Bitcoin (BTC) and Ethereum (ETH) are the two largest virtual currencies in the world. They have been running for several years now and are the most valuable in the market. But there are some differences between Bitcoin vs Ethereum that we would share with you in this article.

Bitcoin could usually be used for some things while Ethereum might work better for other types of things. But what are the main differences between Bitcoin vs Ethereum?

Disclaimer: the information shared by AltSignals and its writers should not be considered financial advice. This is for educational purposes only. We are not responsible for any investment decision you make after reading this post. Never invest more than what you are able to lose. Always contact your professional. financial advisor.

Bitcoin vs Ethereum: Main Differences

Let’s start by understanding what Bitcoin is. Bitcoin is the first cryptocurrency to be created in the world back in 2009. It has been operating since then and it became the largest in the world.

Users can make transfers, receive funds and store value without having to be worried about centralized authorities. Everything is performed through a decentralized network of miners and nodes that are in charge of protecting not only the transactions but also the whole information of the Bitcoin blockchain.

Over the years, new coins were created. Among them, we find Ethereum. Ethereum was created in order for blockchain technology to be able to process smart contracts. These smart contracts became a key part of new blockchain systems and networks as they give flexibility and many other possibilities to developers.

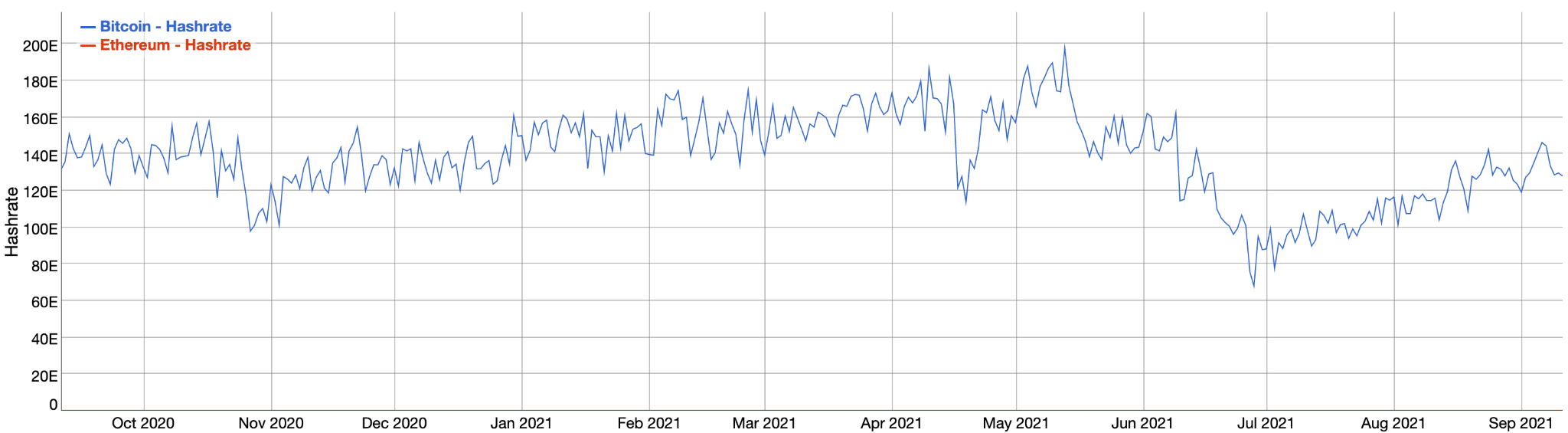

Hash Rate

When we talk about hash rate, we see that Bitcoin has a higher hash rate than Ethereum. Both of these cryptocurrencies have a proof-of-work (PoW) consensus algorithm in which miners process transactions. However, Ethereum is now planning to move to a Proof-of-Stake (PoS) consensus algorithm.

As you can see in the image above, the difference between the hash rates is massively large. Bitcoin is the most secure cryptocurrency network in the world.

Block Times and Transaction Times

When we move to block times, we should know that Bitcoin has a block time of 10 minutes compared to 10 to 20 seconds on the Ethereum network. This is definitely important to understand how fast transactions can be processed.

Usually, we would have to wait close to 10 minutes to get a BTC transaction processed (if there is no congestion), but it could take much less if we use Ethereum. However, due to congestion in both networks, transaction times tend to be higher.

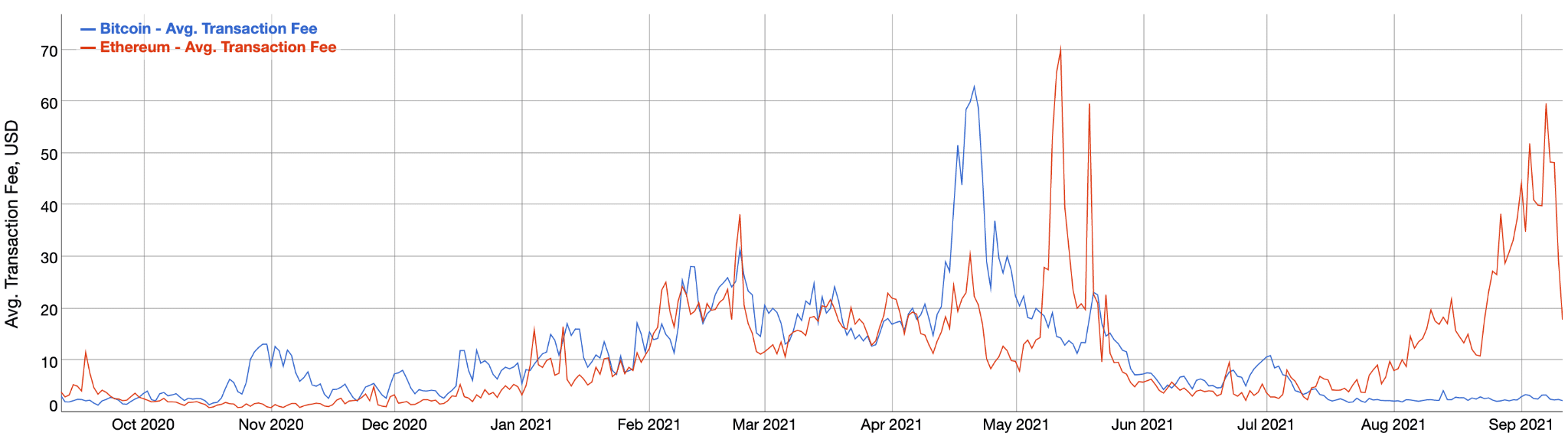

Fees

In terms of fees, the average transaction fee has been larger for Ethereum in the last months. Meanwhile, BTC fees have remained relatively low, close to $3 per transfer compared to over $15 for ETH transactions.

This is highly related to the decentralized finance (DeFi) market and all the smart contracts that are currently being processed on the Ethereum network. Bitcoin, instead, is used mostly for transactions rather than to process smart contracts.

Furthermore, it is worth mentioning that Bitcoin has a second-layer scaling solution called Lightning Network (LN) that has been processing a larger number of transactions over time. This has helped Bitcoin to process smaller payments without having to pay high fees.

Market Valuation

But that’s not all. There are some other differences between Bitcoin vs Ethereum that are worth considering. For example, in terms of price and market valuation, they are totally different.

Bitcoin is the largest cryptocurrency when analysing market capitalization. That means that we multiply the number of coins in circulation by the price of the coin. Bitcoin has a price of $46,000 (which fluctuates at all times) and a market capitalization close to $866 billion.

Ethereum, as the second-largest virtual currency, has a price per coin of $3,400 and a market valuation of $400 billion. This shows how Bitcoin vs Ethereum differentiates. These are different coins with different goals, something that can be seen in the price of both digital assets.

Future

When we analyse the future of both cryptocurrencies, we see a potentially bright future for both of them. Bitcoin is becoming a digital asset to process payments (El Salvador through the Lightning Network) and Ethereum is becoming increasingly useful in the Decentralized Finance industry.

These two coins work together to bring better solutions to investors in the market and to individuals all around the world. Thanks to their solutions, people are having access to better services that would otherwise be provided by centralized financial institutions.