Indicators are definitely useful to trade Forex, indices, stocks and cryptocurrencies. But how to use indicators in TradingView? TradingView is one of the most useful platforms to trade and also to analyse financial markets. It offers the possibility for users to engage in different technical analysis activities.

In the next sections, we will share with you all the information you should have about how to use indicators in TradingView. It is definitely important to know how to open charts and how to easily use the indicators we need to analyse the markets, independently from the instrument you trade.

Disclaimer: the information shared by AltSignals and its writers should not be considered financial advice. This is for educational purposes only. We are not responsible for any investment decision you make after reading this post. Never invest more than what you are able to lose. Always contact your professional. financial advisor.

What are Indicators?

Indicators are trading tools that let investors recognize buying and selling opportunities in the market. At the same time, they are used to visualize charts, recognize patterns and forecast possible future trends.

Although indicators could be very useful, they do not predict the price action of a stock or currency if they are not properly used. Even when they are used correctly, it only helps traders identify key price levels in the charts.

There are different types of indicators depending on the needs of the trader. They could use trend, momentum, volatility and volume indicators. Each of them has different functionalities and would identify different patterns. Additionally, it is the trader and investor the one that should draw the indicators.

Some indicators might be more useful than others. However, a complete trading strategy involves several indicators and fundamental analysis as well. This could help the analyst get better results in the long term.

How to Use Indicators in TradingView?

The question now is how to use indicators in TradingView. This is something that is not sometimes intuitive for many users. TradingView would let you use all the indicators that you want. However, there is a limit for users that have free accounts.

Premium users can use as many indicators as desired. Moreover, they would also have a larger list of indicators as some of them require the investor to pay. If you want to use trading indicators in TradingView you should open the site and search for the trading pair you want to trade, for example BTC/USD. When selecting the trading pair, you would usually have different exchanges and platforms where it is currently traded. It is usually recommended to use the platform that has the largest volume, as illiquid markets could create inefficiencies in the price behaviour.

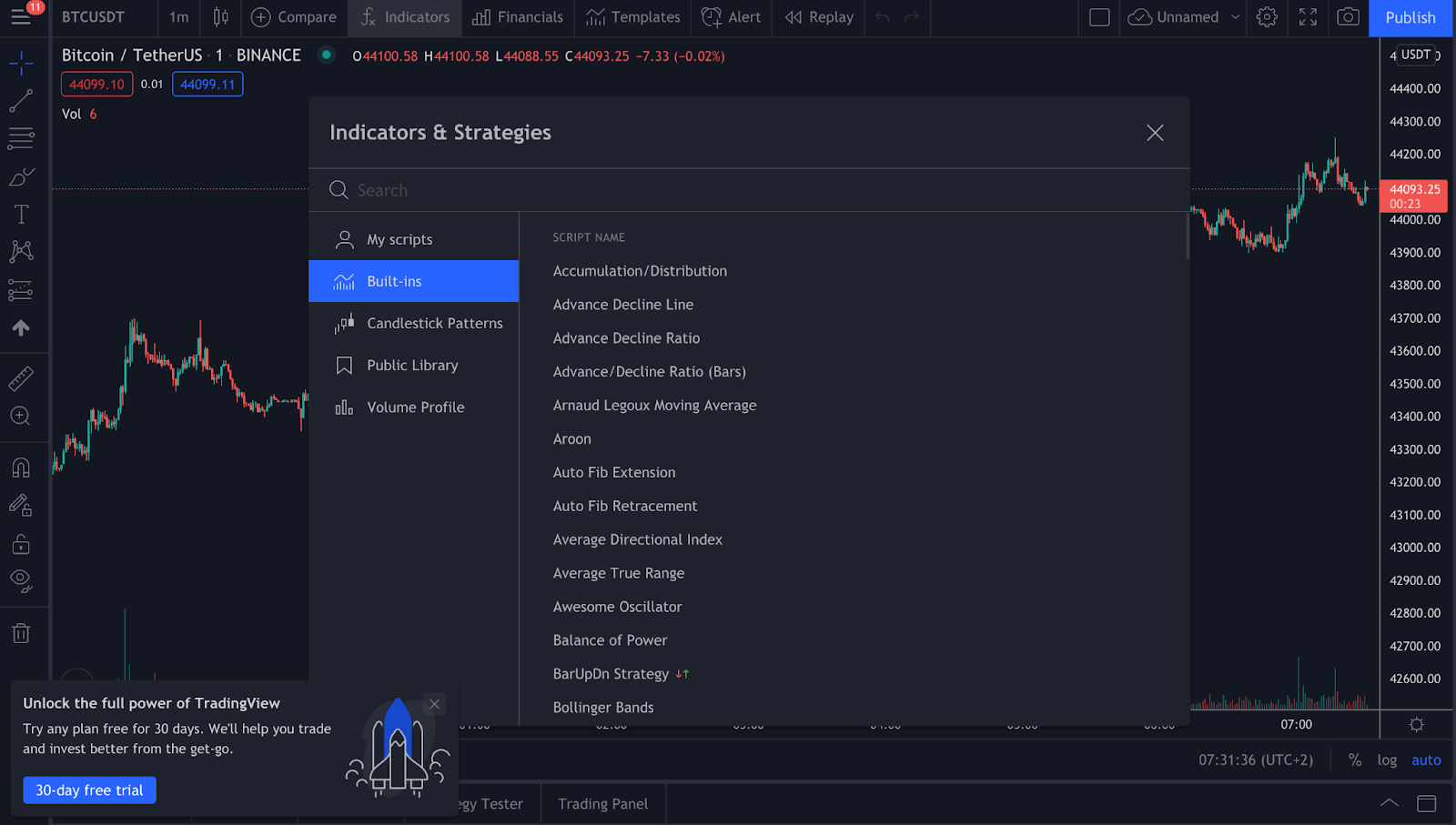

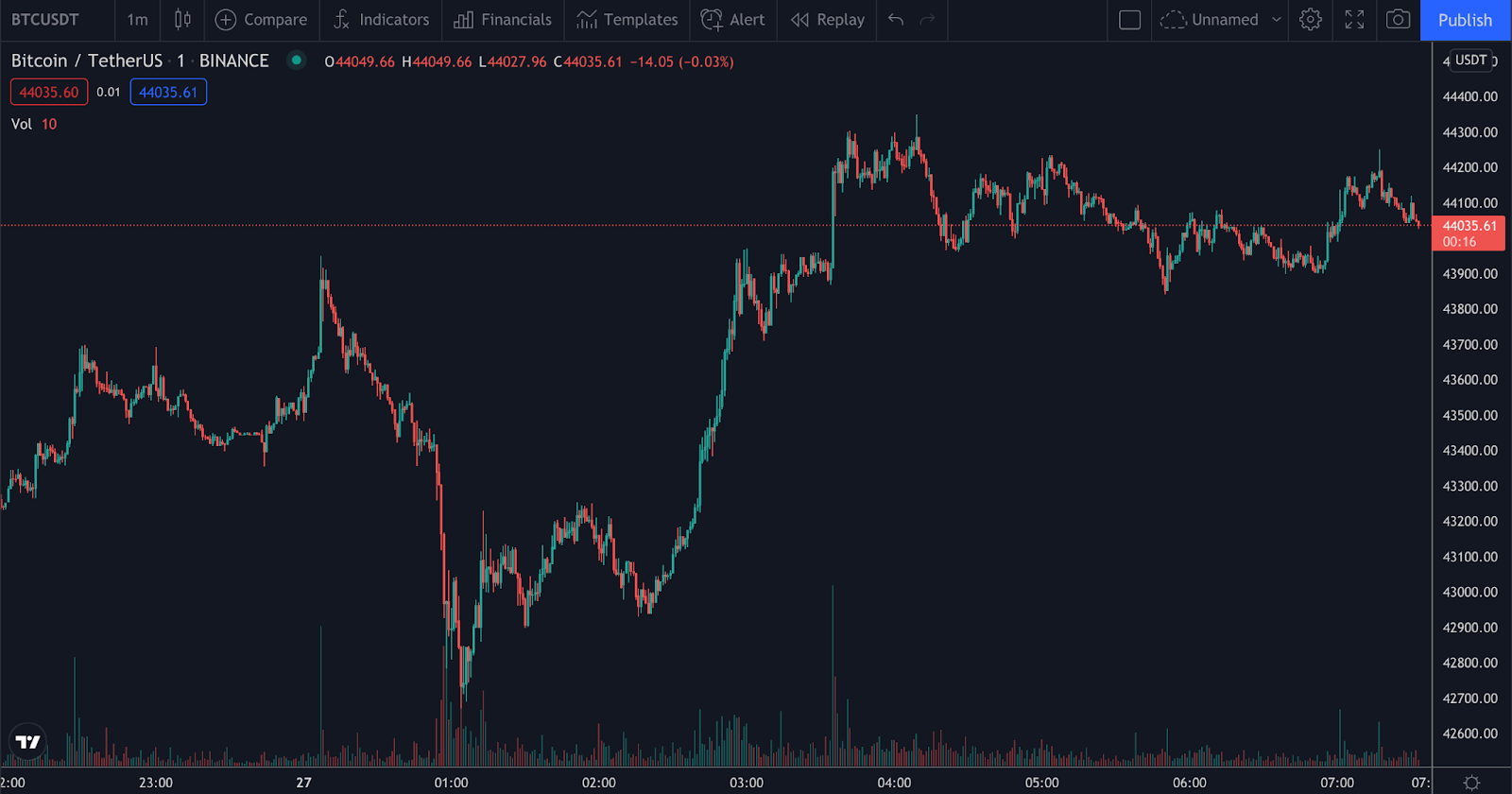

Now that you have selected the chart, you have the possibility to select the “Indicators” menu at the top of the screen. This would open a new window where you will have different types of indicators. You can easily select the “Built-ins” option and add the indicator you want. In our case, we will select the volume indicator, which would display the volume for each specific candle in the chart.

As you can see, the volume indicator is now added to the bottom of the chart, letting us know which were strong movements and which ones were weaker price actions.

What Is the Best Indicator in TradingView?

Now it is time to understand what is the best indicator in TradingView. But the answer would surprise you. There is no indicator that kills them all. It is always good to have several indicators and use them consistently to find buying and selling opportunities.

You will not be able to trade with volume alone. You would also not be able to find patterns with just a support or resistance level. This is where your analytical skills combined with the right use of indicators would let you find the best trading strategies available.

One of the things you should find is an indicator that repeatedly lets you win more times than the times that it makes you lose money. Although this can be difficult to find it can be a great way to get access to some of the best trading strategies in the market.

AltAlgo Trading Indicator

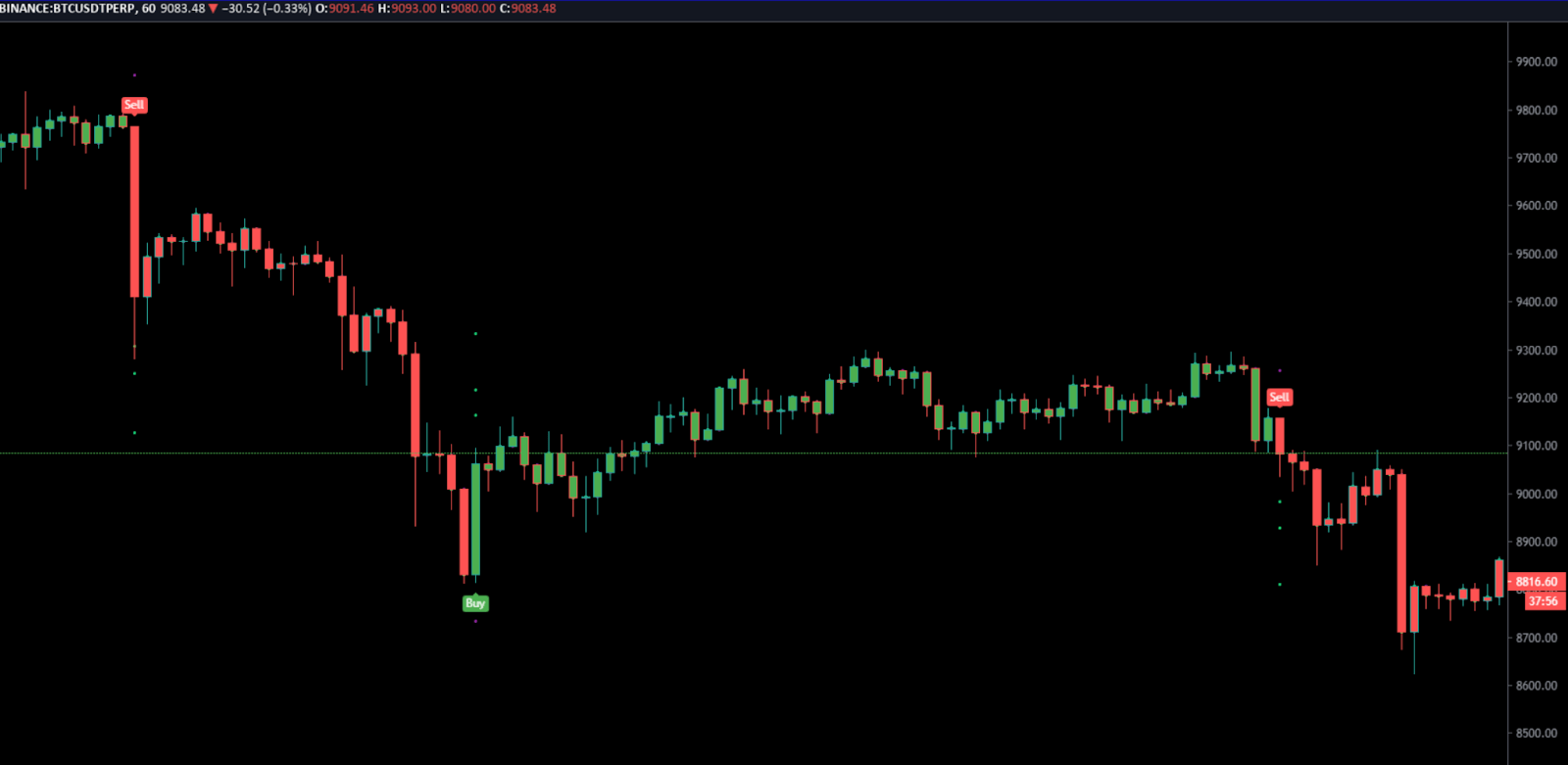

Let’s now focus on the AltAlgo indicator, a proprietary technical analysis tool created by AltSignals that is used to generate some of the most accurate and precise signals for traders in the market. The positive thing about this indicator is that it can be used in TradingView and offer trading opportunities for investors.

Thanks to machine learning, AltSignals’ AltAlgo indicator would be very useful to scan cryptocurrency prices and also understand how to trade the forex market. As soon as you added to TradingView, you would be able to get real-time signals on the charts.