BitMex is one of the most popular and recognized platforms in the cryptocurrency market for margin traders.In this article, we will explain how BitMex works, how to margin trade and how to remain profitable in this volatile market while trading with leverage. It is always worth remembering that margin trading is not for beginners. Traders should always be very careful while trading with leverage considering it is extremely risky despite offering large potential gains.

BitMex Cryptocurrency Trading

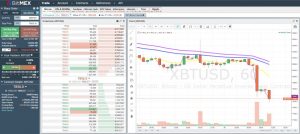

There are different platforms in the cryptocurrency space for traders that want to profit from volatility. However, just a few of these trading sites offer large liquidity and functional services and BitMex is one of these companies. BitMex is one of the largest crypto exchanges in terms of traded volume. At the same time, the site offers the possibility to trade with leverage, which suits perfectly for professional traders. BitMex is one of the most advanced trading platforms for cryptocurrencies considering the high liquidity levels, its performance and the fact that it has never been affected by a hack. However, users should know that the platform is not available for U.S. citizens. This cryptocurrency trading platform supports different cryptocurrencies, including Bitcoin (XBT), Cardano (ADA), Bitcoin Cash (BCH), Ethereum (ETH), Litecoin (LTC), XRP and EOS.

The main difference between BitMex and other traditional spot exchanges is that BitMex allows users to trade with leverage. BitMex works with crypto derivatives considering it offers an instrument that can be bought and sold on margin trading. Users will be trading actual Bitcoin and altcoin contracts that derive their value from the price of their respective assets. This is specifically useful to users that do not have enough funds to perform a large trade but they are certainly sure about the specific direction of the market.

What is Margin Trading?

Margin trading is the practice of trading assets – in this case, cryptocurrencies – using borrowed funds from third parties. In general, margin trading is used by expert and professional traders to have larger amounts of funds to trade in the market. Although this could be certainly profitable, it is a very risky trading method considering positions can be liquidated very fast.

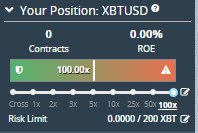

Traders could start trading with 2:1 up to 100:1 leverage. That means:

- if you have 1 Bitcoin (BTC) to trade and you use 2:1 leverage, you will be able to trade with 2 BTC instead of one;

- if you have 1 BTC, and you open a trade with 100:1 leverage you will have the possibility to handle 100 BTC instead of just 1 BTC.

The assets provided by the trader would work as collateral for the borrowed funds. This is very important at the time of understanding how margin trading behaves. When opening a position, there will be a threshold in which the trade would remain open, however, the position could get liquidated if the market crosses this threshold. This is known as liquidation price. BitMex provides traders with a user-friendly calculator that helps them calculate their profits, losses, liquidation price and more. Although the platform offers the possibility to trade with leverage, not all the cryptocurrencies have the same maximum leverage level available. BitMex cryptocurrencies will have these maximum leverage levels: Litecoin: 33X Ethereum: 50X XRP: 20X Tron: 20X Bitcoin Cash: 20XEOS: 20X Cardano: 20X Bitcoin: 100XIt is worth pointing out that using more than 50X leverage is very risky and should be done only if you know what you are doing and if you are 100% sure of the trade.Without enough collateral, these positions can be easily liquidated, ending up with a bad trade and losing money, which is not what we want to achieve.

Long and Short Positions

Traders can simply open long or short positions according to the direction in which they think an asset would move.

Long positions make reference to those that bet the price of an asset will move higher. Short positions work in a similar way but on the contrary direction. That means a short position is a bet that the price of an asset will fall. No matter which position you open, a part of the balance you have in your account will be used as collateral for the funds that you borrowed. If the trade is closed with a profit, the collateral is returned to your account and the profits will be added too. You will only be discounted the fees the platform has for operating the trade. Meanwhile, if the market moves against your position and you are liquidated, that means the trade will be closed and the collateral completely liquidated. The larger the leverage, the highest the possibilities are you could get liquidated faster. In other sections, you will have the possibility to learn about which positions are better to open according to the market conditions. You would not like to open a long position if the market is falling or a short position if the market is growing.

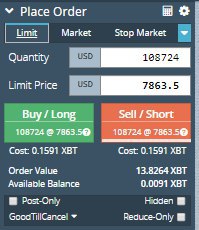

Limit, Market and Stop Orders

There are different kinds of orders that BitMex provides to traders for them to have more professional trading experience. Limit orders allow users to select a price level that will be filled as soon as the price of the asset reaches that level. These kinds of orders are cheaper than market orders and are the preferred method to start trading. Market orders are a good tool for traders that need to enter or leave the market at a specific moment in time. If you need to leave or enter the market, you create a market order that fills immediately. However, these orders have higher fees than limit orders and should only be used when necessary. Take profit is very important for traders because it would help them perform their trading strategy in the best possible way. For example, a trader could set three levels for taking profits. The first and second levels would give 25% of the users’ profits, respectively. The third level will allow them to take the 50% remaining profit.

Stop loss orders are another tool that would help traders prevent them from losing all their assets. For example, if the user opened a long position and the market suddenly drops, a stop loss order would help them reduce their exposure to volatility. The same would happen if a trader opened a short position and the market moves suddenly upwards. A stop loss order would prevent them from keeping their trade open when the market moved on the contrary direction they were expecting. Trailing stops would allow users to easily exit a trade once they are profitable. Traders can set a trailing stop loss of $200. In this way, if they enter the market at $5,000 and the price of the asset surges to $6,000 the trailing stop would be executed if it moves down to $5,800.

Stop loss orders are one of the most important tools that would allow us to reduce our exposure to sudden contrary market movements. When opening a highly leveraged position, the best thing to do is to operate with a tight stop loss that would reduce to the minimum the losses. However, our position may close if the market moves on the contrary direction. However, our position could be opened for a longer period of time and with lower risk if we use lower leverage to trade cryptocurrencies. In this case, our stop loss position would certainly be not so tight and the market would have some more time to develop. This is highly dependent on the risk you are able to handle. Cryptocurrencies are highly volatile and their price changes at all times, this is why it is always important to properly use stop loss while trading.

Isolated and Cross Leverage

There are different types of leverage for traders using Bitmex. Users can use Isolated and cross leverage to trade on the platform. If you open a position with leverage and you see the trade is going as expected, you can use the full amount of funds in the available balance and avoid liquidations. Always remember to use stop loss in order to reduce the risk while trading.

Cross leverage can be used in order to reduce the exposure to a specific trade, in case you would not be able to be controlling it at all times. At the same time, this margin method can be useful for users that are hedging existing positions and for arbitragers that do not want to be exposed on one side of the trade in the event of a liquidation. Isolated margin can be used for speculative positions. Using this margin strategy, it is possible to limit losses on the initial margin set. This helps day traders and short-term investors reduce their exposure if the trade does not go as expected.

If you are a beginner, the best thing to do is not to trade with cross Leverage. This would expose your whole equity balance, which is very risky. The term cross leverage is also known as Spread Margin and it allows you to use your full balance to avoid liquidations. This can be used to hedge existing positions and also to arbitrage and avoid being exposed on one side of the trade if there is a liquidation. At the same time, cross leverage would allow swing traders to be more protected against the fluctuations in the market. Considering that the market fluctuates at all times, using your whole funds would help you avoid excessive movements in the price of specific cryptocurrencies.

Bitcoin vs Altcoins BitMex Margin Trading Strategy

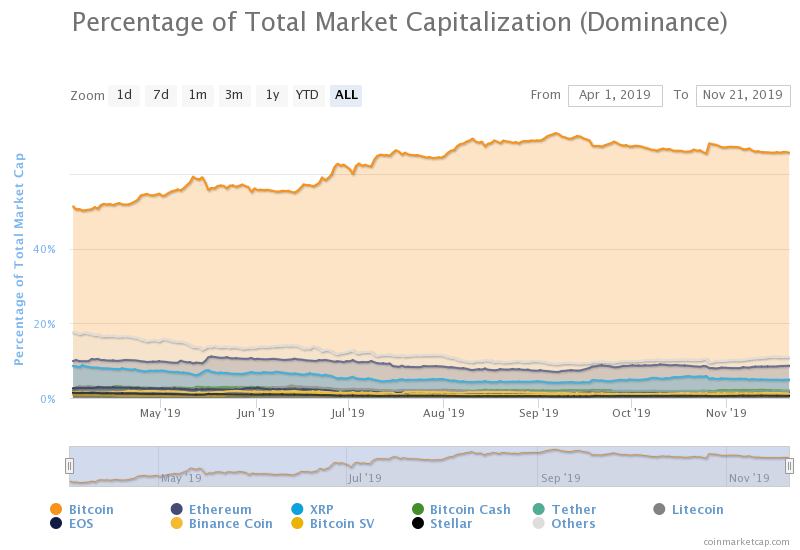

While trading on BitMex, and in other platforms, you should have a clear trading strategy that you want to implement and carry out. The cryptocurrency market is very volatile and it has been massively fluctuating since its inception. However, it is possible to distinguish different cryptocurrencies and understand the trading patterns related to each of them. The usual and basic distinction is related to Bitcoin vs Atlcoins. Altcoins are all the cryptocurrencies besides Bitcoin, which is the oldest and largest one. Although this is not a rule that works every single time, it helps understand specific trends and market behaviours. If Bitcoin surges there could be two different possibilities. The first one takes place when Bitcoin grows and expands because there is a sell-off in altcoins. This is what happened between April and November 2019. It is possible to see Bitcoin’s market dominance started to grow while altcoins’ market capitalization fell.

If you enter this trade very early, you could have enjoyed very positive gains before July if you would have used BitMex margin trading. The second possibility that we could encounter when Bitcoin surges is related to a general bull trend in which both altcoins and Bitcoin experience large gains. Generally, altcoins tend to have higher returns than Bitcoin due to their larger volatility and lower liquidity. If you were able to get the trade and recognize the trend, this would be a good opportunity to use BitMex margin trading and trade with leverage on altcoins.There is also a market situation in which Bitcoin would not be performing well, it could even fall, but altcoins will surge. This is what is known as alt season and would be very profitable for alt lovers. In case the trend is clear, you need to be prepared to short Bitcoin and long altcoins through the BitMex margin trading platform. Eventually, if both Bitcoin and altcoins are in a bear market, the best thing to do would be to analyze entry and exit points and have a clear shorting strategy.If you already know this strategy, you can complement it with market signals that would allow you to understand when to buy and sell a specific asset. AltSignals is one of the most recognized trade calls to trade on BitMex.

How To Handle Liquidations On BitMex Margin Trading?

While trading on BitMex you would usually do so with leverage, which can be very high in some cases. To keep these kinds of positions open traders will need to hold a Maintenance Margin percentage. You will always be able to review your liquidation price per position using the Open Positions Tab and adjust it by adding additional margin through the Leverage Slider or the Risk Limits tab. When a liquidation is triggered on BitMex, the exchange will cancel any open orders in order to free up margin and maintain the positions. Larger position sizes usually require higher margin levels. This allows the BitMex liquidation system to have a more usable margin to effectively close large positions that would otherwise be difficult to safely close.

When you trade a long position, your profits can be even larger than 100%. However, if the price falls more than the funds you used as collateral, then you will lose all these funds. The larger the leverage you use to trade, the riskier it becomes considering that the collateral funds will represent a small part of the total amount traded with leverage. These positions with high leverage should be followed very closely considering they are highly likely to be liquidated in case the price of the cryptocurrency suddenly changes its direction. Moreover, users should always use Stop Loss to reduce to the minimum the losses in case the market moves in the contrary direction. At AltSignals we usually have great results while trading on BitMex with margin because we use a very profitable and efficient signals system developed during the last few years.

Reduce Risk For BitMex Margin Trading

If you are currently analyzing the possibility to start using BitMex Margin Trading, then you may want to follow a few risk management recommendations that would help you better handle your funds.

- If you are a novice trader, use a small amount of money to test whether you feel comfortable while using BitMex Margin Trading. If your position gets liquidated, you would not risk a lot and you would have learned how the platform works.

- Select a specific cryptocurrency and stick to it during the first months of trading. This is a good strategy to get used to the price fluctuations and how the price of the assets behaves. For example, when Bitcoin and the cryptocurrency market drops, XRP price tends to be less affected.

- Trade with limit orders rather than market orders. This would help you to reduce the fees you pay while trading.

- Reduce the leverage you use on your position. If you are still learning how to trade in this market, the best thing you can do is to trade minimising the leverage you use on your position. This would reduce the chances of being liquidated and increase the chances of closing a trade with profit.

- Practising would make you an expert. BitMex is currently offering users the possibility to use a practice environment that would help you get used to the interface, understand the terms and practice your strategy.

If you feel that BitMex Margin Trading is not for you, then don’t be worried. You can always start trading with a traditional cryptocurrency exchange and understand the basics of cryptocurrencies before you move forward with riskier and more complicated trading strategies.

Trade Like a King With AltSignals

Are you a novice trader and you’d like to improve your trading skills? Are you a trading expert and you want to confirm your moves are accurate? AltSignals is the right tool for you. With AltSignals you will receive one of the most accurate trading signals in the market. Check it out and don’t miss a trade anymore. With AltSignals you will be able to receive notifications about entry levels for you to improve your trading strategy while using BitMex.

Disclaimer: The information presented by AltSignals and its writers is for informational purposes only. It should not be considered legal or financial advice. AltSignals and its writers are not financial advisers. You should consult with a financial professional to determine what may be best for your individual needs.AltSignals and its writers do not make any guarantees or other promises as to any results that may be obtained from using their content. No one should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence.Please always invest within your means and do so responsibly.