The stock to flow (S2F) model became popular in recent years after PlanB shared it with the crypto community. This model shows that it might be possible for Bitcoin to reach massively high prices in the coming months or even years, and everything depends on the new issuing of BTC.

There is also criticism about this model considering that the correlation between price and the stock to flow could just be a coincidence rather than causality. In the next sections, we share with you what is the Stock to Flow model, which are its main characteristics and how it behaved over the last few years.

Disclaimer: the information shared by AltSignals and its writers should not be considered financial advice. This is for educational purposes only. We are not responsible for any investment decision you make after reading this post. Never invest more than what you are able to lose. Always contact your professional. financial advisor.

What is the Stock to Flow Model?

The Stock to Flow model for Bitcoin created by PlanB takes into consideration how long time it is necessary for the current production rate of Bitcoin to reach the stock. Basically, it takes into account how long miners would need to create as many Bitcoin as there are now in existence. The higher this number is, the higher the price of the underlying asset.

We know that for Bitcoin there is a limited supply of 21 million and a stable issuance of BTC each day. 900 new BTC are created each day in 2021. This rate would continue until 2024 when Bitcoin will experience a new halving event.

At the moment, the current stock to flow for Bitcoin is the following:

18,744,925 / 328,500 = 57,06

That means that we need 57 years in order to create as many Bitcoins as there are now in the market at the current growth rate. This is very close to the stock to flow of gold, which is currently standing at 62.

As new halvings take place on the Bitcoin network, it might be possible for the Bitcoin price to continue moving higher. The stock to flow model uses a mathematical formula that calculates Bitcoin price over time. Nowadays, this formula shows a price per BTC of $126.077,52 per coin.

Bitcoin Price = exp(-1.84) * 57 ^ 3.36 = $126.077,52

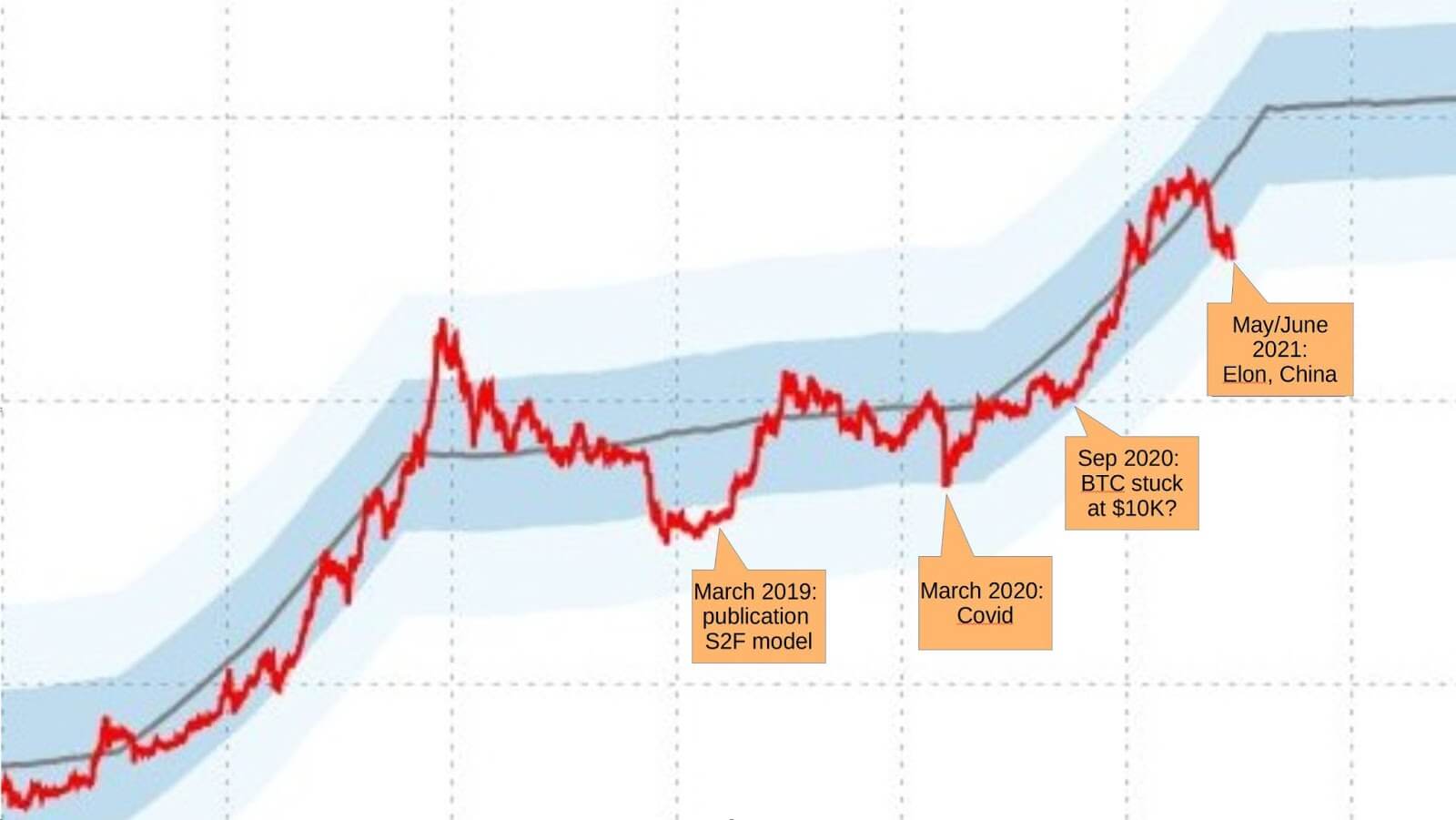

As you can see in the image above shared by PlanB, you have the stock to flow model and its updated version. The boundaries show the price range in which the BTC price could fluctuate. In the future, the price of Bitcoin could continue growing following the Stock to Flow model.

When creating the Stock to Flow model, PlanB quoted a phrase from Nick Szabo that reads as follows:

“What do antiques, time, and gold have in common? They are costly, due either to their original cost or the improbability of their history, and it is difficult to spoof this costliness. [..] There are some problems involved with implementing unforgeable costliness on a computer. If such problems can be overcome, we can achieve bit gold.”

The statistically significant relationship between the Stock to Flow and the market value is surprisingly high, as shown by PlanB. He explains that there are close to zero chances to explain the SF value and the price of Bitcoin by chance. However, he acknowledges that there are other factors that have an impact on the price of Bitcoin.

For example, regulations, hacks and other news could definitely impact the short-term price of Bitcoin in the market. And we have seen this for Bitcoin with the FUD coming from Elon Musk when he talked about Bitcoin consumption and also from China that decided to ban Bitcoin mining from some jurisdictions.

Final Words

For PlanB, Bitcoin is the first scarce digital asset in the world. The positive thing is that this virtual currency can be used by satellite, radio and over the internet. This digital scarcity that we see on Bitcoin, has real value. Moreover, he identified a significant relationship between the S2F model and the market value of Bitcoin. When comparing Bitcoin to other assets such as gold and silver, we see that the S2F model follows the same trend, which shows there is an indication of a “power-law relationship.”

The S2F model has been translated into 32 languages and it is available for free online for those that want to analyse it even further.