Tesla (TSLA), Apple (AAPL) and Microsoft (MSFT) have been growing in the last few months despite the fact that the entire market is not growing and expanding massively. This shows that these are 3 hot NASDAQ stocks that are worth following and taking into consideration at the time of investing in the financial markets.

In this guide, we will be giving you some of the main reasons behind the price increase of these stocks so you can understand better the situation around their price. At the same time, we will share with you what they are doing in order to have their price move higher.

Disclaimer: all the information provided in this article is for educational purposes only and it shouldn’t be considered investment advice. Never invest more than what you are able to lose and always ask advice from a professional advisor.

Top 3 Hot NASDAQ Stocks

Tesla (TSLA)

Tesla (TSLA) is one of the companies that is investing in a wide range of initiatives in the transport industry. The investments it is doing in the industry would certainly have a positive impact in the world and could change the way in which we conceive the way in which we move.

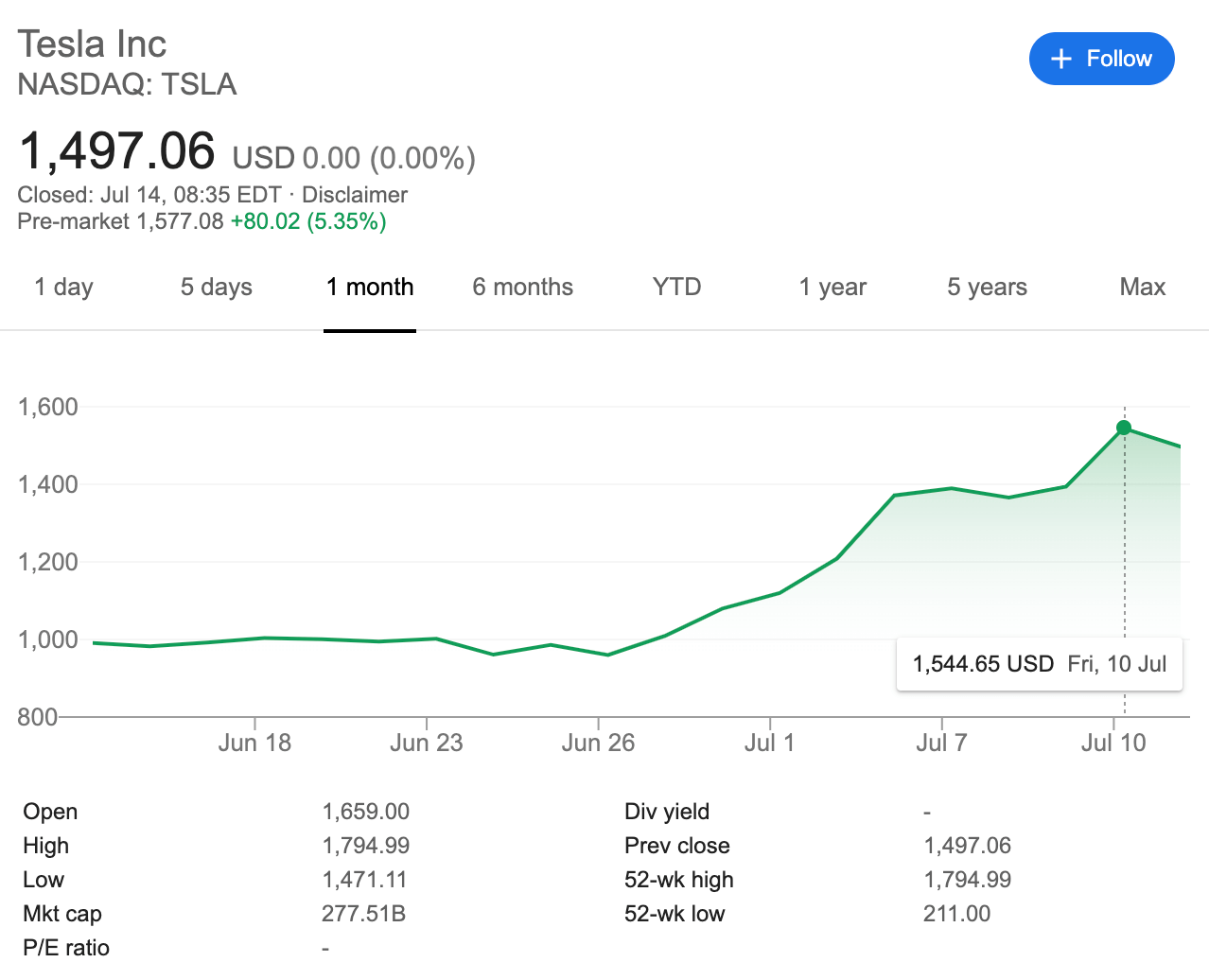

TSLA has moved from $959 at the end of June to $1,544 a few days ago. This shows that TSLA experienced a price increase of over 61% in just a few weeks amid the Coronavirus crisis expanding around the world.

The main question is whether TSLA will continue growing or the current price decrease will become a deeper correction in the coming days and weeks. According to data provided by Bloomberg, around 40,000 Robinhood users purchased TSLA in just 4 hours. That means there were 10,000 buyers per hour in the market (only using Robinhood).

The enthusiasm from users in this platform has pushed TSLA’s price higher. The same happened with other companies that we will share with you in the next sections.

Apple (AAPL)

Apple is known for being the most valuable company producing cellphones, iPads and computers in the world. The iconic iPhone is not only a piece of technology but also a sign of status among individuals in different societies.

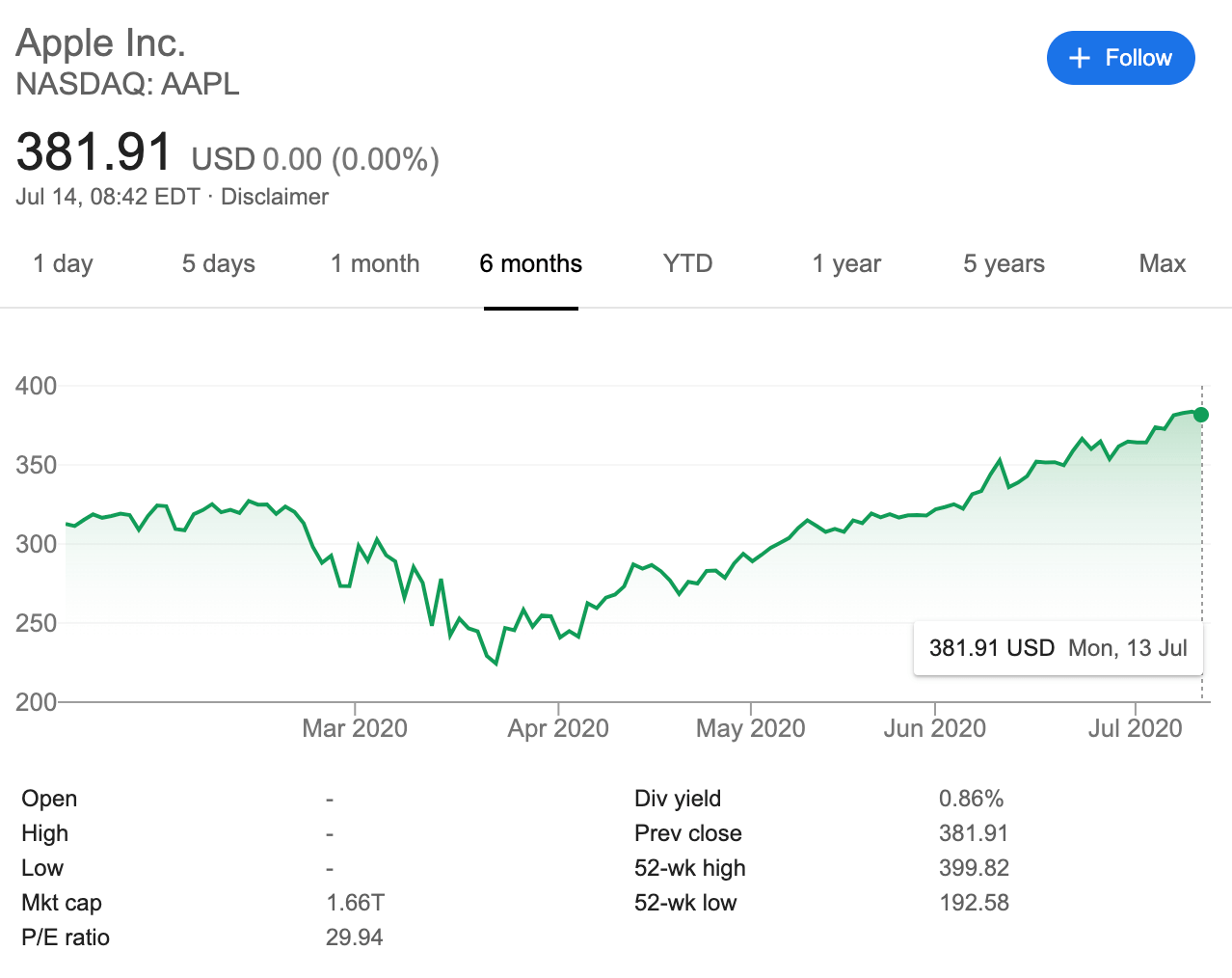

The entire market is waiting for Apple to release new products and understand which are the most exciting products that could be released to the market. All this hype around Apple and the fact that many other large companies such as TSLA and MSFT were growing, allowed AAPL to also register large gains in recent weeks.

As reported by Yahoo Finance, we see that since March 2020 when the Coronavirus crisis exploded, AAPL grew by over 70% from $224 to $381 a few days ago.

At the end of the year, Apple is expected to release its new iPhone, which is the flagship product of the company. This is why the markets are excited about it and seem to be already pricing in the new release.

Despite being affected by the Coronavirus crisis, Apple seems to be working on its products without any interruption and it will certainly be doing everything that’s possible to re-open most of its stores by the year-end. Nonetheless, it is not possible to know what is going to happen in the near future.

Microsoft (MSFT)

Microsoft has been working in the last years as one of the most important technology companies in the world. They have released a wide range of solutions and services for companies and individuals all around the world.

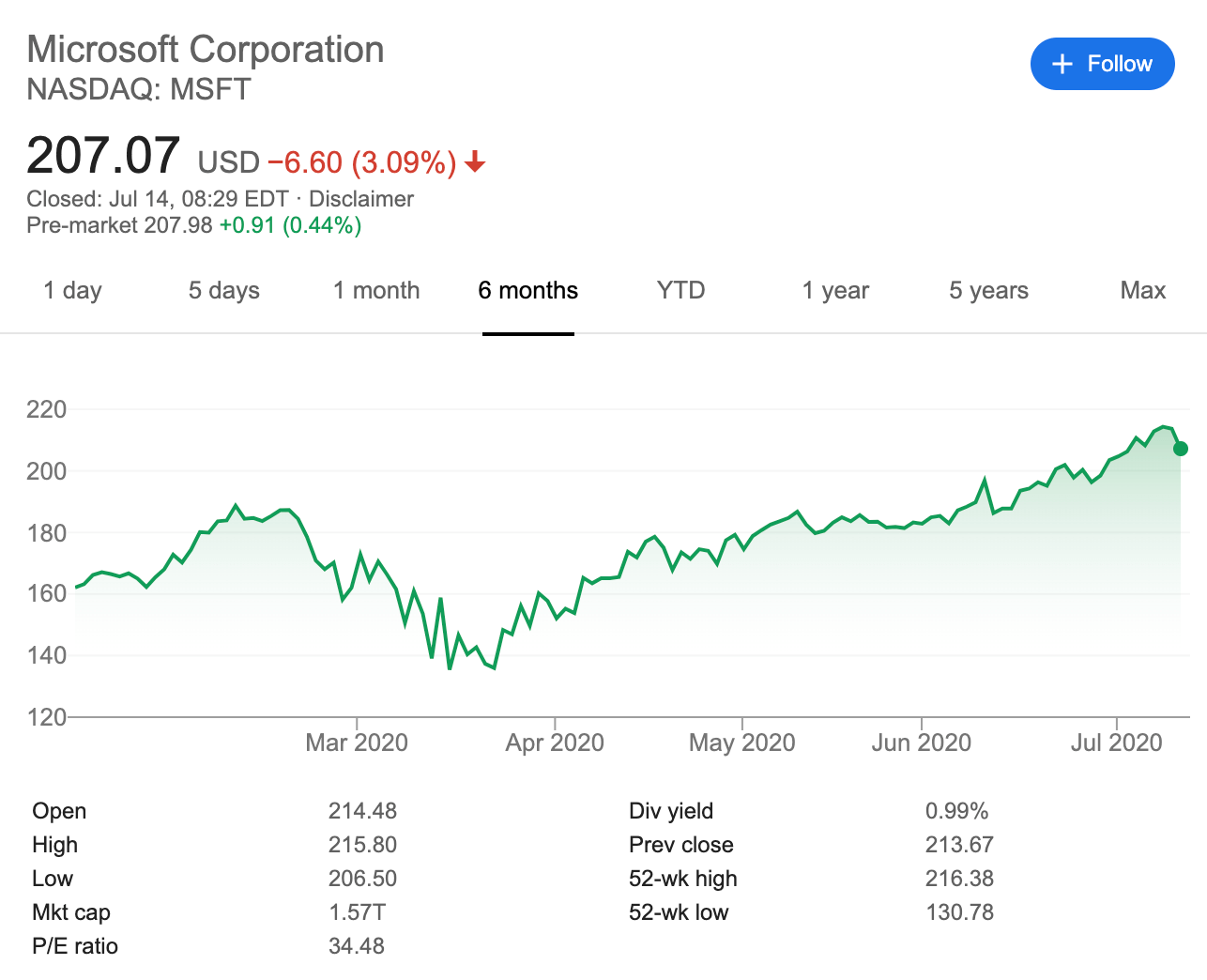

They have also announced they are going to be spinning off a virtual teenager chatbot for Chinese users. This could bring more demand for Microsoft solutions and also increase the value of the company.

If we check the price of MSFT, we see that the price of the stock has been expanding since March. MSFT registered an increase since March’s bottom of over 58% from $135 to $214. This shows there is a large number of buyers pushing for the price higher.

In the last days, as Bloomberg reported, the number of buyers in the market has certainly increased due to apps such as Revolut in Europe and Robinhood in the United States. This is going to increase the buying pressure in stocks if the trend continues. However, we should also understand that there could be a market correction and that the price could certainly move lower as it has been doing the recent days.