Cryptocurrency calls, also known as signals, are recommendations or predictions made by experienced traders to capitalize on potential price movements in the crypto market. Whether you’re a novice or have some trading experience, understanding and utilizing these calls can greatly enhance your chances of success.

In this guide, we’ll explain what crypto calls are, how they work, and why they are important. We’ll also discuss the various types of calls, the strategies involved, and provide tips on how to identify reliable signals. By the end, you’ll have a solid foundation to start making informed trading decisions and capitalize on lucrative opportunities in the cryptocurrency market.

So, strap in and get ready to take your crypto trading journey to the next level with the ultimate beginner’s guide to crypto calls.

Crypto calls are becoming an increasingly important facet of the cryptocurrency trading space. Before, traders relied on their own research, or tips from other people to determine which cryptocurrency to buy and at what time. However, with the price-action of a majority of cryptos being largely stagnant, it’s becoming more and more difficult for the average crypto investor to make a return. This article will explore why crypto calls are currently the best bet of making triple digit percentage returns, and who’s calls is it that you should be following.

What are Crypto Calls

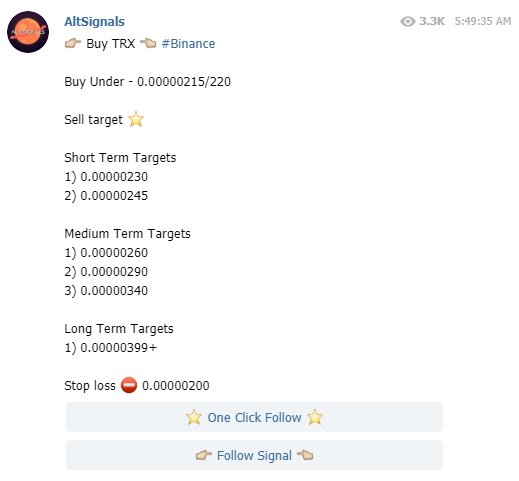

In short, crypto calls are instructions sent to you indicating which cryptocurrency to buy. These calls contain information such as:

- The crypto to buy – The call specifies which cryptocurrency to buy e.g. BTC, ETH, XRP

- The buy-in price – The price you should try to buy the cryptocurrency at

- The sell-targets – The price you should sell the cryptocurrency at in order to achieve a profit

- Stop losses – A mechanism to automatically exit your position to mitigate losses

There are various ways to receive crypto calls, but by far the most popular method of getting them is on Telegram. Telegram is an instant messaging service app that has the look and feel of WhatsApp. However, Telegram has certain unique features that sets it apart, the most important being its bot functionality.Telegram bots can be programmed and designed to handle messages automatically. Users typically interact with these bots by issuing command messages in group environments. These bots can be used to issue crypto calls that allows users to place a trade automatically without have to get on to a cryptocurrency exchange. As long as the correct permissions have been setup, you can place all your trades with the click of a button through Telegram.

Crypto calls are also cryptocurrency exchange specific, meaning, you can only follow a call if you have an account with that exchange. This isn’t typically a problem as most traders tend to have accounts with the major exchanges such as: Binance, BitMex, Coinbase and Bittrex. However, before deciding which calls to follow, just ensure you have an account with the exchange the calls are based on, so you don’t have any issues.

Moving on, another key feature of crypto calls are the periodic updates you receive on any position you have chosen to enter into. For example, if you decide to follow a crypto call and buy Bitcoin, if a profit-target is reached, you’ll receive a notification letting you know that you’ve made a profit. It’s at this point that you can decide whether to continue to hold your crypto to reach a higher profit target, or cash out for a nice return. Conversely, you’ll also immediately receive a notification if a stop-loss has been triggered so you can be certain that any losses you may have incurred are thoroughly mitigated.

Crypto Calls to Follow – AltSignals

Hopefully readers can now appreciate just how profitable crypto calls can be. However, which calls you follow can often be the difference between a profit and a loss.When deciding which crypto call provider to go with, one very important factor to consider is the size of the following. AltSignals, the best crypto call provider in the space, currently have over 55,000 people following and relying on their calls on a daily basis. They are one of the oldest providers, having been launched in 2017, and since then have been gradually gaining the trust of their followers.

One key feature they provide is producing analysis justifying exactly why to follow certain calls. This can often be important in helping you decide if or not to follow a call in the first place, as well as if you should continue holding your crypto to see if higher price targets can be reached.They currently provide crypto calls for exchanges: BitMex and Binance, as well as a newly launched Forex service. You can find out more about their signals by visiting: AltSignals Crypto Calls.

The importance of crypto calls in the cryptocurrency market

In the rapidly evolving landscape of cryptocurrency trading, the significance of crypto calls cannot be overstated. As the market is notoriously volatile, making informed decisions is crucial for anyone looking to capitalize on price movements. Crypto calls serve as a guiding light, helping traders navigate through the noise and fluctuations of the market. These recommendations, often provided by seasoned traders or specialized groups, highlight potential buying or selling opportunities based on market analysis and trends. By leveraging these insights, beginners can enhance their trading strategies and make more informed decisions.

Another fundamental aspect of crypto calls is their ability to democratize access to market expertise. Not every trader possesses the same level of experience or understanding of technical analysis, and this gap can often lead to missed opportunities. Crypto calls bridge this gap by offering insights from individuals who have honed their skills over years of trading. For beginners, joining a community that shares these calls can provide a supportive environment where they can learn and grow. This collective knowledge can help level the playing field, making it easier for newcomers to participate in the crypto market confidently.

Moreover, the importance of crypto calls extends beyond mere recommendations; they also foster an environment of collaboration among traders. Many successful crypto groups encourage members to share their insights, analyses, and experiences. This exchange of information not only enhances individual trading strategies but also contributes to a more informed community overall. As new traders engage with experienced members, they can develop a deeper understanding of market dynamics and improve their trading acumen, paving the way for long-term success in the cryptocurrency market.

Key concepts and terminology related to crypto calls

To effectively engage with crypto calls, it’s essential to familiarize yourself with key concepts and terminology that are commonly used in the cryptocurrency trading space. One of the primary terms you’ll encounter is “signal.” A signal refers to a specific recommendation to buy or sell a cryptocurrency, often accompanied by entry and exit points. Understanding the nuances of signals is crucial, as they can vary in terms of urgency and the level of risk associated with them.

Another important concept is “stop-loss.” This term refers to a predetermined price point at which a trader will exit a losing position to prevent further losses. Stop-loss orders are vital for managing risk, especially in a volatile market like cryptocurrency. By setting a stop-loss, traders can protect their investments and avoid emotional decision-making during periods of market downturns. Familiarity with this term will help you execute trades more effectively and minimize potential losses.

Additionally, you’ll often hear the term “FOMO,” which stands for “Fear of Missing Out.” FOMO describes the anxiety traders experience when they believe they might miss out on a profitable opportunity. This can lead to impulsive trading decisions, often resulting in losses. Understanding FOMO is critical for beginners, as it encourages a more disciplined approach to trading. By relying on well-researched crypto calls rather than succumbing to emotional impulses, traders can make more rational decisions that align with their investment strategies.

Understanding the risks and benefits of crypto calls

As with any investment strategy, utilizing crypto calls comes with its own set of risks and benefits. On the positive side, crypto calls can significantly enhance a trader’s ability to identify profitable opportunities in the market. By relying on the expertise of seasoned traders, beginners can gain insights into market trends, sentiment, and potential price movements, which can lead to successful trades. This access to experienced analysis can empower newcomers to make informed decisions, ultimately improving their trading outcomes.

However, it is crucial to acknowledge the risks associated with crypto calls. Not all signals are created equal, and relying solely on external recommendations can lead to poor decision-making. Market conditions can change rapidly, and what may seem like a promising call can quickly turn into a loss. Beginners must cultivate a sense of skepticism and conduct their own research to validate the information they receive. It is vital to understand that crypto calls are not foolproof guarantees of profit but rather informed predictions based on analysis.

Moreover, the psychology of trading can also pose risks when engaging with crypto calls. The excitement of a potential gain can lead traders to overlook their risk management strategies, resulting in significant losses. Additionally, the fear of missing out can compel traders to enter positions without adequate analysis or preparation. Understanding these psychological factors is essential for maintaining a balanced approach to trading and ensuring that decisions are grounded in research rather than emotions.

How to join and participate in a crypto call group

Joining a crypto call group can be a transformative step for beginners looking to enhance their trading skills. The first step is to conduct thorough research to identify reputable groups that align with your trading goals and values. Many groups operate on platforms such as Telegram, Discord, or even social media channels, and it’s crucial to evaluate their credibility before committing. Look for groups with positive reviews as does AltSignals on Trustpilot, active discussions, and a history of successful calls. Engaging with members and assessing the group’s overall atmosphere can also provide insights into whether it’s the right fit for you.

Once you’ve found a suitable group, the next step is to participate actively. Engaging in discussions, asking questions, and sharing your insights can significantly enrich your learning experience. Many successful traders started as novices but progressed by leveraging the collective knowledge of their group. Don’t hesitate to seek clarification on calls, strategies, or market trends. Active participation not only helps you learn but also fosters relationships with other traders, creating a supportive network that can benefit you in the long run.

It’s also important to understand the etiquette of crypto call groups. Many groups have guidelines in place to ensure respectful and constructive communication. Adhering to these guidelines demonstrates professionalism and helps maintain a positive trading environment. Additionally, be prepared to share your experiences and insights, as contributing to the group can enhance your learning while providing value to others. By being an active, respectful member, you can maximize the benefits of joining a crypto call group and improve your trading journey.

Tips for successful crypto calls

To make the most out of crypto calls, beginners should implement specific strategies that can enhance their success rate. One essential tip is to always conduct personal research before acting on any call. While crypto calls can offer valuable insights, they should serve as a starting point rather than the sole basis for your trading decisions. Analyzing market trends, studying the fundamentals of the cryptocurrency in question, and understanding the broader economic context can provide a more comprehensive view that aids in making informed choices.

Another critical aspect of successful trading is establishing a clear plan and sticking to it. This plan should outline your entry and exit points, risk tolerance, and profit targets. By having a structured approach, you can mitigate the emotional influence that often accompanies trading decisions. It’s also advisable to utilize stop-loss orders, as they can help you manage your risk effectively. Setting these parameters before entering a trade allows you to remain disciplined, even when market conditions shift unexpectedly.

Lastly, patience is a virtue in the world of crypto trading. Many beginners may feel compelled to act quickly on every call, fearing they might miss a potential opportunity. However, taking the time to analyze and reflect on a call can lead to better decision-making. It’s essential to remember that not every call will lead to a profitable trade, and sometimes waiting for the right conditions can yield better results. Cultivating patience while adhering to your trading plan can significantly enhance your overall trading success.

Tools and resources for analyzing crypto calls

Utilizing the right tools and resources can greatly enhance your ability to analyze crypto calls effectively. One essential tool is a reliable cryptocurrency price tracking platform. Websites like CoinMarketCap or CoinGecko provide real-time data on various cryptocurrencies, enabling traders to monitor price movements and make informed decisions based on current market conditions. These platforms often include historical price charts, which can be invaluable for analyzing trends over time and understanding potential entry and exit points.

Technical analysis tools are also crucial for evaluating crypto calls. Platforms like TradingView offer advanced charting capabilities, allowing traders to apply various technical indicators to their analyses. By utilizing tools such as moving averages, Bollinger Bands, and Relative Strength Index (RSI), traders can gain insights into market trends, overbought or oversold conditions, and potential reversals. Familiarizing yourself with these technical analysis tools can empower you to validate crypto calls and make more informed trading decisions.

Additionally, staying updated with news and developments in the cryptocurrency space is vital for effective analysis. Websites like CoinDesk and CryptoSlate provide timely news articles, analyses, and expert opinions on market trends. Subscribing to relevant newsletters or following influential figures in the crypto space on social media platforms can also keep you informed about emerging trends and potential market-moving events. By combining real-time data, technical analysis tools, and up-to-date news, you can develop a holistic approach to evaluating crypto calls and making informed trading decisions.

Common mistakes to avoid when participating in crypto calls

While engaging with crypto calls can be beneficial, beginners often make several common mistakes that can hinder their trading success. One prevalent mistake is blind trust in signals without conducting personal research. Relying solely on recommendations without understanding the underlying factors can lead to costly errors. It’s essential to validate the information you receive through your own analysis, ensuring that you make informed decisions based on a comprehensive understanding of the market.

Another mistake is succumbing to emotional trading. The fear of missing out (FOMO) can lead traders to make impulsive decisions, entering or exiting positions without proper analysis. Additionally, overreacting to market fluctuations can cause unnecessary losses. Establishing a trading plan with clear entry and exit points, as well as maintaining a disciplined approach, can help mitigate the emotional challenges of trading. Remember, patience and rational decision-making are key components of successful trading.

Lastly, neglecting proper risk management can be detrimental to your trading journey. Many beginners fail to set stop-loss orders, exposing themselves to unnecessary losses during market downturns. Always define your risk tolerance before entering a trade, and utilize stop-loss orders to protect your capital. By managing your risks effectively, you can safeguard your investments and position yourself for long-term success in the cryptocurrency market.

Conclusion and next steps for mastering crypto calls

To conclude, crypto calls are instructions sent directly you to indicating which cryptocurrency to buy along with trade information such as: buy-in price, sell price and stop losses. These calls can be communicated over a variety of methods, but the most popular way of following these calls is Telegram due to its in-built bot feature.Crypto Calls can be cryptocurrency exchange specific, therefore it’s key to make sure you have an account on the exchange the calls are based on. The most well-known and best performing crypto call provider is currently AltSignals.

As you embark on this journey, remember that continuous learning is crucial. The cryptocurrency market is ever-evolving, and staying informed about new developments, trends, and strategies will help you adapt to changes and seize opportunities as they arise. Leverage the tools and resources at your disposal to analyze calls effectively, and don’t hesitate to seek guidance from experienced traders in your community.

Ultimately, mastering crypto calls is a process that requires patience, diligence, and a willingness to learn from both successes and failures. By approaching your trading journey with an open mind and a commitment to growth, you can navigate the exciting world of cryptocurrency with confidence and maximize your potential for success.