Compounding is a process that allows investors to generate additional income over time by re-investing their profits. Compounding interest comes with a wide range of risks and benefits. This guide will allow you to understand all the facts about Compounding interest and how a small investment could become massive over years.

Disclaimer: the information shared in this post is not financial advice. Always contact your professional financial advisor before trading cryptocurrencies or any other asset. Never invest more than what you are able to lose.

What is Compounding Interest?

As we have already mentioned before, Compounding interest is an investment decision that allows us to increase our profits by re-investing earnings. Let’s give an example.

If we invest $1,000 and we are able to get a 20% profit on this investment, we will then have $1,200. Without compounding our investment, we would take our $200 and use them for other things. We can spend them, save them or simply put them away. That’s totally fair and we can again make a 20% profit from our initial $1,000 and again have $200.

However, with compounding interest, we could be making a lot more over time. Let’s come back to our $1,200. We can then re-invest all these funds and get 20% on the $1,200 rather than on the $1,000. In this way, we will then have $1,440 rather than $1,400 if we didn’t do Compounding interest.

If you repeat this sequence many times over several years, this could definitely bring financial independence to you. However, you should be lucky enough to spot trades that would be profitable for you, which is not an easy task to do.

Additionally, starting with larger amounts, the compounding interest is expected to be larger in nominal terms. You can calculate your Compounding interest using a compounding calculator. This can be applied to trading and to other types of investments.

How Can Investors Receive Compounding Returns?

Investors can receive compounding returns by re-investing their funds once they close a profitable investment. What does that mean? That means that rather than continuing with your initial investment, you can try leaving the profits obtained and reinvesting them with your initial investment.

For example, if you start with $10,000 and expect to get 10% per year, then re-investing your profits would be a good idea for the next 10 years. Without compounding your investment, you would have earned $10,000 without taking into consideration inflation. You would make $1,000 per year.

Now, let’s do the same thing but compounding interest. The first year we will make $1,000. In the second year, we would make 10% on $11,000 and not $10,000. Thus, at the end of the second year, we would have $2,100 rather than $2,000.

If we now compound again the earnings, at the end of the third year we would have made $3,310 rather than $3,000. We already made 10% more in three years. In ten years we would have made $15,937 rather than $10,000. This is 59% more than without compounding investment.

You do not need to compound 100% of your profits. But you can always take some profits throughout the way. This can help you enjoy some of the money you are making and at the same time make more over time.

However, one of the main risks of compounding interest is that when you reach a comfortable level of profits, you would reinvest them and lose them without being able to take any profits along the way. This is why it is always important to withdraw some of the profits at the end of every investing period.

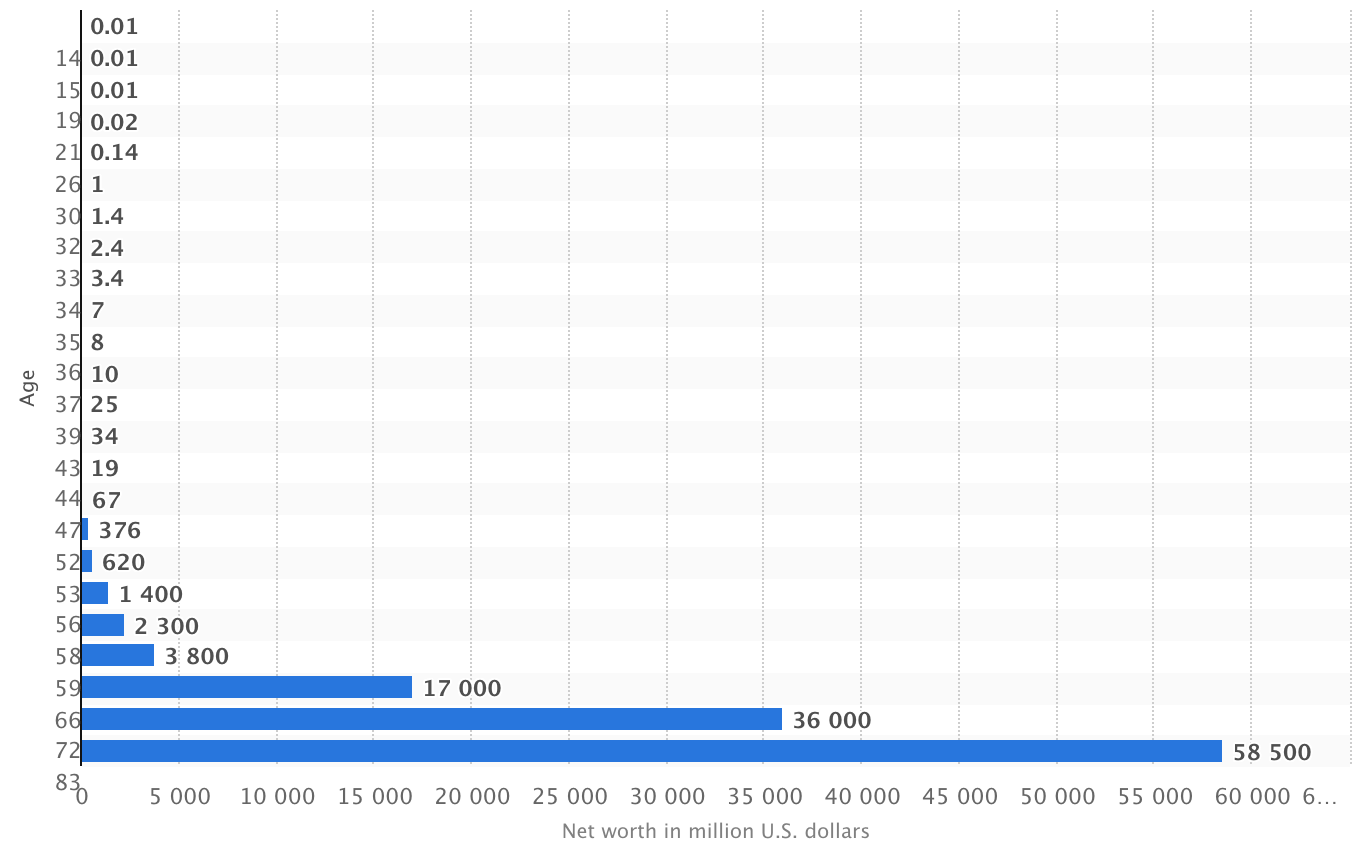

Net Worth of Warren Buffett Compounding Interest

Warren Buffett can be a great example of how compounding interest could help investors increase their wealth over time. At the age of 26, Buffett was already a millionaire. From that moment, its net worth increased massively.

As you can see in the image above, in just 10 years, he had multiplied by 10 his investment. This shows how important it is to do compounding interest. Although we will certainly not become Warren Buffett, we can start learning from compounding interest and how it can be a great way to increase our profits over time.

This can be applied over a period of ten, twenty or forty years and to learn how to plan your portfolio. In the long-term, those that do compounding interest would be the ones with the larges amounts of money.