In today’s fast-paced and ever-changing financial landscape, understanding finance index signals is essential for investors who want to achieve success. Whether you’re a seasoned investor or just starting out, having a comprehensive understanding of these signals can greatly impact your investment decisions and overall portfolio performance.

In this ultimate guide, we will delve deep into the world of finance index signals, providing you with the knowledge and insights you need to navigate the markets with confidence as well as our top 5 Telegram based Index Signals Groups. From the basics of index signals to advanced strategies for interpreting them, we’ve got you covered.

These top 5 index signals groups for Telegram will allow you to get some of the best trading signals to trade indices. Rather than focusing on individual stocks, currencies or cryptocurrencies, these groups will share with you the best signals to trade indices from all over the world.

In this guide, we share with you which are the top 5 index signals groups for Telegram and how you can use them to improve your trading strategies. Trading channels will definitely help you if you want to improve your trading skills, capture possible bottoms and tops and more.

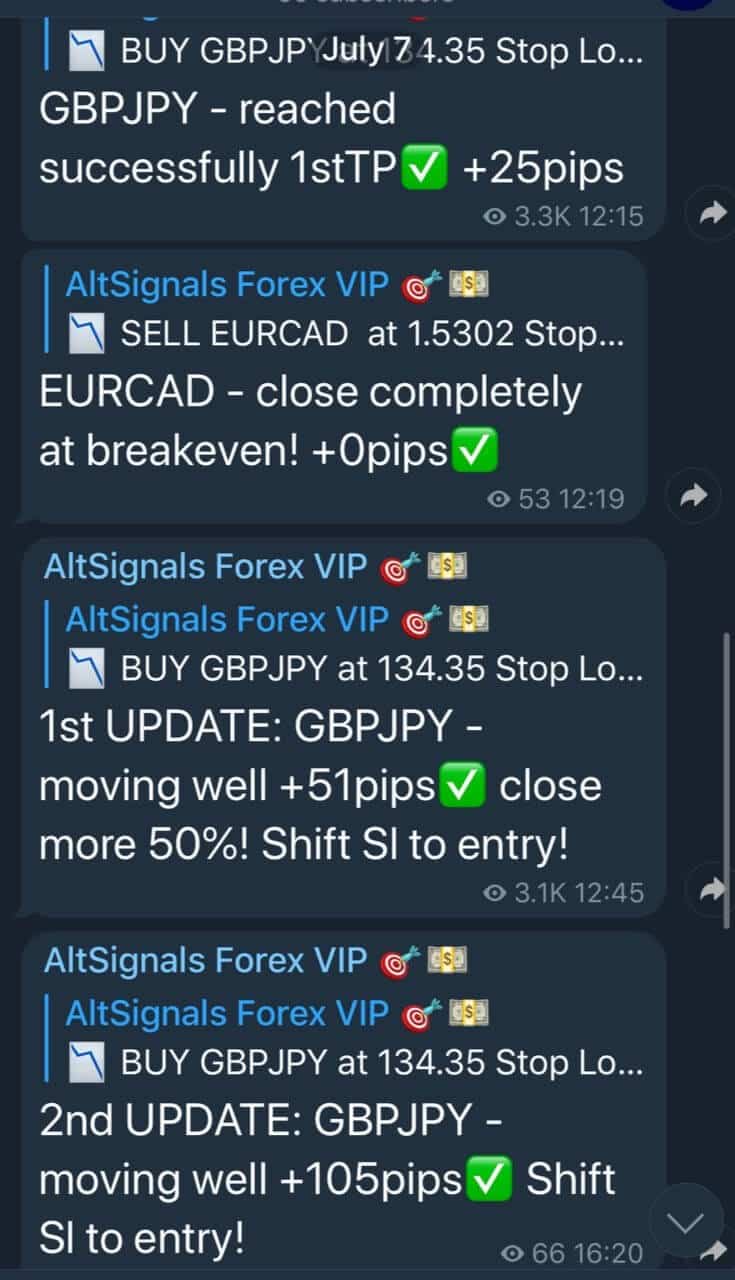

1st Place – AltSignals

AltSignals is by far one of the best index signals channels for Telegram. The team behind AltSignals has been working for several years and it has offered crypto, forex and stock signals.

AltSignals is working in order to offer some of the most accurate and profitable trading signals for indices in the market. This trading signals group shares regular reports about the trading signals they share so users are able to analyse the results and improve their trading.

If you want to get some of the best Nasdaq, FTSE and S&P500 trading signals right to your Telegram, then AltSignals is one of the best options currently available. The positive thing about this group is that thanks to its integration with trading bots, you will be able to automate your trading.

Furthermore, AltSignals shares very valuable content for users to learn how to trade rather than just following trading signals without any meaning. On a regular basis, they share with followers educational content, reports and unique market analyses.

Finally, AltSignals shares signals for the forex and cryptocurrency markets as well. This allows you to get one of the most advanced and complete indexes signals groups on Telegram. With more than 50k users, they are the leading signals group.

2nd Place – SafeSignals

SafeSignals.com is a growing multi-market trading group offering reliable signals across indices, Forex, gold, and crypto. Their index signals are shared through a well-structured Telegram channel and are backed by technical analysis, clear trade setups, and strong risk management. The team behind SafeSignals brings years of experience in trading major index products and aims to simplify the process for their growing community.

What makes SafeSignals stand out is their focus on precision and consistency. Signals come with defined entry, stop-loss, and take-profit points, and are easy to follow regardless of your trading experience. The team is active in their Telegram channel and available to answer trading-related questions 24/7, creating a supportive environment for members. Their approach is methodical, and the signals are never rushed or spammed—traders only get high-conviction setups.

SafeSignals was built to give traders access to cleaner, more transparent trades—especially in volatile markets like indices. The team continuously updates subscribers with charts, insights, and trade breakdowns, while prioritizing user education. Their mission is to help traders improve both technically and mentally through structure and clarity.

- Exchanges supported: Most major FX and crypto brokers

- Languages supported: English

- Reports: Yes

- Trading Period: Daily

- Support: 1-1 VIP support via Telegram

3rd Place – Index Signals

indexsignals.com is a community of traders in indexes that provide chat room signals based on their own technical analysis. A team of expert traders, with years of market experience who trade in commodities and indices daily, provide signals in a clear format on their telegram group. In addition, you get 24/7 support for any questions you may have about trading.

The reason for their standout success comes down to their focus on simplicity and affordability. They take the time to explain the market, and the why and how of technical analysis in a way that is easy to understand and implement. As a result, subscribers tend to stick around and develop confidence in their trading methods. This group was started by market traders who had seen too many folks get wiped out by investing in the wrong index at the wrong time. The team focuses on what they do best, indices/indexes, as masters of their craft they have helped hundreds of traders find their way in the lucrative world that is trading indices.

indexsignals is committed to providing traders with quality signals and they work hard to build a community of traders who can learn from experts. Check out their free Telegram Channel full of results, news and market updates. If you want great results, consistency, and a team you can rely on look no further than indexsignals.com.

- Exchanges supported: Most FX brokes are supported by this forex trading signal channel

- Languages supported: English, Spanish, French, Portuguese

- Reports: Yes

- Trading Period: Daily

- Support 1-1 24H support

4th Place – Nasdaq / Gold Signals

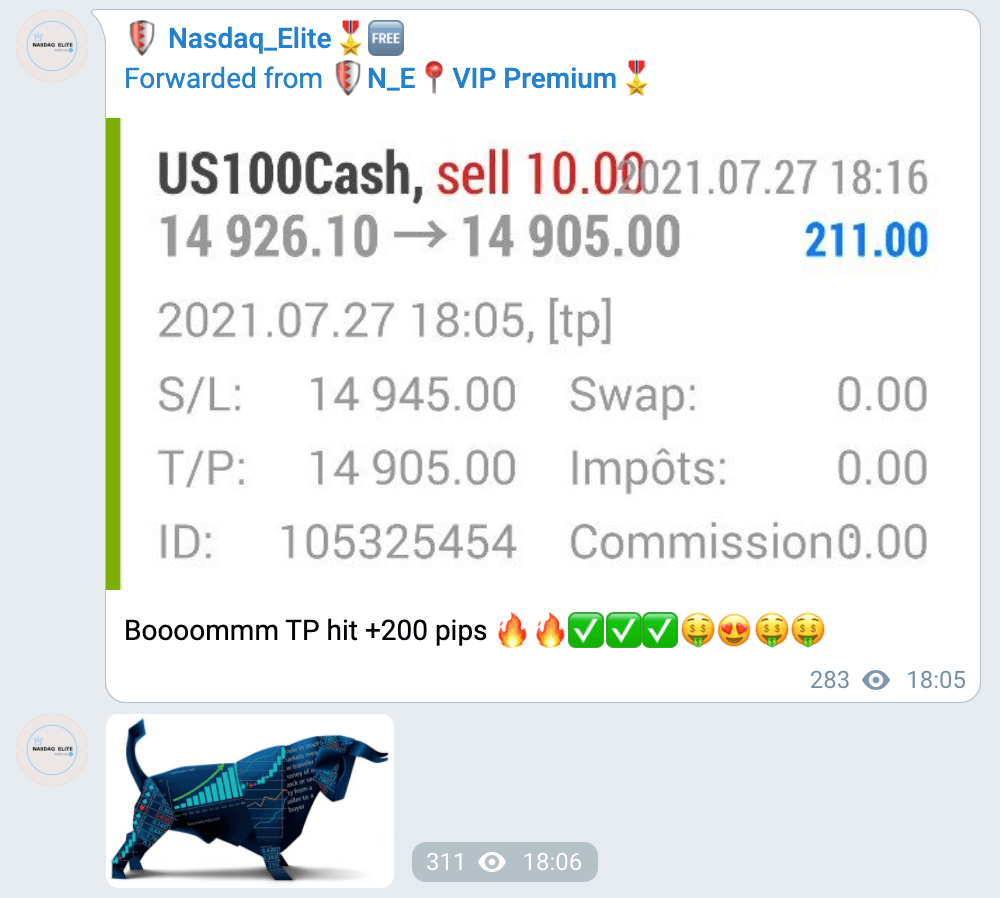

Let’s now move to Nasdaq / Gold signals. This group has been working for some months now and it was able to attract several followers and traders. They have over 10k users and they share daily Nasdaq and gold signals.

If you are an indices trader, this channel could be one of the best options available right now. This is why we have decided to add it to our top 5 index signals groups for Telegram. The signals are very clear and help you get an idea of which could be profitable trades and good opportunities to invest in.

![Top 5 Index Signals Groups for Telegram [MonthYear] 5 610789487b18551d90e8050b aJEEaYJEL185CTgXxY6Q2sN pA2QFnFaTQ ldA3DvMIHj11xsylKqgkzVspPAHEEkbegv6SB q3KDpdFdPW3ZVzO9f6jlOJ4kpQtW6FuoTzcHxyjfsOEL1KV6m6VktfRb U35G8](https://altsignals.io/wp-content/uploads/2024/01/610789487b18551d90e8050b_aJEEaYJEL185CTgXxY6Q2sN-pA2QFnFaTQ_ldA3DvMIHj11xsylKqgkzVspPAHEEkbegv6SB-q3KDpdFdPW3ZVzO9f6jlOJ4kpQtW6FuoTzcHxyjfsOEL1KV6m6VktfRb-U35G8.png)

The team behind this signals group would not only tell you the best trades, but they will also share with you the results. However, they do not share regular reports as AltSignals.

5th Place – Forex Signal Telegram

Forex Signal Telegram offers two different groups, one free channel and a VIP group for professional traders. They share with users indices and forex signals from different markets and regions. This allows users to have diversified portfolios and some of the most advanced solutions for traders.

The share weekly trading signals of some of the most popular indices right now. AT the same time, they send recommendations about the trades users should open and how to do that. Although this group is not so popular, they continue to grow.

This is the reason why we have added them to our top 5 index signals groups for Telegram.

6th Place – Nasdaq Elite

The last one of our top 5 index signals groups for Telegram is Nasdaq Elite. The team behind this channel focuses on Nasdaq signals that would help you open and close positions on this market.

This team claims they have more than 10 years in the market and that they share around 4,000 pips per month to investors. Although this changes every single month, the results are definitely very positive for this small group.

Finally, they share intraday signals and also swing trades for users that prefer longer time frames for their trades. The goal of this group is to also attract users to their VIP channel where they share more exclusive signals on a daily basis.

Now that you have your Telegram groups, lets move into a bit more information in general regarding index signals.

Importance of understanding finance index signals

In the world of investing, understanding finance index signals is crucial for anyone looking to navigate the complexities of the financial markets. These signals serve as vital indicators that can help investors determine market trends, make informed decisions, and optimize their investment strategies. By grasping the significance of these signals, investors can enhance their ability to predict market movements and identify potential opportunities before they become apparent to the broader market.

Finance index signals can provide insights into the overall health of various asset classes, helping investors gauge when to enter or exit a position. For instance, a rising index signal may indicate bullish market sentiment, suggesting that it could be a favorable time to invest. Conversely, a declining signal may serve as a warning to reassess current holdings or consider defensive strategies. Understanding these signals allows investors to make more strategic decisions based on empirical data rather than emotional responses to market volatility.

Moreover, finance index signals are not just reserved for seasoned investors; they are equally beneficial for beginners. By learning to interpret these signals, novice investors can develop a keen sense of market dynamics and build a more robust portfolio. This knowledge empowers individuals to take control of their financial futures and make decisions that align with their investment goals, ultimately leading to greater financial success over time.

Different types of finance index signals

Finance index signals can be categorized into several types, each serving a distinct purpose in the analysis of market trends. The most common types include moving averages, oscillators, and momentum indicators. Moving averages, for instance, are widely utilized to smooth out price fluctuations and identify the underlying trend over a specific period. This type of signal can help investors determine whether an asset is in an uptrend, downtrend, or sideways movement, providing a clearer picture of market conditions.

Oscillators are another crucial category of finance index signals. These indicators typically fluctuate within a defined range and are used to identify overbought or oversold conditions in the market. Popular oscillators include the Relative Strength Index (RSI) and the Stochastic Oscillator, both of which can signal potential reversals in price movement. By understanding how to read these indicators, investors can better time their entry and exit points, ultimately enhancing their trading strategies.

Lastly, momentum indicators assess the speed and strength of price movements, helping investors understand the underlying force driving market trends. These signals are often used in conjunction with other indicators to validate potential investment decisions. By recognizing the various types of finance index signals, investors can develop a more comprehensive approach to analyzing market conditions and making informed choices about their portfolios.

How finance index signals are calculated

Calculating finance index signals involves the use of mathematical formulas and algorithms designed to analyze price data over time. For moving averages, the simplest form is the Simple Moving Average (SMA), which is calculated by summing the closing prices of an asset over a specific number of periods and then dividing that total by the number of periods. For example, a 10-day SMA would involve adding the closing prices from the last ten days and dividing by ten. This method helps to smooth out price fluctuations and provides a clearer view of the asset’s trend.

In contrast, more complex indicators like the Exponential Moving Average (EMA) weigh recent prices more heavily than older prices, making it more responsive to new information. The EMA is calculated using a specific formula that incorporates the previous period’s EMA and the current price, allowing traders to capture changes in price momentum more effectively. Understanding how these calculations work is essential for investors looking to leverage moving averages in their decision-making processes.

Oscillators, such as the RSI, rely on a different calculation method. The RSI is determined by comparing the average gains and losses over a defined period, typically 14 days. The formula for the RSI takes these averages and converts them into a value between 0 and 100. Values above 70 may indicate an overbought condition, while values below 30 can suggest an oversold condition. Mastering these calculations can provide investors with a deeper understanding of market dynamics and enhance their ability to interpret various finance index signals accurately.

Common finance index signals and their meanings

Several finance index signals are commonly used by investors to gauge market conditions and make informed decisions. Among these, the Moving Average Convergence Divergence (MACD) is a popular choice that combines both trend-following and momentum elements. The MACD consists of two moving averages and a histogram that indicates the relationship between them. When the MACD line crosses above the signal line, it may suggest a bullish trend, while a cross below could indicate a bearish sentiment. Understanding the implications of the MACD can help investors identify potential entry and exit points in their trades.

Another essential signal is the Relative Strength Index (RSI), which measures the speed and change of price movements. As mentioned previously, the RSI ranges from 0 to 100 and helps investors determine whether an asset is overbought or oversold. An RSI above 70 suggests that an asset may be overbought and due for a correction, while an RSI below 30 indicates that it may be oversold and could experience a rebound. By interpreting the RSI in conjunction with other indicators, investors can gain valuable insights into potential market reversals.

Lastly, the Bollinger Bands are a widely utilized technical indicator that provides insights into volatility and potential price movements. These bands consist of a moving average and two standard deviation lines that track above and below the moving average. When the price approaches the upper band, it may indicate overbought conditions, while a price near the lower band may suggest oversold conditions. By using Bollinger Bands in conjunction with other finance index signals, investors can develop a comprehensive understanding of market dynamics and enhance their investment strategies.

Using finance index signals for investment decision-making

Utilizing finance index signals for investment decision-making involves integrating these indicators into a broader investment strategy. Successful investors often combine multiple signals to create a comprehensive analysis of market conditions. For example, an investor might look at a combination of moving averages, MACD, and RSI to confirm a potential buy or sell signal. This multi-faceted approach can reduce the risk of false signals and increase the likelihood of making informed decisions.

Moreover, timing plays a crucial role in using finance index signals effectively. Investors should pay attention to the context in which these signals arise. For instance, a bullish signal may be more reliable during a confirmed uptrend, while the same signal could be less trustworthy during a volatile market phase. By considering the overall market conditions and the historical performance of the signals, investors can make more strategic decisions that align with their investment goals.

Additionally, it is important for investors to develop a disciplined approach to using finance index signals. This involves setting specific entry and exit points based on the signals generated and adhering to these predetermined levels. Emotional decision-making can lead to poor investment outcomes, so maintaining discipline and sticking to a well-defined strategy is essential for long-term success in the markets.

Tips for interpreting finance index signals accurately

Interpreting finance index signals accurately requires a combination of analytical skills and market awareness. One key tip is to avoid relying solely on a single signal when making investment decisions. Instead, investors should consider the context of multiple signals and use them in tandem to form a clearer picture of market conditions. This holistic approach can help filter out noise and provide a more accurate assessment of when to enter or exit positions.

Another important aspect of accurate interpretation is understanding the underlying market trends. For instance, when analyzing moving averages, it is essential to recognize whether the overall market is in an uptrend or downtrend. This context can help investors determine the significance of a signal and how to act upon it. Additionally, keeping abreast of economic news and market events can provide valuable insights into potential price movements, allowing investors to make more informed decisions based on current conditions.

Lastly, practice and experience play a significant role in improving one’s ability to interpret finance index signals. Investors should regularly review their trades and the signals that influenced their decisions, learning from both successes and mistakes. Over time, this continuous learning process can enhance an investor’s skill set, enabling them to interpret signals more accurately and make better investment choices.

Risks and limitations of relying on finance index signals

While finance index signals can be powerful tools for investors, it is crucial to recognize their limitations and potential risks. One major risk is the possibility of false signals, which can lead to misguided investment decisions. Market conditions can change rapidly, and relying solely on technical indicators without considering broader economic factors can result in losses. Therefore, investors should always exercise caution and incorporate fundamental analysis alongside technical indicators to obtain a more comprehensive view of the market.

Another limitation is the lagging nature of many finance index signals. Indicators such as moving averages are based on historical price data and may not react quickly to sudden market changes. This lag can sometimes result in missed opportunities or delayed responses to market trends. Investors need to be aware of this time lag and consider using leading indicators, which can provide early warnings of potential market movements, to complement their analysis.

Finally, market sentiment can also play a significant role in the effectiveness of finance index signals. Psychological factors, such as fear and greed, can influence market behavior and lead to unexpected price movements that technical indicators may not account for. As such, investors should remain vigilant and be prepared for market volatility that may not align with the signals generated by their analysis. By acknowledging these risks and limitations, investors can adopt a more balanced approach to using finance index signals in their investment strategies.

Lastly, educational resources, such as online courses, webinars, and books, can enhance an investor’s understanding of finance index signals. These resources often cover various technical analysis techniques and provide practical tips for interpreting signals effectively. By investing time in learning and honing their skills, investors can improve their ability to analyze finance index signals and make more informed investment decisions over time.

Conclusion: Harnessing the power of finance index signals for investing success

In conclusion, understanding finance index signals is an essential skill for any investor looking to achieve success in the financial markets. By recognizing the importance of these signals, familiarizing themselves with different types and calculations, and learning how to interpret them accurately, investors can enhance their decision-making process and navigate market fluctuations with confidence.

However, it is equally vital to remain aware of the risks and limitations associated with relying solely on these signals. By adopting a balanced approach that incorporates both technical and fundamental analysis, investors can develop a more robust investment strategy. Moreover, leveraging the various tools and resources available for tracking finance index signals can further enhance their ability to make informed decisions.

Ultimately, harnessing the power of finance index signals requires continuous learning and adaptation. As market conditions evolve, so too must an investor’s strategies. By staying informed, practicing disciplined trading, and refining their analytical skills, investors can unlock the potential of finance index signals and pave the way toward long-term investing success.

![Top 5 Index Signals Groups for Telegram [MonthYear] 8 image](https://altsignals.io/wp-content/uploads/2025/10/blog-cta-card-scaled.webp)

![Top 5 Index Signals Groups for Telegram [MonthYear] 9 image](https://altsignals.io/wp-content/uploads/2025/10/blog-cta-card-mobile.webp)