Interest rates became one of the most discussed topics in recent months. We do not only talk about the interest rates of credit you could get at your local bank but also about the interest rates set by central banks all over the world.

This guide will go through interest rates, mortgage rates and how they affect the economy. Moreover, we will share with you the effect of negative interest rates.

Disclaimer: the information shared by AltSignals and its writers should not be considered financial advice. This is for educational purposes only. We are not responsible for any investment decision you make after reading this post. Never invest more than what you are able to lose. Always contact your professional. financial advisor.

What are Interest Rates?

An interest rate is a charge a borrower pays to a lender for using assets. The interest rate is usually measured on an annual basis and it needs to be paid according to the conditions set. Interest rates apply to public and private contracts on the economy. Once the expiry date arrives, the borrower needs to give back the main amount and the interest rate.

Interest rates are determined by central banks. They use different tools in order to keep the economy expanding and avoiding recession. The central bank interest rates have also an impact on the general interest rates of the economy.

The interest rate definition could also be understood as the cost of borrowing money. These rates change on a regular basis and have a deep impact on the economy.

Learn how to trade using AltSignals.

What are Negative Interest Rates?

Negative interest rates are also one of the main topics discussed right now. They have a deep impact on the market and could certainly affect economic outcomes. Negative interest rates involve paying interest to borrowers rather than borrowers paying interest to lenders.

These interest rates appear in an economy when there is a recession. Usually, central banks increase the costs of storing money and increase the credit on an economy. In this way, the economy could keep running or at least reduce the impact of the recession.

Negative interest rates could also affect inflation levels. This happens due to the large amount of money that is used and how fast it circulates. Negative interest rates aim at encouraging lending, spending, consumption and pushing investments forward.

Mortgage Rates Today

A mortgage is a loan that is related to the real estate market. These are used to purchase a home and differ from traditional interest rates. However, they are strongly linked to the reference interest rate set by the central bank of a country.

Mortgage rates today are very low when compared to previous decades. However, the cost of the mortgage depends on the loan you take, your earnings, the location of the home you want to purchase and your credit rating, among other things.

It is worth noting that some mortgages could use compound interest. That means that the interest rate is applied not only to the principal but also to the accumulated interest of previous periods.

If you are not able to pay the interest of your mortgage, then the real estate purchased would work as collateral.

What Are Interest Rates Today?

The reference interest rates set by central banks have been at a minimum in years. In some countries, interest rates have even reached negative levels. This shows how desperate central banks are around the world to keep credit moving and the economy running.

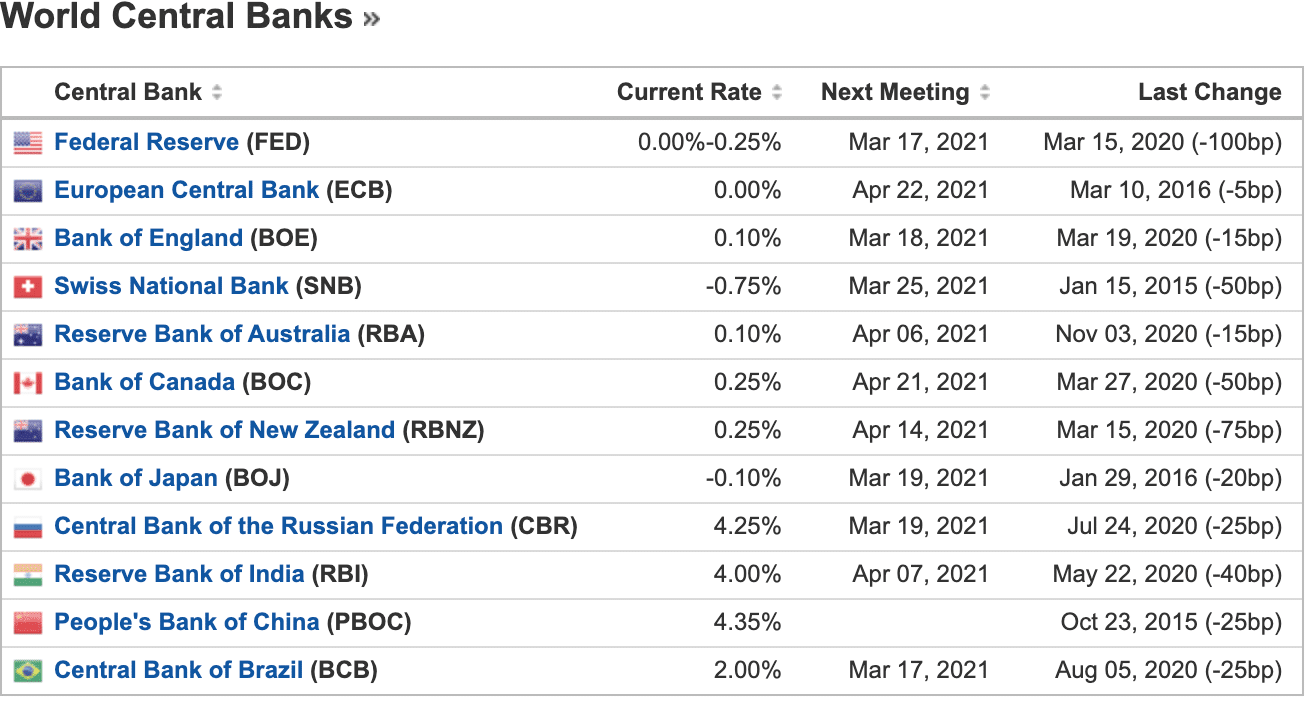

The lower the interest rates, the easier it is for people to take a loan and use it to invest, expand their business or renovate the home. The largest central banks around the world have a current interest rate that ranges between -0.75% and 4.35%.

The Swiss National Bank (SNB) has a reference interest rate of -0.75% while the Central Bank of the Russian Federation (CBR) has an interest rate of 4.25%. It is worth mentioning that each of the banks has a different economy and inflation level. Thus, we also need to take into consideration the interest rate after deducting inflation.

Some other examples include the European Central Bank (ECB) with an interest rate of 0.00%. Furthermore, the Bank of England (BOE) has an interest rate of just 0.10%. In the future, digital innovation could push the cost of lending money even lower. Thus, we might see even lower interest rates in the future.