What is InstaDApp? A Detailed Beginner’s Guide

InstaDApp is a decentralized finance, DeFi, application that seeks to provide a simple-to-use layer in order to interact with other DeFi protocols. Instead of using 4 different applications to perform a specific function such as: lending and borrowing, InstaDApp provides an interface that allows you to do it all in one place. It can be thought of as being similar to a banking portal that allows you manage your crypto finances more efficiently.

How Does InstaDapp Work?

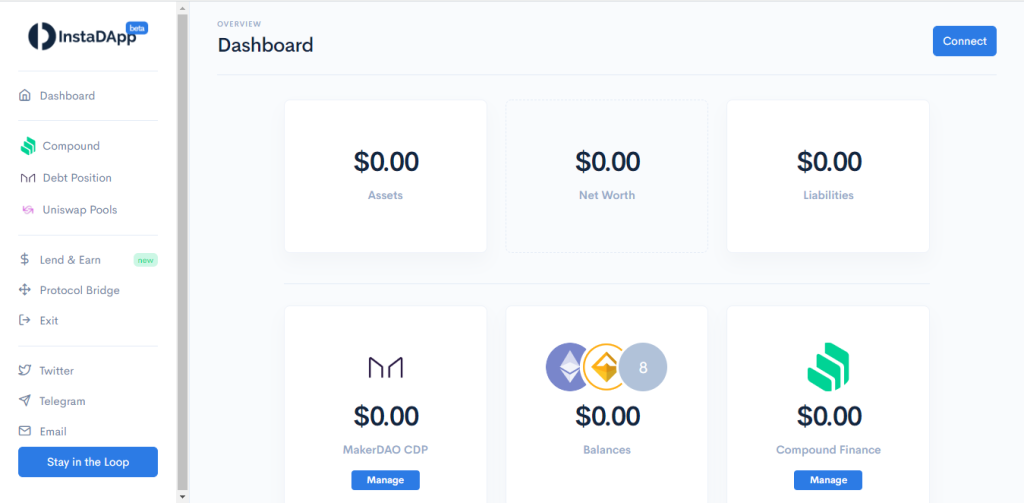

To use InstaDApp and interact with its portal, a user needs to have an Ethereum web3 wallet like MetaMask, a Coinbase Wallet or Trust Wallet. With this, they can then manage all their digital asset from the InstaDApp dashboard.All transactions that take place on the platform are done using smart contracts, with crypto assets stored in a users’ contract wallet – this ensures they keep full custody over their assets. InstaDApp also does not take a fee when processing transactions, a user simply needs to ensure they have enough gas when initiating one.

There are four main activities you can perform on the InstaDApp platform, these include:

- Lending – Deposit your crypto and earn interest on it;

- Borrowing – Borrow instantly directly from the InstaDApp dashboard;

- Leverage – Increases the capital you’re able to trade with;

- Swap – Instantly exchange tokens from your web3 wallet.

Lending & Borrowing – The way InstaDApp acts as an interface to allow lending and borrowing on its platform is by plugging into the DeFi protocol, Compound Finance. Compound Finance is an open-source protocol that allows developers to build DeFi applications on top of it. Its core functionality is to establish money markets (short-term loans) that algorithmically set interest rates on those loans depending on supply and demand. All of this is integrated into InstaDApp and simplifies the experience of lending and borrowing.

Leverage& Swap – InstaDApp uses Kyber Network, a protocol that aggregates liquidity from a wide range of sources, to power its leverage and swap functionalities. For example, if a user wanted to place a leveraged trade with ether, InstaDApp connects with Kyber to grant them the additional ether with which to place the trade. With swaps, because Kyber has access to a wider range of cryptocurrencies due to its liquidity reserves, it allows an InstaDApp user to swap their crypto with virtually any other as long as it’s support by Kyber.

Uniswap Pools & MakerDAO CDPs

Uniswap Pools – Uniswap is a protocol that allows for the exchange of Ethereum and ERC-20 tokens in seamless manner. One way it is able to achieve this is through users participating in liquidity pools. For example, if Bob wanted to exchange his ether for BAT tokens, the trade wouldn’t be possible if there were not BAT tokens to swap with. However, if there was a liquidity pool of BAT tokens, this trade then becomes possible.Users who lock up their ERC-20 tokens to provide liquidity to the Uniswap platform receive a fee for doing so – this is where InstaDApp comes in. InstaDApp has integrated Uniswap pools, therefore allowing any liquidity providers to easily manage their pools from the InstaDApp dashboard.

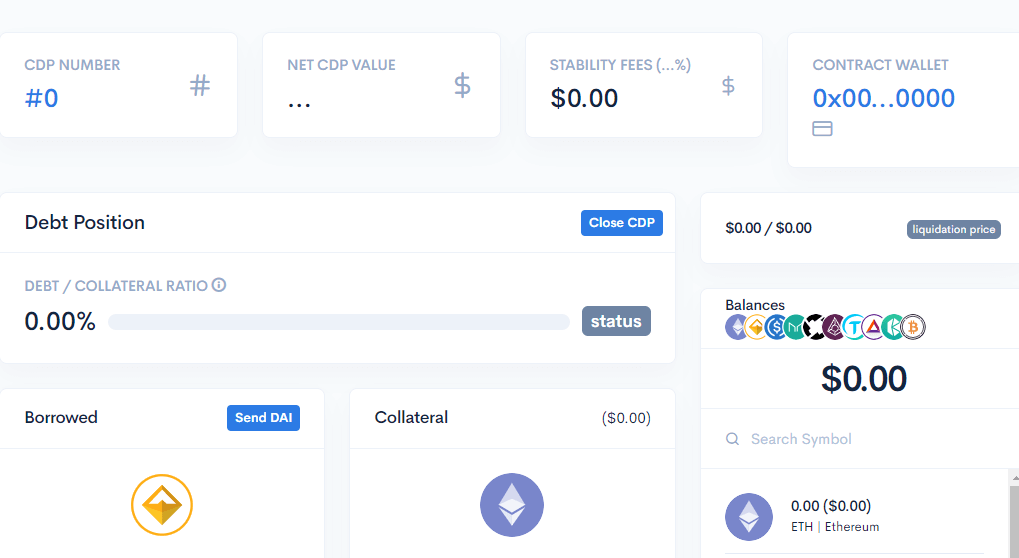

MakerDAO CDPs – CDPs, or collateralized debt position, is the manner in which the DAI stablecoin is generated on the MakerDAO platform. Users can create CDPs by locking ether into them as collateral – the individual would then receive up to 2/3 the value of the locked ether in DAI. This collateral will remain locked in the CDP until owner repays the debt, or liquidation occurs via the value of the collateral falling below a certain point.InstaDApp aims to simplifying the creation and maintenance of MakerDAO CDPs on its platform by designing an intuitive interface specifically for it. As MakerDAO is the most valuable DeFi platform with $275 million currently locked into it, InstaDApp may quickly become the preferred place to manage a users’ debt positions.

Conclusion

To conclude, InstaDApp is a DeFi application that provides a simple interface in order to interact with other DeFi protocols. It is currently integrated with Compound Finance in order to allow users to lend and borrow cryptocurrency, as well as Kyber Network to facilitate swapping tokens and leveraging them. It also has integrated in it: Uniswap pools and MakerDAO CDPs. Having only launched in December 2018, InstaDApp has gone on to be the 4th most valuable DeFi platform with a total of $31 million currently locked into it. In addition, they have also gone on to raise a seed round of $2.4 million from a network of venture capitalists including the likes of: Pantera Capital, Naval Ravikant, Balaji Srinivasan and Coinbase Ventures.