In times where the U.S. dollar is experiencing high volatility and when many EM currencies are getting stronger against the USD, it can be a good moment to understand what the US Dollar Index (DYX) is.

In this guide, we will share with you the basics of the US Dollar Index, how it works and how it can help us understand the volatility of the USD compared to other currencies around the world.

Before we start, this is not investment advice. All the information is for educational purposes only. We are not responsible for any decisions you make after reading the guide. Never invest more than what you are able to lose and always ask your professional financial advisor.

What is the US Dollar Index (DYX)?

The US Dollar Index is a measure to understand whether the dollar is gaining value or losing it against a predetermined basket of currencies. The currencies included in this basket are the Euro (EUR) with a 57.6% weight, the Japanese yen (JPY) with a 11.9% weight, the Canadian Dollar (CAD) with a 0.1% weight, the Swedish krona (SEK) with a 4.2% weight and the Swiss franc (CHF) with a 3.6% weight.

The US Dollar Index was created in 1973 and it provided information about the U.S. dollar value against the currencies we have mentioned before. The DYX has been moving from 164.72 (its highest value) in February 1985 to 70.698 on March 16, 2008 (the lowest value).

This index is affected by economic and political events in the United States and also those that take place around the world. Events such as tax cuts, increase or reduction in interest rates by central banks, international crises, and military interventions can play an important role in modifying the value of the US Dollar Index.

Analysts all over the world use it to make investment decisions, understand how other markets are behaving and how currencies are behaving. Thus, the Dollar USD Index provides information about the value of currencies from different countries compared against the USD.

Controversies About the Basket

Of course, this index has been criticized many times for different reasons. One of them is the fact that it does not include information about the changes in the U.S. trading partners over time. Since the index was created it has only been modified at the end of the 90’s with the expansion of the EUR.

Despite that, countries such as China, Brazil and India have been playing a more important role in the world and as trading partners of the United States. The CNY, the BRL and INR have been used to import goods from the United States in larger amounts almost on a yearly basis.

Due to this reason, many analysts consider that new currencies should be added to the US Dollar Index to have better information about the value of the USD compared with other currencies. At the same time, it is also possible to modify the weight of the current basket of currencies considering it follows almost exactly the value of the EUR over time.

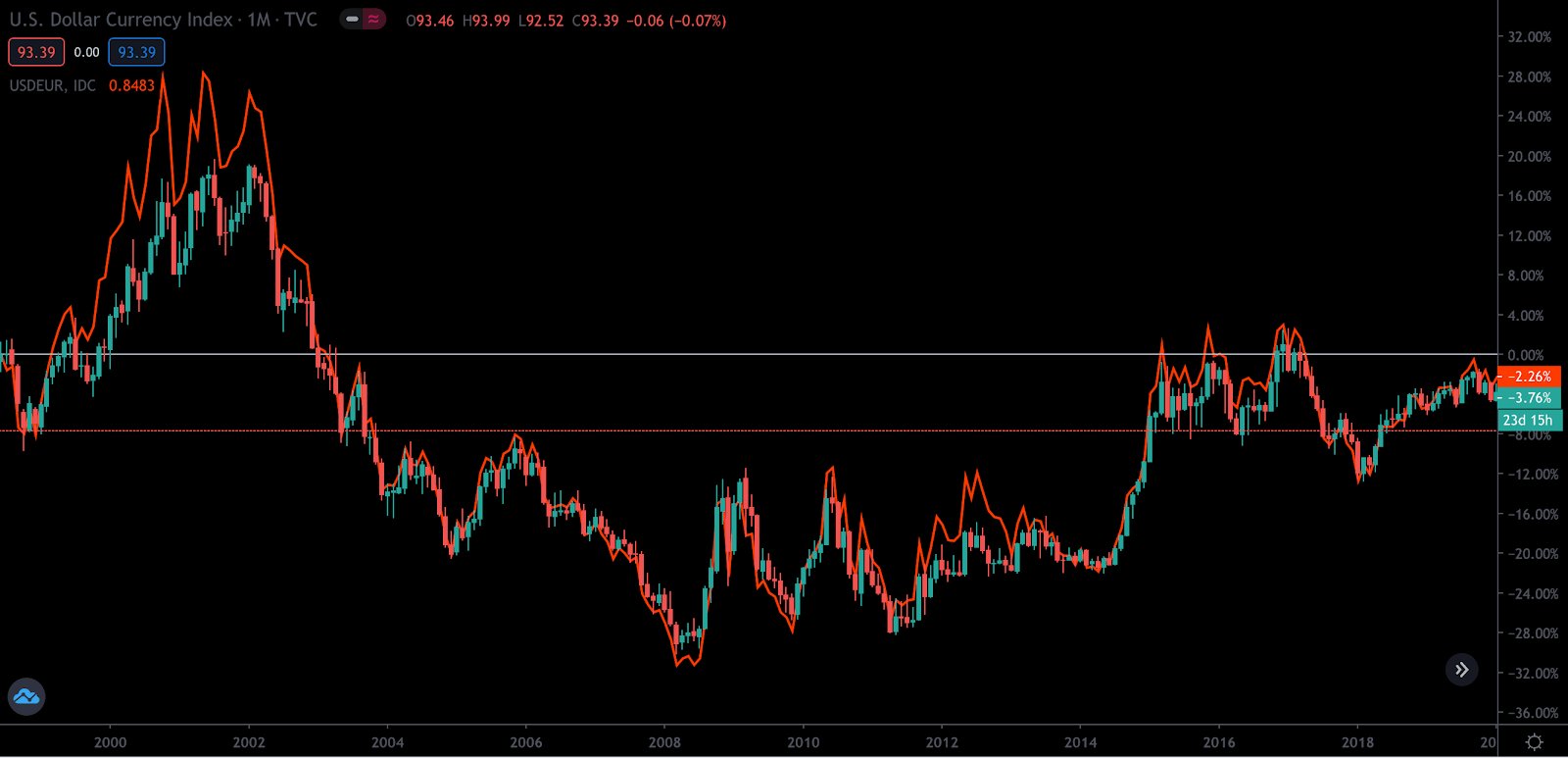

In this image, you can see how the USDEUR followed very closely the evolution of the US Dollar Index. This is one of the main reasons why it is criticized and why it could be changed in the future to better represent the relationship between the U.S. and other currencies.

Furthermore, it is worth pointing out that the US Dollar Index does not take into consideration EM currencies. These EM currencies behave in a different way compared to developed countries currencies. Thus, this can also be considered a critic of the US Dollar Index. Including representative EM currencies such as those from the countries mentioned above could make the US Dollar Index a much better indicator of the relative value of the U.S. dollar in the world.

Conclusion – US Dollar Index

The US Dollar Index is a great index to understand the value of the U.S. dollar compared to other currencies around the world. This helps investors and analysts understand whether it is a good moment to invest in specific assets, in the FX market and more.

There are some critics related to the US Dollar Index due to the fact that it does not take into considerations EM currencies. In the future, this could change and new currencies could be added to the index. This could provide more detailed information about FX exchange rates of U.S. trading partners.