If you want to trade cryptocurrencies or in the Forex market, you will realize that there are different order types in the platform you use. These order types can be very useful in different circumstances and will be a key part of your trading strategy.

In this guide, we will share with you the different types of orders available in most of the exchanges. Moreover, we will tell you how you can use them to improve your trading.

Disclaimer: this post should not be considered investment advice. This is only for educational purposes only. Never invest more than what you are able to lose and always ask for information to your professional financial advisors. We are not financial advisors.

Basic Order Types: Limit and Market Orders

There are different order types, so let’s start with the basic ones. These are going to be the simplest to set up. If you do not have an advanced trading strategy, they are certainly going to be very useful.

Market Order

The first order type includes the market order. A market order is the fastest and simplest trading order you can execute, You just simply need to select the amount of cryptocurrency you want to buy or sell and click on the buy/sell button.

Your order will be executed immediately at the best possible price available at the time of the trade, What does it mean? Let’s see an example.

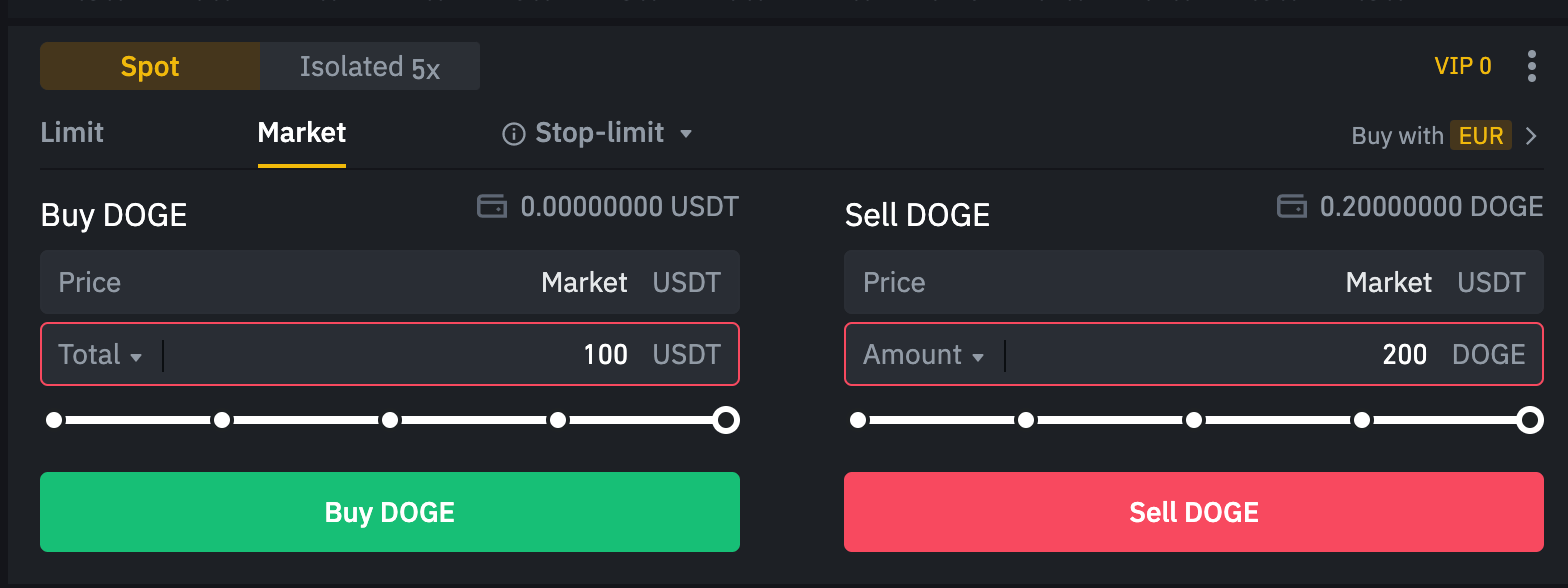

If you want to buy 1000 DOGE right now, you will go to the market order section and select the amount of USDT/EUR (or any other currency) you want to use to buy DOGE. As you can see in the image below, we wanted to buy 100 USDT worth of DOGE and sell 200 DOGE.

This trade will get executed immediately considering this exchange has large liquidity. These 100 USDT will allow you to buy DOGE for the best selling price offered on the platform. The same will happen if you sell DOGE. These DOGE coins will be purchased at the best available price in the market.

Market orders are very convenient for relatively small trades in liquid markets.

Usually, market orders tend to have higher fees. When you place a market order you are taking liquidity from the market. This is something that tries to be discouraged. Limit orders are usually cheaper to execute in most of the exchanges.

Limit Orders

This takes us to the second basic type of orders: the limit orders. They are going to be very useful if you are a newcomer or if you just want to buy some crypto at a specific price. With these limit orders, users can select the price at which they want to buy or sell an asset.

For example, let’s come back to the example before. If you want to buy 100 USDT of DOGE with a market order, the trade will get executed immediately. You will receive the DOGE that were offered at the lower price in the order book.

By placing a limit order, you are participating in the order book. Although your trade will not be executed immediately, it can offer you a better price and reduced fees (limit orders are usually encouraged by exchanges).

In these types of orders, you will be providing liquidity to the market and enlarging the order book. Rather than buying 200 USDT worth fo DOGE at the best available price, you will be able to select the price per DOGE.

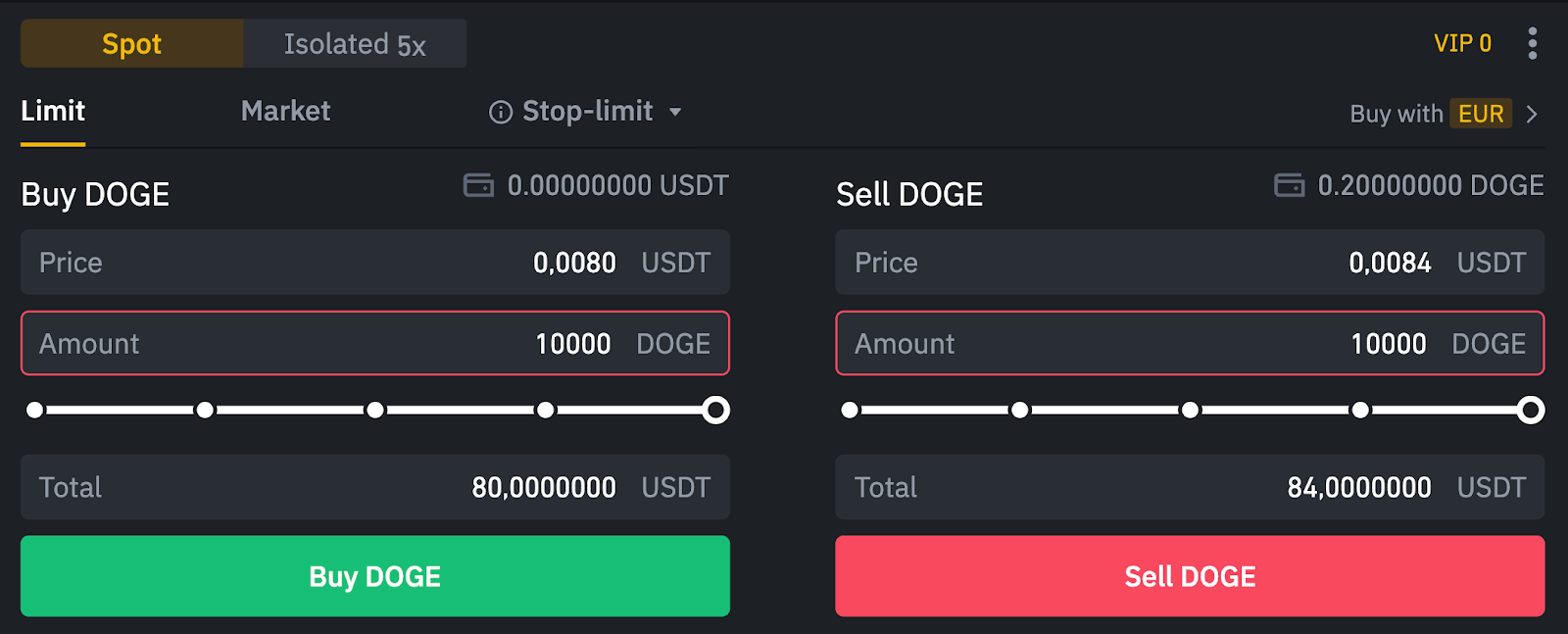

In the image above, you can see that we select the price at which we want our order to get executed. We want to buy 10,000 DOGE for a price of 0.0080 USDT each coin. We will pay for this transaction 80 USDT. Once we click on the Buy DOGE button our order will get published in the order book. Once the market reaches the 0.0080 USDT price per coin (it falls), then our order can get executed.

If we instead are selling DOGE for 0.0084 USDT, then we will receive 84 USDT for our sale. Although it can take some time for the market to reach 0.0084 USDT per DOGE, we are getting a better price than the one available right now.

The same will happen if we want to buy DOGE (or any other asset). We will get a more attractive price for the virtual currency we want to buy. Nevertheless, the order will not get executed immediately and there is a small possibility it might never be executed (if for example you want to buy BTC for 1 USDT).