2022 is already here and it could be a great year for Ethereum. This virtual currency enjoyed a great 2021 with its price surpassing $4,500 over ten times more than in March 2020 with the Covid-19 crisis. The question now is related to the continuity of the current bull market to the upcoming years.

In this guide, we share all the details about Ethereum price prediction and this digital asset. We tell you how Ethereum works, what analysts say about its future and why this virtual currency is now so important for the entire crypto market.

Disclaimer: the information shared by AltSignals and its writers should not be considered financial advice. This is for educational purposes only. We are not responsible for any investment decision you make after reading this post. Never invest more than what you are able to lose. Always contact your professional financial advisor.

What is Ethereum (ETH)?

Ethereum (ETH) is the second-largest cryptocurrency in the world after Bitcoin. This blockchain network was one of the first to offer smart contracts compatibility. Smart contracts get executed if certain conditions are met, meaning that it is possible for developers to create complex applications that do not require the oversight of centralized parties.

Thanks to this approach, Ethereum is now letting users enjoy hundreds of different decentralized applications that offer solutions in different industries, from decentralized finance (DeFi) to closed blockchain networks, among other things.

Over the last few years and thanks to the expansion of the entire cryptocurrency market, Ethereum saw the appearance of competitors such as Solana (SOL), EOS (EOS), Tron (TRX) or Cardano (ADA), among others. However, none of these projects was able to take the second position from Ethereum in the market.

This shows the resilience of a cryptocurrency project that is now one of the most valuable in the world. Ethereum transactions take a few minutes to get approved by the network and fees change depending on market conditions. Ethereum works with a Proof-of-Work (PoW) consensus algorithm but it is now planning to move to a Proof-of-Stake (PoS) blockchain network.

This change would let Ethereum become faster, cheaper and easier to handle for users and investors from all over the world. Basically, this would let Ethereum users avoid congestion, which became very common in recent years on the Ethereum blockchain.

ETH Fundamental Analysis

It is now time to focus on Ethereum’s fundamental analysis. There are some things to take into consideration about this blockchain network. The change from PoW to PoS could be a very important reason for investors to think about diversifying their crypto portfolio with Etheruem.

This cryptocurrency network is going to be faster and cheaper to use, which could increase the number of participants and generate a larger demand for ETH. Let’s not forget that due to the lack of scalability new projects and blockchain networks expanded (trying to solve the scaling issues faced by Ethereum).

This has taken a large market from ETH. However, if Ethereum becomes more efficient and scalable, it could be possible for it to recover part of the market that it lost against other competitors such as Solana, Binance Smart Chain or Cardano, among others.

Furthermore, it is also very important to follow what developers have planned about the total supply of Ethereum. Let’s not forget that Ethereum has no total supply like Bitcoin. Nonetheless, Ethereum developers have created a way for this blockchain network to reduce its supply over time (burning a larger part of ETH than those being created). This could have a strong impact on the price of the second-largest virtual currency in the world.

ETH Price Analysis

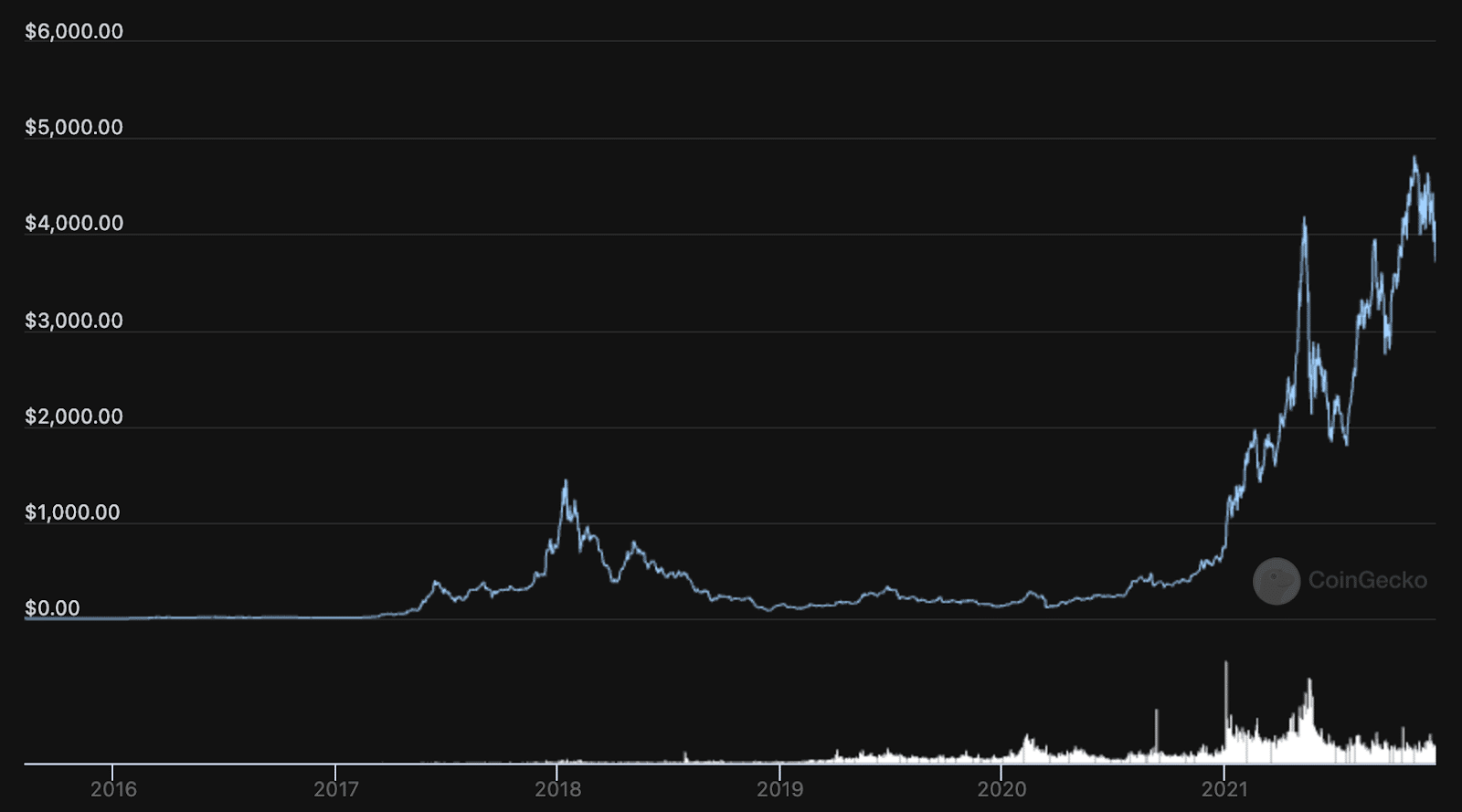

When it comes to Ethereum’s price, we have seen how this digital currency moved from below $100 to over $4,500 in just a matter of years. There has been a large demand for Ethereum that allowed investors to register large gains over the last few years.

As you can see in the image above, Ethereum experienced different bull market periods. For example, 2017 was a very positive year for this digital asset. In early 2018, Ethereum reached an all-time high of $1,420, which lasted until early 2021.

2021 was, by far, the best year for Ethereum. It started below $1,000 and it suddenly skyrocketed to new highs above $4.000. This was thanks to the expansion of Bitcoin (BTC), which registered new all-time highs as well.

Basically, the whole crypto market behaved bullishly in recent months. However, Ethereum was able to sustain the best price close to its all-time high. Few other digital assets remained as high as Ethereum in terms of price. Other coins have already retraced from their ATHs by over 50% in some cases.

ETH Market Price Prediction

Let’s now move to Ethereum’s market price prediction. It is very important to understand what could happen to Ethereum in the coming months and years. This is why we have decided to create a list of the next years to analyse together which could be the effect of a bull or a bear market in the cryptocurrency industry.

ETH Price Prediction 2022

Let’s start with this recent price prediction and analysis of Ethereum. ETH investors were looking for a rejection from the structure level at $4,530 as they were expecting one more move down before the next bull run.

What we have seen is that the price was rejected and it came down to retest the 38.2 Fibonacci level. This happened as predicted. Now, analysts consider that it could be a good opportunity to enter below the 38.2 Fibonacci level.

However, the market moved downwards once again in recent days. It would be very important to understand how this could have an impact in the coming year for Ethereum. Let’s not forget that a bull market could be very positive for ETH and for other altcoins.

Instead, a bear trend could result in Ethereum and other digital currencies erasing the gains that they registered throughout 2021. This is why it would be very important to understand whether the trend continues for 2022 or not, as this would pave the way to new and different outcomes in the coming years.

ETH Price Prediction 2023

What will happen with Ethereum in 2023 would highly depend on the previous years. IT is very important to understand whether 2022 was a bull or a bear market. If it was a bull market, then 2023 should be the year of the bear trend. That means that Ethereum could find itself in a downward trend if Bitcoin and other coins reach a top in 2022.

Instead, if 2022 was already a bearish year for cryptocurrencies, we should see Ethereum trying to recover in 2023. It might not be a full bull market yet but it is highly possible that Ethereum would have already bottomed.

As you can see, this is simply understanding major cryptocurrency cycles. The clear example is Bitcoin, the oldest cryptocurrency in the world. It has experienced four major cycles and we could still experience new ones in the coming years.

ETH Price Prediction 2024

2024 and 2025 would also depend on the previous years and how Ethereum behaved. If 2023 was the year of the slow recovery for Ethereum, 2024 could be the beginning of a new bull market. This is just speculation, as predicting price trends for virtual currencies is similar to gambling.

Instead, if Ethereum experienced a bearish year in 2023, then 2024 should be the year of recovery. In this case, we could see Ethereum moving higher but without the intensity of a bull market. The digital asset will be trying to leave the bear market that affected it in 2022 and 2023.

ETH Price Prediction 2025

2025 is too far away to understand what could happen with Ethereum. However, it is possible to see Ethereum moving higher if it proved to be a reliable cryptocurrency. Moreover, if Proof of Stake has already been implemented, then we could see a digital asset that would be very efficient and that would be competing with a large number of other digital currencies in the cryptocurrency market.

It is just a matter of time to see what can happen to Ethereum in 2025 as it would also depend on the previous years and how the market behaves at that time.

How to Buy Ethereum (ETH)?

It is now time to know how to buy Ethereum using cryptocurrency exchanges.

Step 1: Search for a Cryptocurrency Exchange and Open an Account

The easiest way for you to buy cryptocurrencies is by opening a cryptocurrency exchange account. This is something that can be done in just minutes if you have already selected the crypto exchange you want to use. Make sure that you select a crypto exchange that supports fiat currencies. This would make the whole process even easier.

Moreover, there are hundreds of crypto exchanges in the market. Hence, you should make sure you select the correct one for your region. Not all of them could be available in your jurisdiction.

Step 2: Deposit Funds

Now that you have a cryptocurrency exchange account, it is time to deposit funds. But how to do so? Nowadays, cryptocurrency exchanges have different deposit options, including fiat currencies through debit and credit cards or bank transfers.

Some platforms would let you buy Ethereum directly, without having to deposit funds. You simply select the option to buy Ethereum and the exchange would tell you how much it costs. The rest would then be almost automatic: you just wait for the ETH to be deposited in your account after you make the purchase.

Step 3: Buy ETH

As we have already said before, you can already buy Ethereum from the exchange before even depositing funds. This is possible because they would simply take your deposit and transform it to ETH at market rates.

However, if you want to trade or exchange ETH manually, you can also do it. As soon as you deposit your local fiat currency through debit or credit cards (or bank transfer), you would be able to start trading. You should go to the exchange section and select the ETH pair for the fiat currency that you have deposited. If you are in Europe, this trading pair would be ETH/EUR.

You can also select the type of order for you to execute the trade. A market order will execute your purchase immediately at the best possible price. Instead, a limit order would let you purchase Ethereum at lower prices. However, this would take some time to get executed. If you select a very low price (for example $10) it would never get filled (unless ETH moves to $10).

Frequently Asked Questions (FAQ)

It is now time to answer some of the most asked questions about Ethereum.

What is Ethereum?

Ethereum is the second-largest blockchain network in the cryptocurrency industry. Smart Contracts are Ethereum’s main feature. This is one of the first networks that allowed for smart contracts to be released on top of it, making it possible for the crypto market to expand and create new solutions for investors and crypto enthusiasts.

Difference Between Ethereum and ETH

There are some differences between Ethereum and ETH. Although these terms are used almost interchangeably, there are some differences. Ethereum is the blockchain network that offers smart contracts to investors. Instead, ETH (or Ether) is the digital currency that powers this distributed ledger.

Where Can I Buy ETH?

You can buy Ethereum at a large number of cryptocurrency exchanges. Binance, Coinbase, KuCoin, Coinex and OKEx are just some of the most popular exchanges for you to purchase Ethereum. It is up to you to decide which one to use.