A Comprehensive Exploration of Stream Finance’s $93 Million Setback

In an unexpected turn of events, Stream Finance, the decentralized finance protocol, suffered a loss of $93 million. This event has sparked unparalleled revelations about how the loss influenced multiple indirect collateral positions and loan amounts. These, in turn, may have ramifications across a global network of lending markets, liquidity vaults, and stablecoins.

Stream Finance’s Network: All You Need to Know

Analysts from YieldsAndMore, a collection of DeFi power users and on-chain researchers, meticulously dissected Stream Finance’s network. They uncovered that Stream’s liabilities traverse a minimum of seven networks. The investigations also revealed the involvement of several counterparties, some of which include MEV Capital, Varlamore, Elixir, TelosC, and Re7 Labs.

How Were Other Assets Affected?

The analytical examinations by the Yields and More collective also revealed how xUSD, xBTC, and xETH tokens, linked with Stream, were rehypothecated across other protocols like Silo, Euler, Sonic, and Morpho. This action further magnified the propagation of the potential impact across the decentralized finance ecosystem.

The Cost of Exposure

When evaluating the total assets associated with Stream, YAM projected a total debt of $285 million, excluding the indirect exposure via derivative stablecoins. YieldsAndMore’s data also drew attention to Elixir, MEV Capital, and TelosC, as the largest curators associated with the lending markets backed by Stream, with debts amounting to approximately $123.6 million, $25.4 million, and $68 million, respectively.

The Domino Effect of the Massive Loss

In the words of the YAM syndicate, this incident amounts to a massive loss. They also highlighted the uncertainty hovering over how the xETH, xBTC, and xUSD lenders and holders will settle. Additionally, there is anticipation that more vaults and stables may potentially experience the aftershock of this situation.

Fallout from the Protocol Missteps

A close look at YAM’s findings gives us a picture of the consequent exposure. The most substantial single exposure is witnessed in Elixir’s deUSD, which lent $68 million in USDC to Stream. This amount makes up around 65% of deUSD’s overall support. But the repayment is currently on hold pending legal scrutiny, as per what Stream team communicated to creditors. Other indirect exposures may also include Treeve’s scUSD, which is involved in multi-layered lending loops involving Euler, Silo, Mithras, and other positions held by Varlamore and MEV Capital.

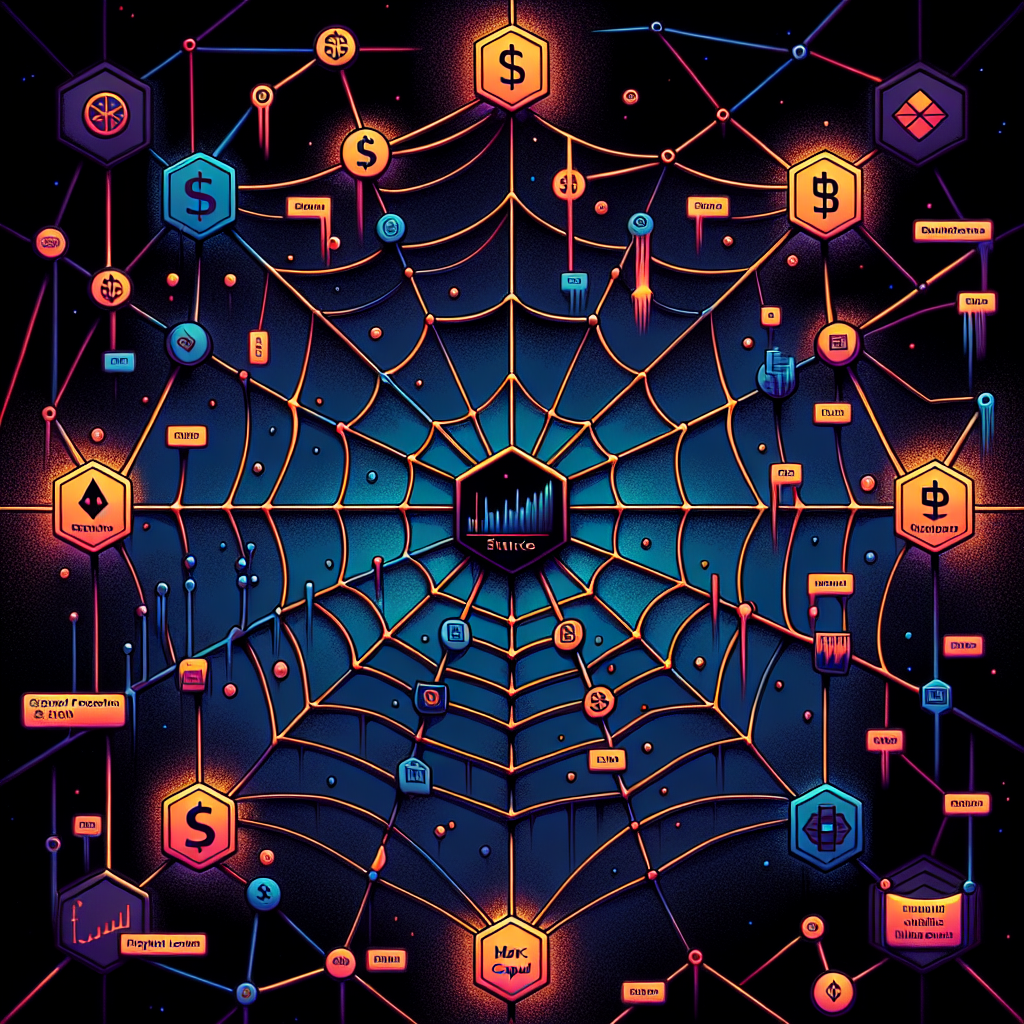

Unraveling the Complex Web

While YAM has attempted to diagram the situation, they acknowledge that the pattern is incomplete. There is an expectation that more affected vaults will come to light as lending contracts are audited, and positions continue to unravel.

Unraveling the Reasons for Stream’s Downfall

Stream’s downfall amplified as it halted all withdrawals and deposits following the revelation of a $93 million loss within its synthetic asset markets. Stream Finance operates a synthetic asset protocol that issues tokens, primarily xUSD, xBTC, and xETH. These are backed by on-chain collateral and pegged to their real-life counterparts. This model achieves maximum capital efficiency via rehypothecation across multiple lending loops and depends on overcollateralization. However, this design also enormously scales systemic risk.

DeFi’s Difficult Start to November

Regrettably, the Stream event is one of three significant DeFi incidents happening in less than a week. The other two include a $128 million Balancer exploit and oracle manipulation attack on Moonwell DeFi, causing a loss of around $1 million. Collectively, these events have wiped around $222 million off the value of DeFi protocols in early November, casting light on the increasingly intertwined nature of collateral and liquidity systems.

Disclaimer

All the information provided in this article is for informational purposes solely and should not be considered as legal, financial, tax, investment or any other advice. As we drive towards delivering factual, well-researched, and objective reporting, we encourage you to do your due diligence before making any financial decisions.