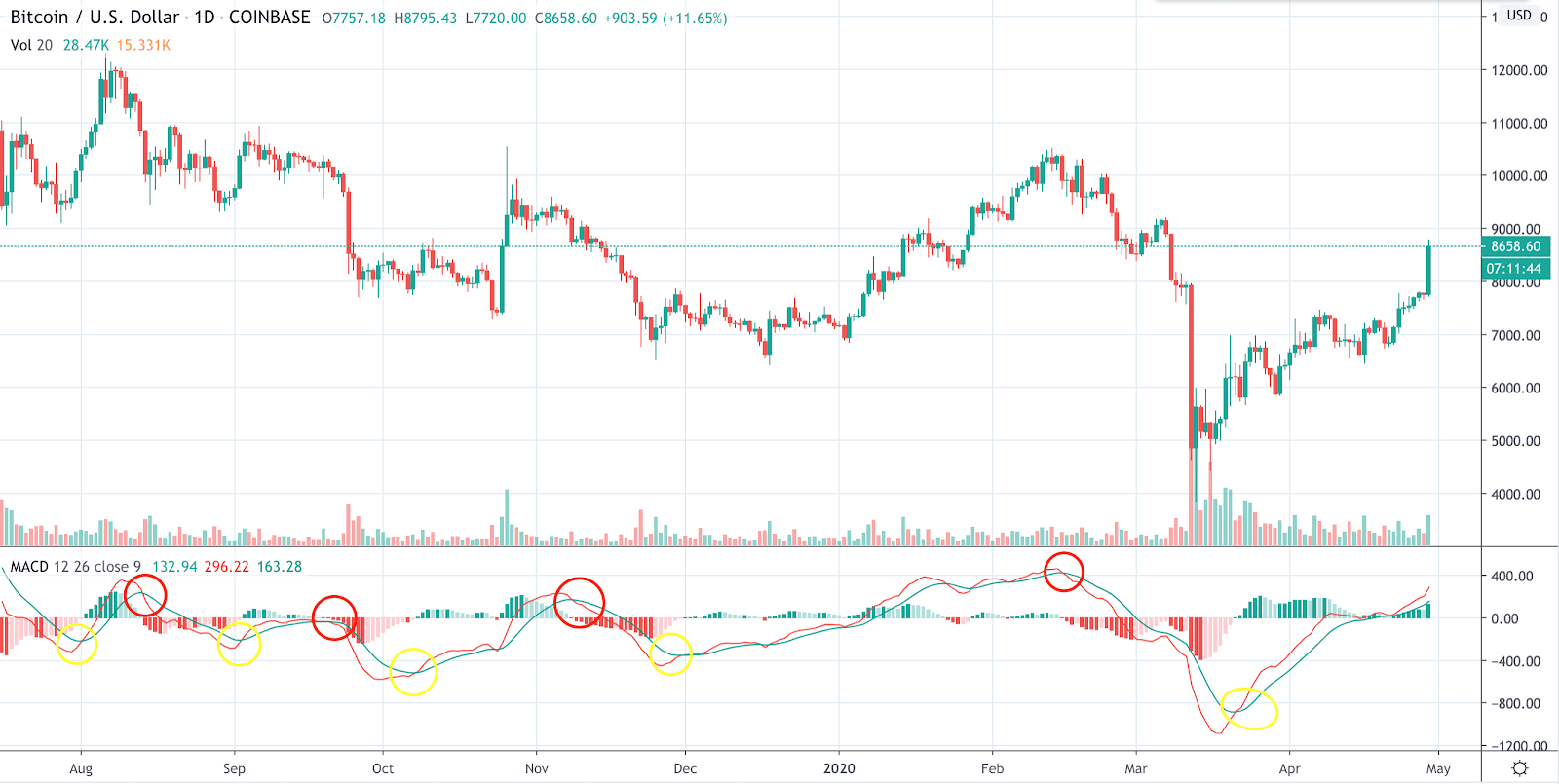

The MACD, as we have mentioned before, will provide you with valuable information about when to enter or exit a trade. Let’s see the example we used before but focusing on the MACD indicator.

In this chart, we can see two different circles. Some of them are yellow and some of them are red. The red circles indicate the moment in which it could be a good moment to sell and the yellow circles show and indicate which could be good moments to buy or enter a trade.

The red line represents the 9 MACD and it would be providing the signals that we need to trade in this specific market.

If you are using AltSignals crypto trading signals, then you can skip this step considering the team behind AltSignals will be providing you with the best crypto trading signals in the cryptocurrency market.

It is worth taking into account that when MACD is above the zero line, we could consider the market is in a bull trend. The contrary would happen if the MACD line is below the zero line. Obviously, we need to take into account how the markets behave and understand that the MACD could be a great tool despite the inefficiencies there may be.

Histogram Trend Understanding

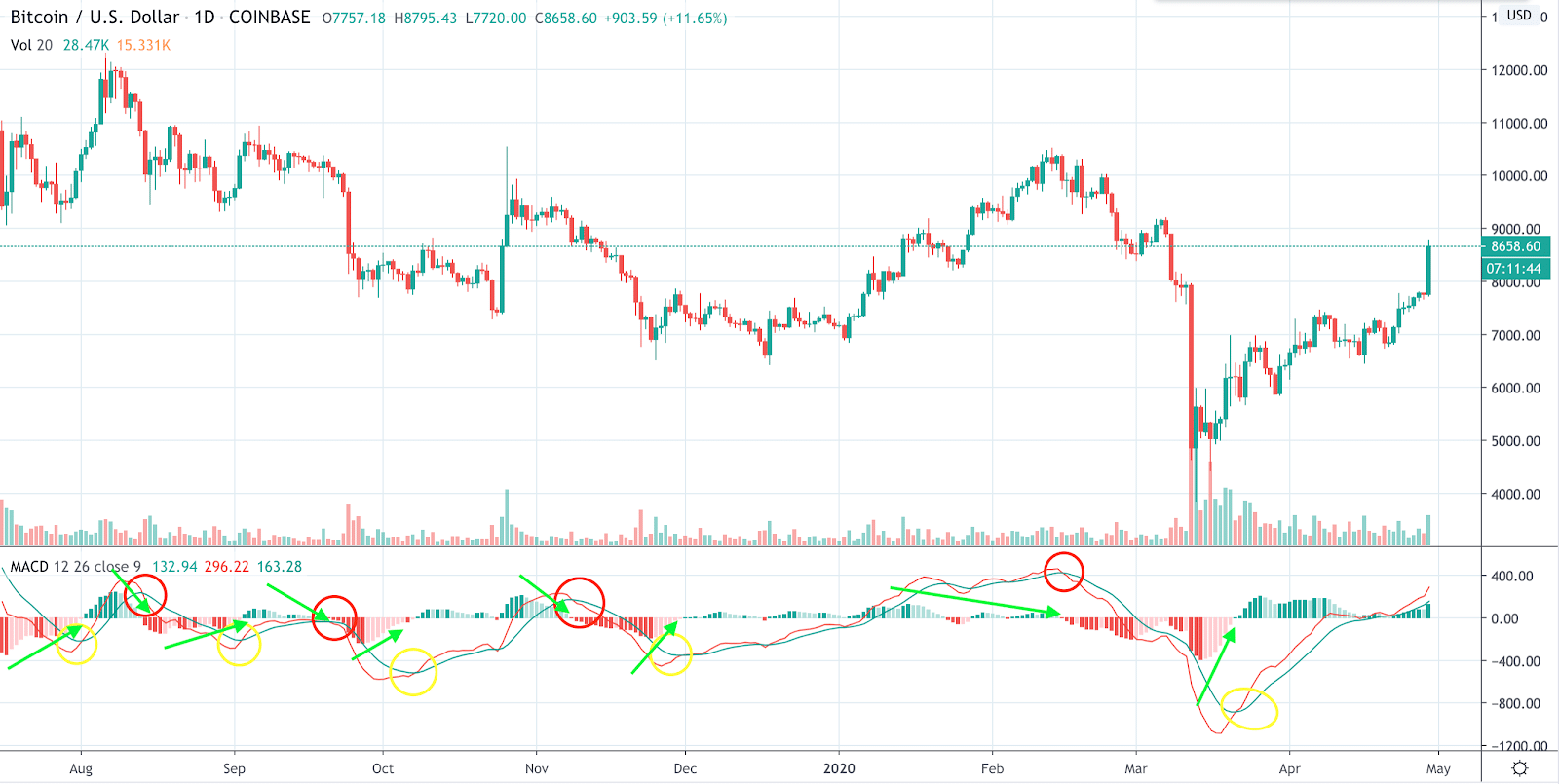

The Histogram that we see in the MACD chart shown below represents the trend in which the market is moving.

As you can see, the green arrows indicate the trend of the histogram. With this information, we can predict where the market is moving. If the histogram goes upward, we can consider the market is moving into a bullish trend, if the histogram goes downward, the market is falling and we should consider exit the trend before the actual signal comes into place.

Indeed, as you can see from the example above, the green arrows precede the signals calls from the MACD 9 crossing the MACD chart. Thus, it is worth using both the histogram and the crosses to get a better idea of how to trade with the MACD indicator.

Of course, there are many other indicators we might use. We shouldn’t rely on just one tool to trade in the cryptocurrency space or in any other market. There are many useful solutions that would allow us to improve our trading strategy and increase our profits over time.

Conclusion

In this article, we aimed at sharing with you the basics of the MACD indicator and how it can be useful for us to improve our trading strategies in the cryptocurrency market. This can be a great way to add to other indicators and help us increase our profits. However, this article is for educational purposes and all that you have read shouldn’t be considered investment advice.