When trading different types of assets, technical analysts use harmonic patterns. They are very helpful to understand how the market could move and how the price of an asset could evolve. Although they are not 100% effective, they give a clear idea of possible price movements.

In this guide, we are going to show you how harmonic patterns work, what they are and how you can use them to trade.

Disclaimer: the information shared by AltSignals and its writers should not be considered financial advice. This is for educational purposes only. We are not responsible for any investment decision you make after reading this post. Never invest more than what you are able to lose. Always contact your professional. financial advisor.

What are Harmonic Patterns?

Harmonic patterns in trading are structures that can be used to recognize specific structures on the charts. These structures are built based on different parameters such as Fibonacci ratios and market cycles.

One of the things we see with these patterns is that they usually repeat over time. This is why they are usually used by technical analysts in order to understand what could happen with the price of an asset.

As we mentioned before, there is no certainty about how the price of an asset would continue to move. Nevertheless, those that use harmonic patterns consider that these structures and figures could repeat over time.

Types of Harmonic Patterns

There are different types of harmonic patterns that can be found by analysts in the market. Each of them would have different structures and work in different ways. It is up to the chartist to find and analyse the harmonic patterns they find.

Some of these harmonic patterns include the following: Bat, Shark, Cypher, Deep Crab or Butterfly.

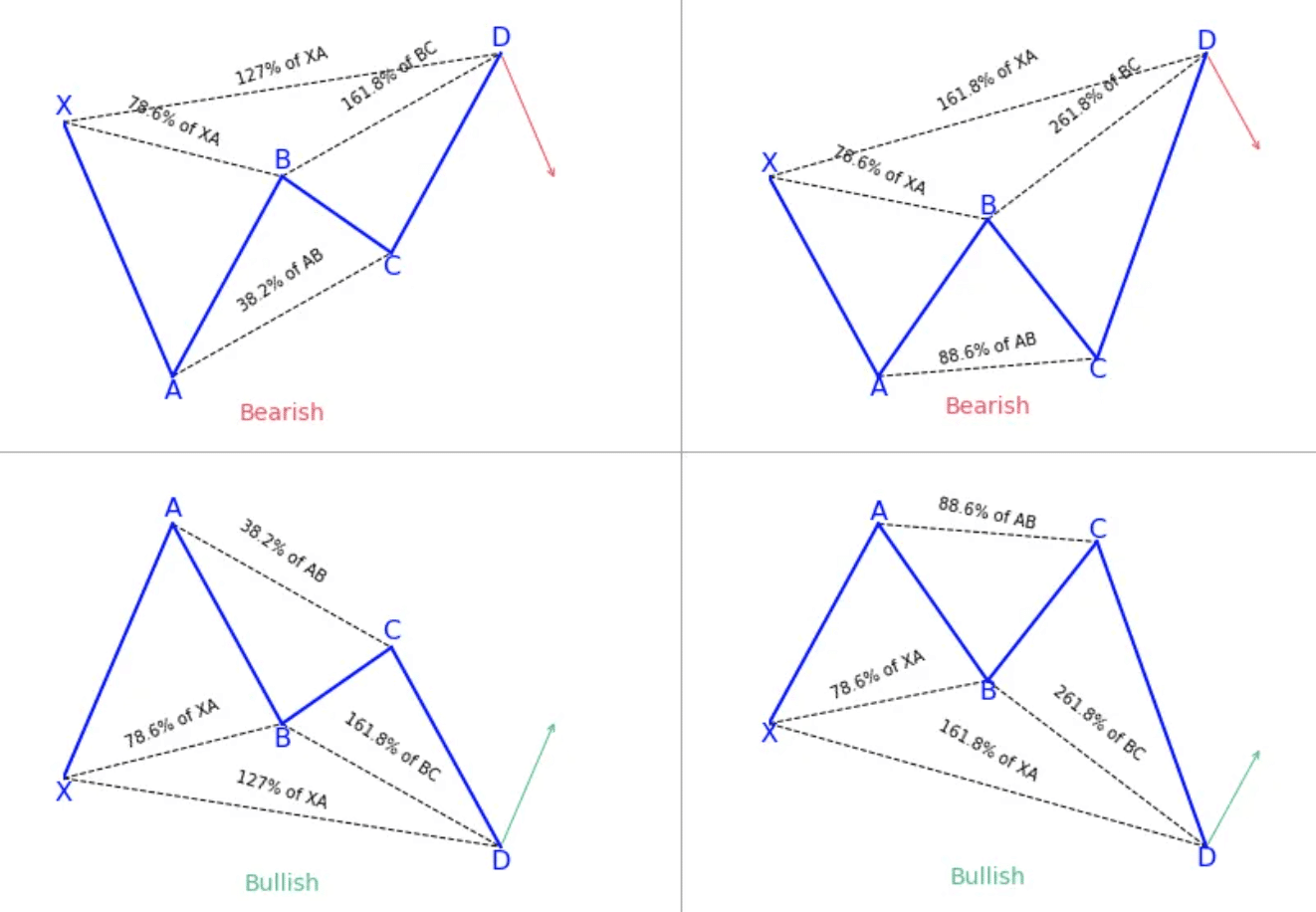

Source: PatternsWizard

Each of them takes into consideration different parameters and things. As you can see in the image above, there are different points and distances that are measured in a very detailed way.

There are bullish and bearish patterns that would help us understand whether it could be a good moment to buy an asset or to sell another asset. Depending on the type of pattern and how the price moved, we should make an investment decision if we are traders.

Harmonic Pattners Forex

The forex market is one of the most popular ones. In that market, traders usually use harmonic patterns that help them understand when to enter or leave a trade. The forex market is one of the largest markets where traders execute their trading strategies and where these patterns are applied.

Technical analysts are working on a daily basis in the forex market. Harmonic patterns forex traders draw on their charts are those that we mentioned before and some others. Everything depends on the type of trader, the tools they use and which are the indicators they prefer to use on a regular basis.

How to Draw Harmonic Patterns?

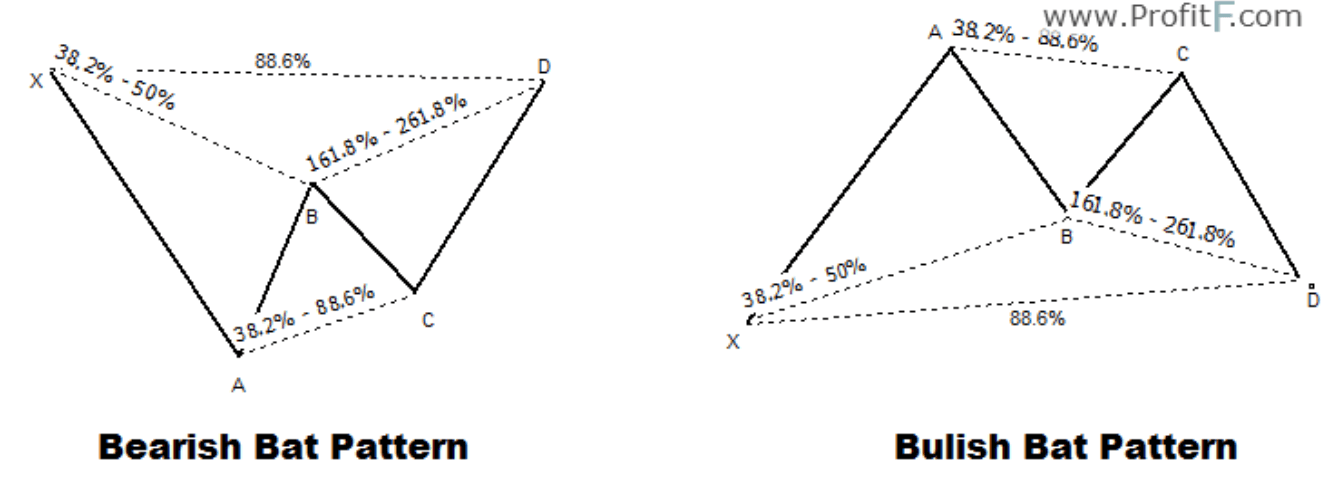

In order to draw harmonic patterns, you should also know how they look. The Bat Pattern, for example, is considered to be one of the most accurate harmonic patterns in the market.

With it, users can get valuable information about clear entry and exit moments. Thus, it could be very helpful to trade different currencies and assets (not only in the forex market).

Source: Profitf.com

In the pattern above, you see that there are two different figures, one that shows a bullish trade and the other a bearish trade. You can use traditional trading tools in order to draw them on your charts.

You can use Metatrader 4 (MT4) or any other charting platform you prefer. It is up to you how to use them. There are some plugins that you can add to MT4 in order to easily draw these patterns on the charts.

How to Trade Harmonic Patterns?

Finally, to trade harmonic patterns you should know each of the patterns and how they behave. Understanding how they are and how to draw them you will also know how to trade harmonic patterns.

In general, each of the patterns has an entry or exit point. If this is a bullish figure, then you should open a trade at the conjunction point. However, if this is a bearish pattern, then you might open a short position or close a trade.

Of course, this is not financial advice. However, these harmonic patterns could be very useful to help us trade different assets and in a wide range of markets.