2022 could be a positive year for Litecoin (LTC). The virtual currency had a good year in 2021 and it could continue this bull market also in 2022. But there are some things that we need to take into consideration about Litecoin price prediction.

This layer-1 blockchain network is offering services to users, but it lost the top 10 position in the market due to the expansion of other blockchain networks such as Solana (SOL), Terra (LUNA) and many others. In this Litecoin price prediction guide, we go through the most important things to take into consideration about Litecoin and the coming years in the cryptocurrency market.

Disclaimer: the information shared by AltSignals and its writers should not be considered financial advice. This is for educational purposes only. We are not responsible for any investment decision you make after reading this post. Never invest more than what you are able to lose. Always contact your professional financial advisor.

What is Litecoin (LTC)?

Litecoin is one of the oldest cryptocurrencies in the world. It was created by the Software Engineer Charlie Lee and it fastly became one of the largest virtual currencies in the world after Bitcoin (BTC). This digital currency offers cheaper and faster transactions than Bitcoin, meaning that it is possible for LItecoin to avoid congestion and other types of problems.

Litecoin is also known as the silver to Bitcoin’s gold. People suggested that Litecoin could be used to buy and sell things (as a digital asset for daily use) while Bitcoin could become the store of value in the cryptocurrency market.

LItecoin developers are also working on other solutions that could be implemented in the coming years, including private transactions. At the moment, Litecoin has 2.5 minutes blocks and it has a total supply of 84 million coins.

Over the last years, Litecoin became a testnet for new improvements that could also be added to the Bitcoin network. That means that due to its similar blockchain structure and characteristics, Litecoin was used as a testnet for Bitcoin. Before implementing an upgrade on the Bitcoin network it would be first tested on top of Litecoin and see which are the effects that it has on the Litecoin network. If everything worked well, then it could be discussed to be added to BTC.

Litecoin (LTC) Fundamental Analysis

When it comes to Litecoin fundamental analysis, we need to think about some projects that are currently being developed on top of this blockchain network. The first thing to take into consideration is that Litecoin is a faster and cheaper blockchain network to use when compared to Bitcoin or Ethereum (ETH). That means that investors and users can send and receive funds using LTC without having to be worried about paying high fees or waiting long periods of time for a transaction to be processed.

Another thing that is worth mentioning about Litecoin is that developers are working on Confidential Transactions. This implementation would let Litecoin become the largest private currency in the cryptocurrency market.

As we already know, nowadays blockchain transactions are visible to everyone. If we use Bitcoin, Ethereum or Litecoin to send and receive payments, all the information about the wallets, transactions and funds is visible to everyone online. That means that it becomes somehow difficult to protect our privacy if we use digital currencies.

However, with Confidential Transactions, it is possible for Litecoin to become more private and its LTC coins could become fungible. Nowadays, Bitcoin wallets can be blacklisted, meaning that BTC coins are not fungible. The same happens with Ethereum. If users want privacy, then Confidential Transactions could be one of the main characteristics of Litecoin in the future.

Litecoin (LTC) Price Analysis

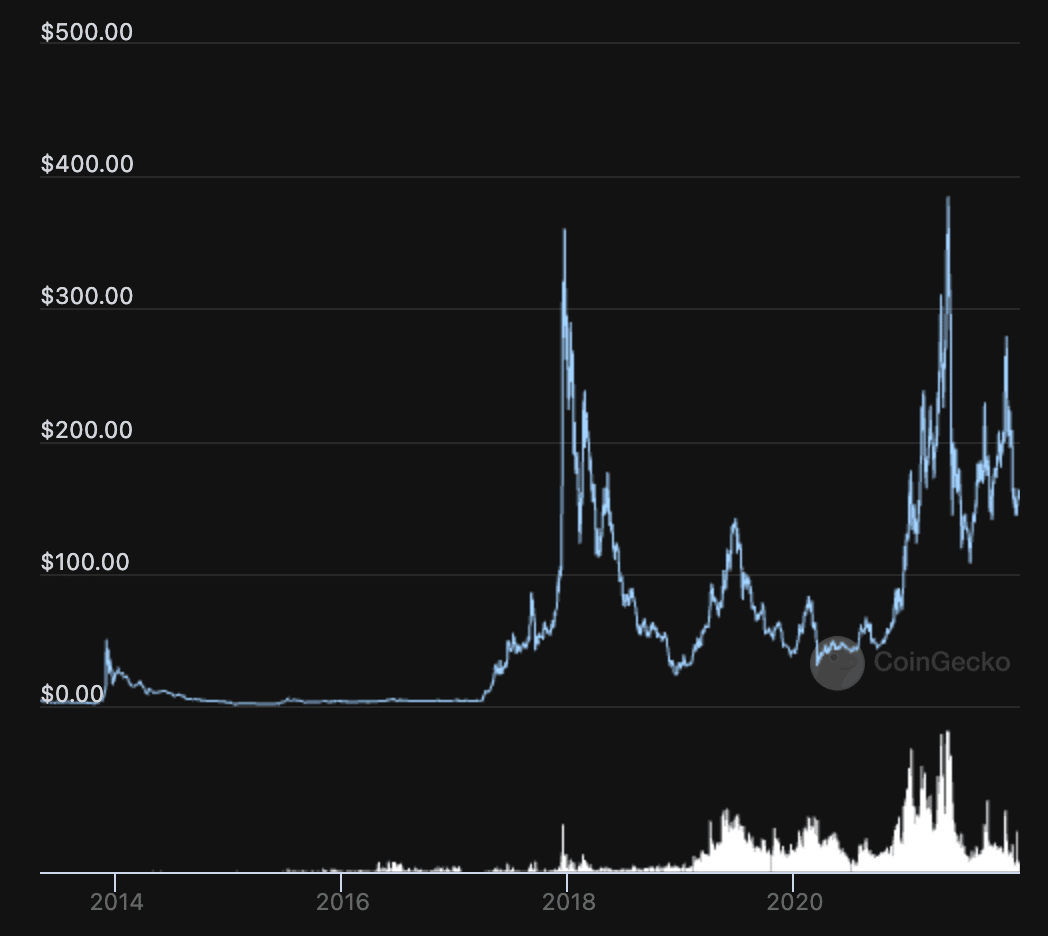

There are many things to take into consideration about Litecoin in the last few years. This cryptocurrency followed Bitcoin’s trend almost since it was released. It started with a short bull market in 2014 reaching $50 per coin followed by a bear trend that lasted until 2017.

Let’s not forget that 2017 was the year in which Bitcoin and cryptocurrencies started moving higher. At that time, BTC surged to almost $20,000 and Litecoin followed the same trend reaching an all-time high of $420 in some exchanges.

A second bear market affected Litecoin (the same bear market that hit other digital currencies, including Bitcoin and Ethereum). Litecoin fell below $25 in December 2018. 2018 was a hard year for Litecoin holders and investors.

2019 and the first part of 2020 were nothing special for Litecoin. Indeed, it remained all the time below $100 with the exception of a few weeks in the summer of 2019 when it moved to $130 per coin.

At the end of 2020, it was clear that Litecoin was entering a bull market similar to the one experienced by Bitcoin. This cryptocurrency surged to over $420 per coin in some exchanges, but it then fell once again in a matter of months to $110 per coin. Now, Litecoin is the 18th largest cryptocurrency in the world and it has a market capitalization of $10.4 billion with a price per coin of $150.

Litecoin (LTC) Market Price Prediction

When it comes to Litecoin’s price prediction for the coming year, we need to take into consideration many different things. For example, will the cryptocurrency market be in a bull run? Are we going to be in a bear trend? Knowing this will be very important in order to understand whether there will be a higher or lower LTC price in the coming years.

As it happens with other virtual currencies, LTC experiences different price cycles. These price cycles are very important if we want to know Litecoin price prediction for the upcoming years. In the next sections, we will analyse the trend that Litecoin could follow depending on different things. Additionally, AltSignals’ analysts will share their short-term analysis on Litecoin and how this could define what could happen in 2022 with this virtual currency.

Litecoin (LTC) Price Prediction 2022

Let’s start with Litecoin’s price prediction for 2022. This is very important if we want to understand Litecoin’s performance in the market this year. Furthermore, it would let us know whether the market will continue growing in 2023 and 2024.

As per AltSignals’ analysts, everything could be lining up for Litecoin to go on a ridiculous bull run in early 2022. This could be very important as it could let us see Litecoin move higher throughout the entire year. As per their analysis, it might be possible to see Litecoin above $500.

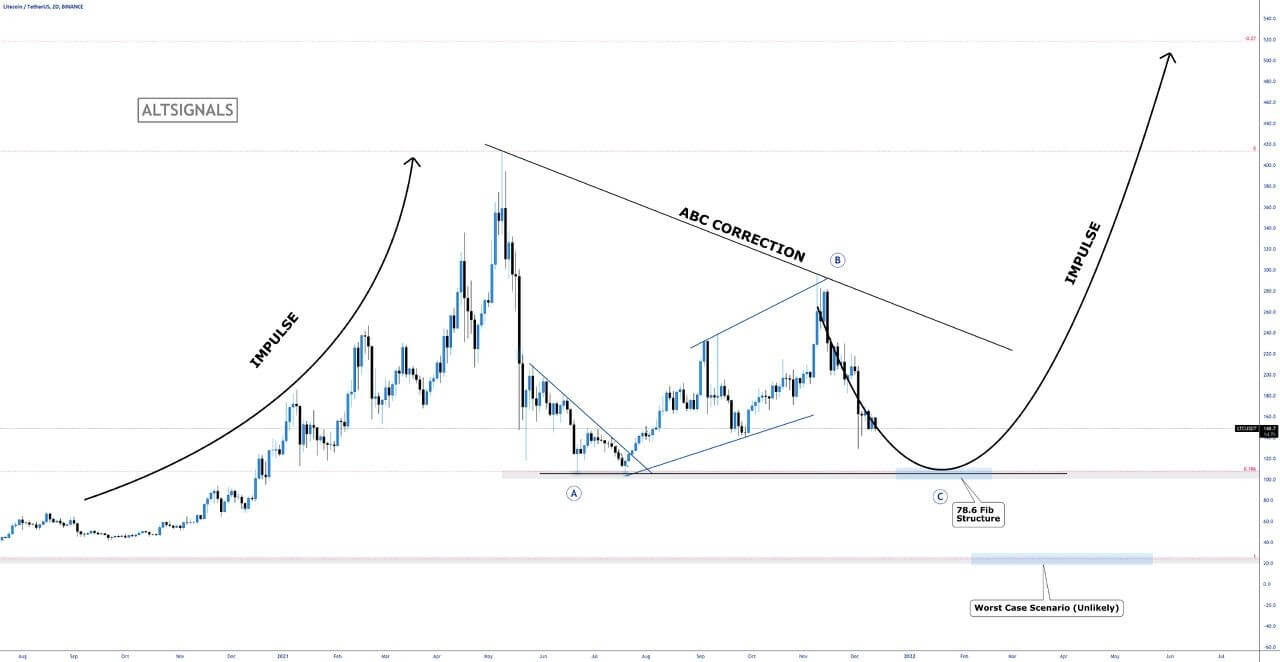

There has been a major impulse during the last months of 2020 and all over 2021. This has preceded a correction in the form of an ABC. Now LTC is approaching a 78.6 Fibonacci retracement level where it would be a great place to set up some buy positions (close to $100).

As per the analysts, it would be very important to see whether Litecoin reaches $100 and setup some buy orders close to that level. If we enter a position at this level, then it would be important to set up a stop-loss below and get ready for a bull run. The targets include $280, $400 and $500.

As they say, there is a large potential in 2022 for this virtual currency that could let us make a return of 400% in the coming months and pave the way for a bullish year in 2023.

Litecoin (LTC) Price Prediction 2023

The future of Liteocin would highly depend on what happens in 2022 with this virtual currency. Let’s not forget that markets work with cycles. If 2022 tends to be a bullish year, then 2023 could then start with a bear market. This bear market could be extended to 2024 and push a large number of Litecoin investors out.

Instead, if 2022 was a bearish year, 2023 would then be the continuation of a bear market. However, as we showed before, AltSignals’ analysts consider that it could be a bullish year for Litecoin. That means that we could expect a bear trend or a period of accumulation in 2023 with a price that tends lower rather than higher.

Litecoin (LTC) Price Prediction 2024

As mentioned before, this would highly depend on the previous years. We had two possibilities for 2023: a full bear market or a consolidation period (2nd year of ber trend). It is highly possible that 2024 would be an erratic year. That means that we could have some months in which it seems that digital currencies start moving higher while others in which Litecoin would trend lower.

Considering crypto market cycles 2024 could be the year in which digital currencies reach a bottom. This would be very positive as it could be a great moment for LTC investors to get ready for a new bull run. Let’s also not forget that in 2023 Litecoin is going to experience a new halving event, which could be very positive for the virtual currency.

Litecoin (LTC) Price Prediction 2025

Finally, we need to think about Litecoin’s price prediction for 2025. This is yet too far away to be able to predict what could happen. Moreover, we are not financial advisors. Liteocin could start moving higher after several years in a bear trend (2023 and 2024). However, if the bear trends were in 2022 and 2023, then 2024 and 2025 could see a new bull market.

It is just a matter of time to wait and see what could happen with Litecoin in the coming years and how this cryptocurrency could behave in the next few years. People are waiting for Litecoin to start moving higher when compared to Bitcoin, but this is something that has been pending for several years now.

How to Buy Litecoin (LTC)?

The easiest way to buy Litecoin is by opening a cryptocurrency exchange account. The process is quite standardized among different cryptocurrency exchanges. You should simply follow the next steps.

Step 1: Search for a Cryptocurrency Exchange and Open an Account

The first thing that you have to do is search for a cryptocurrency exchange and open an account. There are different crypto exchanges that would let you buy Litecoin in just a few simple steps. You should select a cryptocurrency exchange that will let you purchase Litecoin with your local fiat currency.

Most crypto exchanges nowadays let users buy digital currencies and pay using debit or credit cards and bank transfers. There are dozens of exchanges, creating an account after carefully analysing the services and solutions offered by that platform.

Step 2: Deposit Funds

The second thing that you have to do is to deposit funds in order to buy Litecoin. Depending on the exchange that you selected you will have different possibilities to deposit funds. In some platforms you would be able to send funds through a bank transfer while others would require you to use debit or credit cards. It is up to you to decide the payment method that you want to use to deposit funds.

Step 3: Buy LTC

Finally, you should buy Litecoin. This is an easy step as the exchange will guide you throughout the whole buying process. Basically, you can buy Litecoin directly from the exchange section of the platform or through a “fast buy” option. If you are new to the cryptocurrency market, the “fast buy” option could be the best option. If you are a trader, then you should definitely go through the exchange option.

Frequently Asked Questions (FAQ)

There are some questions that we need to answer about Litecoin.

What is Litecoin?

Litecoin is one of the oldest and largest cryptocurrencies in the world. This cryptocurrency is known to be a very close digital asset to Bitcoin and both communities are closely collaborating on different initiatives and solutions. Litecoin lets you send and receive money for very low fees and in just minutes.

Difference Between Litecoin and LTC

Litecoin is the blockchain network that supports LTC transactions. Despite that, Litecoin and LTC can be and are mostly used interchangeably.

Where Can I Buy Litecoin (LTC)?

You can buy Litecoin at any online cryptocurrency exchange. This is the easiest way to get access to Litecoin and digital currencies.