Cryptocurrency trading has been shown to return juicy profits to investors as it is one of the most volatile markets, thus giving traders the opportunity to earn money by trading long and short. Although we can agree that Bitcoin is the most popular cryptocurrency, it is not necessarily the only one that can make us earn money.

There is no general rule on what should be the minimum amount with which you should start to buy cryptocurrencies, since it depends a lot on your personal situation, your goals, and of course, your financial situation. In addition, almost all trading platforms allow you to position leveraged orders in the market, which means that you will be able to opt for a higher trading power than you really have.

Guidelines to start cryptocurrency trading

- Never risk more money than you are willing to lose

- Never put your financial assets, assets, or your family’s basic survival at risk.

- Do not go into debt to buy bitcoins or other cryptocurrencies.

- Be totally suspicious of those people or companies that promise you high returns since regardless of what they tell you and all the arguments they present to you, in 99% of cases they turn out to be scams, Ponzi schemes or people/companies intervened by governments.

- Only deposit your capital in legitimate exchange companies whose policies are tailored to your needs.

Set Up Your Trading Foundations

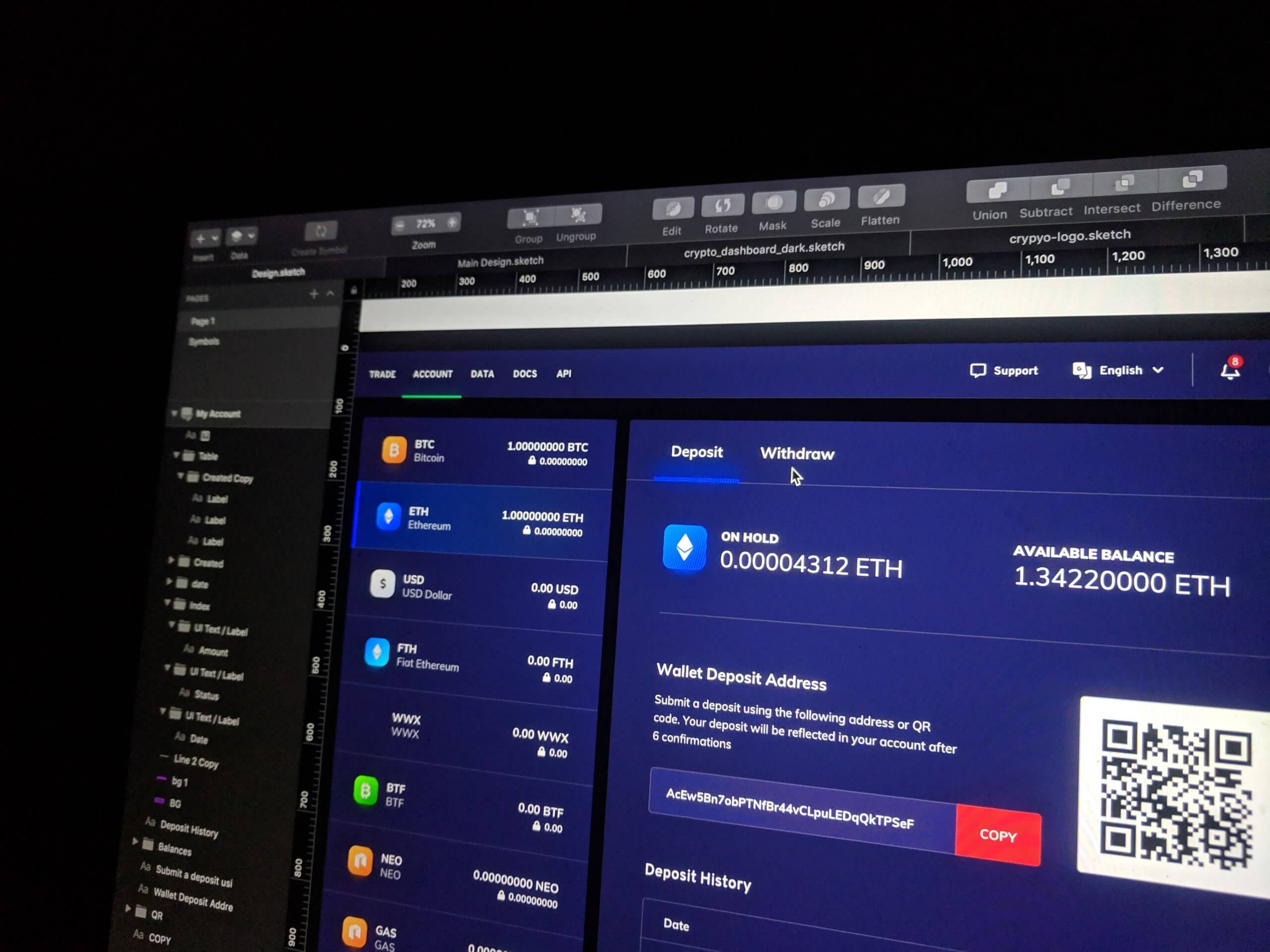

Before diving into trades, it’s essential to lay the groundwork. Start by selecting a reliable cryptocurrency exchange — popular options include Binance, Coinbase, and Kraken. Look for platforms that are secure, user-friendly, and offer a variety of trading pairs.

Next, set up a crypto wallet to store your assets safely. While exchanges provide custodial wallets, using a non-custodial or hardware wallet like MetaMask or Ledger adds an extra layer of security, especially for long-term holdings.

Lastly, verify your identity (KYC), secure your account with 2FA, and understand the exchange’s fee structure before trading.

Learn Basic Trading Concepts

Understanding the mechanics of trading is crucial. Start by learning about trading pairs (e.g., BTC/USDT), order types (market, limit, stop-loss), and the basics of technical analysis, such as chart patterns, trends, and indicators like RSI or MACD.

You don’t need to become an expert overnight, but knowing how to read a chart and spot momentum can drastically improve your decision-making. There are plenty of free and paid educational resources available — consider joining trading communities or signal groups to learn from more experienced traders.

Practice with a Strategy and Start Small

Jumping into crypto without a plan is risky. Choose a simple trading strategy to start with — like swing trading, day trading, or trend following — and stick to it. Most importantly, manage your risk: never trade more than you can afford to lose, and always use stop-loss orders.

Many platforms offer demo accounts or paper trading environments where you can practice without using real money. Once you’re comfortable, start small with real trades and gradually scale up as you gain confidence and experience.

How to earn money from cryptocurrency trading?

Each cryptocurrency has is valued on another asset, such as a fiat currency (USD for example) or another cryptocurrency. In the case of Bitcoin, currently 1 token is valued at USD 9,650 but it can change depending on supply and demand within the market. If there is a high trading volume and the market is inclined to buy BTC, its price will probably increase, while if the volume is low and there is no sufficient demand, this price will seek lower levels.

The objective of cryptocurrency trading is to buy at a low price (For example, USD 9,300) after having made the necessary confirmations through market analysis, and then sell your position at a higher price (such as 9,500). The percentage that said cryptocurrency (or perpetual contract) has risen while in your possession will be reflected in earnings, which you can receive in BTC, USD or another currency, depending on the pair you are trading.

Just as you can make money buying (long) you can also earn by selling a cryptocurrency that you really don’t have (short). Margin trading allows you to trade a contract whose value is equal to that of the underlying asset and if the price reaches its target, you will have earned the percentage that the price has changed. In this case, if the price fell 10% and you placed a short order for $1000, you will have earned $100.

To support a good market analysis you should always stay informed of the industry and especially of the latest news or rumors that in the vast majority of cases cause an increase or decrease in the price of cryptocurrencies.

Where to start cryptocurrency trading?

You can trade cryptocurrencies on “unregulated” platforms or exchanges like BitSeven and Overbit if your only deposit method is through Bitcoin. The disadvantage of unregulated platforms is that you do not have adequate support and guarantees that can maintain your confidence.

If you can make deposits in fiat currency, you can use “regulated” trading platforms or brokers with the advantage that you have better guarantees as a client and can receive more professional support. However, your winnings will be reflected in USD or EUR and can only be withdrawn through bank wire transfer.