The simple vs exponential moving average is one of the main differentiations we find in technical trading tools. Moving averages are a key part of the toolkit used by cryptocurrency, forex and stock traders.

Having a clear idea of the differentiation of exponential vs simple moving average helps users create better technical strategies. In the long-term, this could also have a positive impact on the portfolio of an investor.

In this guide, we will share with you the main differences between exponential vs simple moving average.

Disclaimer: the information shared by AltSignals and its writers should not be considered financial advice. This is for educational purposes only. We are not responsible for any investment decision you make after reading this post. Never invest more than what you are able to lose. Always contact your professional. financial advisor.

What is a Simple Moving Average (MA)?

The Simple Moving Average (MA) is a technical analysis tool that takes into consideration the average price of a stock, currency or digital asset in a predefined period of time. The MA helps technical analysts to smooth trends in the market and understand which is the general trend in which they are trading.

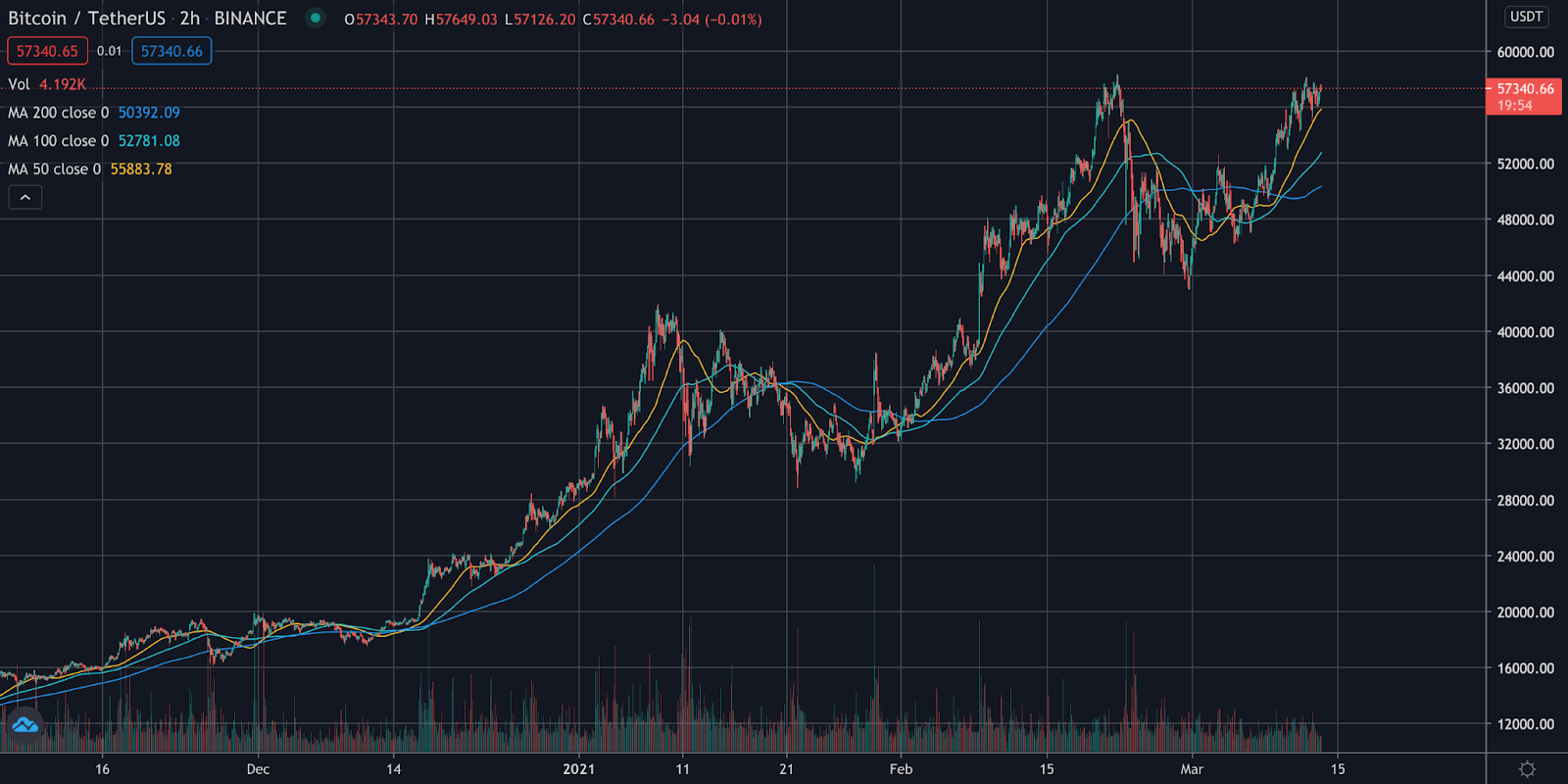

In order to understand how the Simple Moving Average works, analysts use three different MAs. For example, the most common ones include the 200-day, 100-day and 50-day MAs. They rely on the average price of each of the periods they measure. In the image below, you can see the previously mentioned MAs applied to the BTC/USDT trading pair on the Binance exchange.

This tool can also produce very accurate trading signals. For example, when the MA-200 crosses the MA-100 we could have a bullish or bearish signal depending on where the market is heading. If it moving downwards, then we could be entering a bear market. If it crosses upwards, then we could be entering a bull market.

You can join AltSignals and get some of the best trading signals in the market.

What is the Exponential Moving Average (EMA)?

Now that we know what the Simple Moving Average (MA) is we can move to the Exponential Moving Average (EMA). The EMA is also a price average measure that focuses on the most recent data available.

In this way, the EMA focuses more on the short-term price fluctuations giving less importance to price movements that took place in the past. In this way, investors and traders have updated information on the market and where the trend is moving based on the most recent price moves.

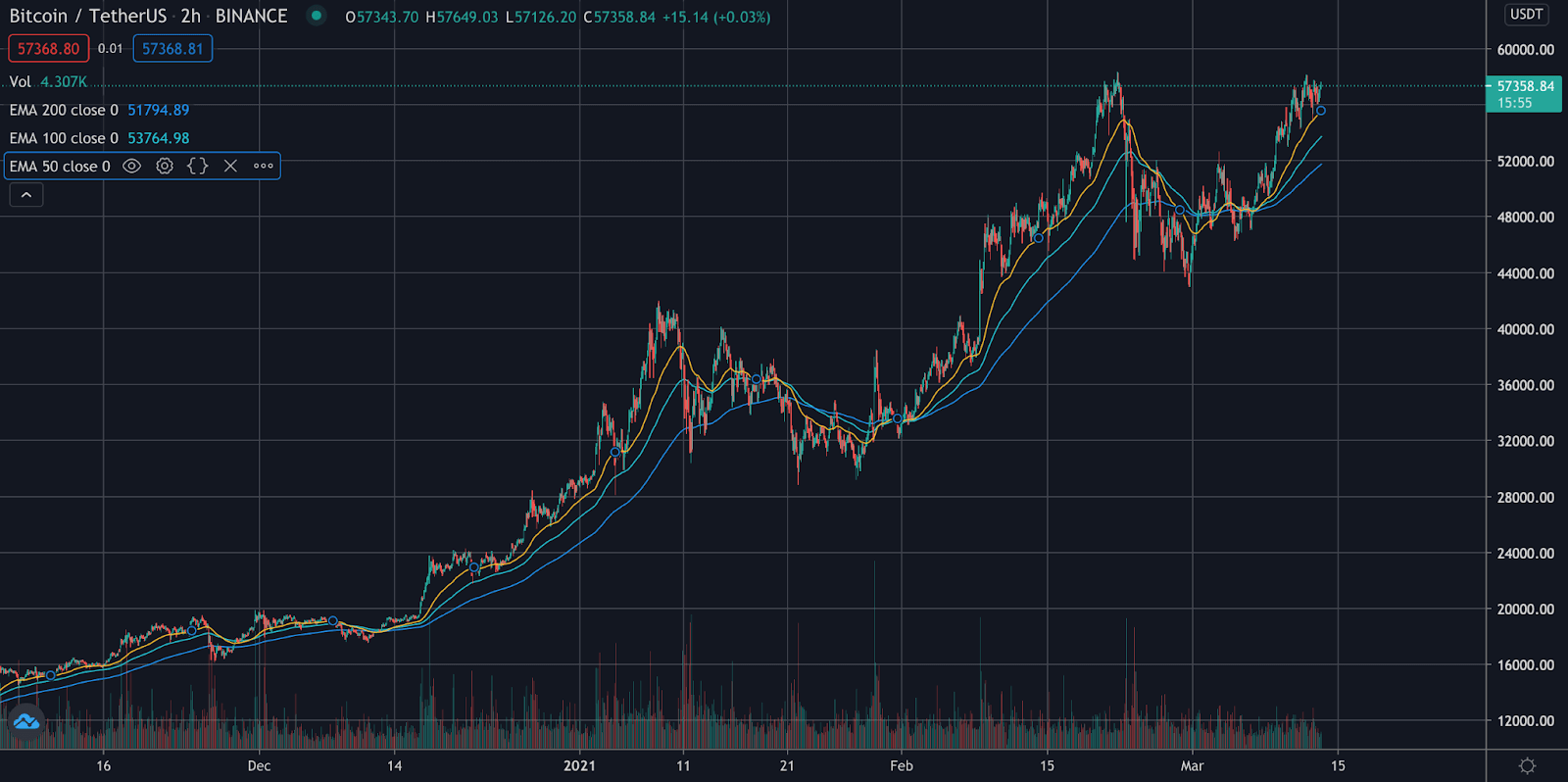

In the image below, you can see the EMA-200, EMA-100 and EMA-50 in the same chart as we have shown the MAs. In this way, you are able to distinguish the differences between both of the moving averages.

Simple vs Exponential Moving Average

The simple vs exponential moving average discussion is not necessary nowadays. Indeed, both of these tools are very useful for traders and investors that want to have a clear idea of how the market is evolving.

The main thing to take into consideration is that some investors prefer to use the MA while others the EMA. Everything depends on the trading strategies that you follow and the technical analysis tool that you use.

As we mentioned before, the EMA focuses on the most recent price action, smoothing the trend in long-term time frames. The simple moving average place the focus on the whole period that is being analyzed. This is something that should be understood.

The short term price action allows investors to have a clear idea of where the short term trend is going without losing information about the long-term macro trend in which they are trading. This could be good for swing traders.

Moreover, it is worth taking into consideration that successful traders use not just a simple or exponential moving average but also many other tools. These are just two indicators that help investors understand the direction of the trend and whether the asset has recently changed its macro trend.

Short term traders or scalpers might not find this tool useful to enter or exit the market. These short-term investors are trying to make profits with market fluctuations that take place every single minute. Thus, the MA or EMA would not help them develop their trading strategies at all.

However, position traders or long-term traders should definitely include these two technical analysis indicators in their strategies if they want to have better information about the market.