What is Nuo Network? A Beginner’s Guide

Nuo Network is a decentralized finance (DeFi) application that provides a platform connecting lenders and borrowers using smart contracts. Built on top of the Ethereum protocol, Nuo is backed by ConsenSys Ventures and has a total value of $10.7 million currently locked in smart contracts.The application currently permits users to lend and borrow using various digital assets such as: BTC, ETH, DAI, LINK and more. In addition, the platform is non-custodial, meaning only users, and not Nuo Network itself, has access to their funds; this is achieved through the use of smart contract accounts.

How Does Nuo Network Work?

Nuo Network has two key players within its ecosystem, namely: lenders and borrowers. To use the platform, these players are required to create a Nuo account with Metamask/Web3 wallet or password-based sign up. ETH or an ERC-20 token must then be transferred to the registered account address in order to begin lending or borrowing.There are 3 main activities that a user can take part in on the Nuo platform, this includes:

- Lending

- Borrowing

- Margin Trading

Lending – To lend, a user must first fund their Nuo smart contract account with ETH or an ERC-20 token. Once this is done, something called a debt reserve must then be created. Debt reserves are pools of ETH or an ERC-20 token which is lent out to borrowers according to their loan request. Reserves have a duration and upon expiry, the initial funding amount plus any interest is automatically transferred to a users’ Nuo account. The annual premium rate (APR), or return that a lender receives from making a loan, is calculated based on the yearly interest that an average debt reserve receives. For example, if the average debt reserve consisting only of ETH receives a yearly interest of 0.2%, this means locking up ETH for one year would yield a return of 0.2%. Debt reserves are also pooled, i.e. combined with other reserves in order to ensure loan requests are funded. Lenders can ensure they earn interest by being part of a pool at the point at which a loan is repaid.

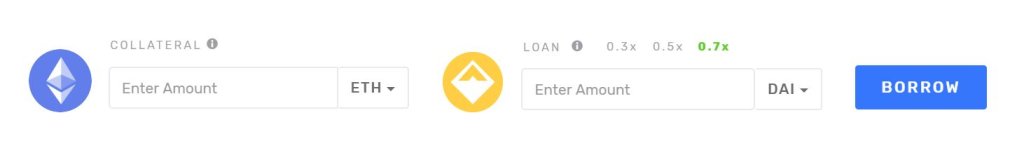

Borrowing – In order to borrow on the Nuo platform, you must first select a digital asset to borrow, as well as put up collateral in case of default. Default can happen either by failure to repay the loan, or the value of the collateral falling close to the loan amount. Once the details of the loan request are established, the loan is then matched to a debt reserve to be funded.Every loan on Nuo has a fixed interest that must be paid back. The amount of interest paid will depend on the length of the loan as well as the availability of currency wishing to be borrowed. Shorter term loans will likely have high interest rates; loans where the currency wishing to borrowed is scarce will also likely have high rates of interest.

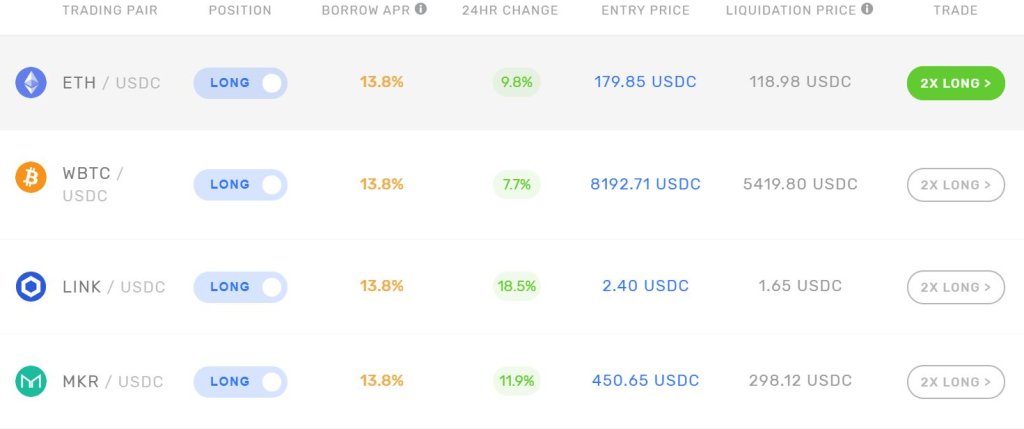

Margin Trading – Nuo also allows users to margin trade with 30+ trading pairs, across 4 markets, with a maximum of 3x leverage. These trades can either be long or short, i.e., betting that the price of a digital asset will go up or down. To margin trade, a user must first select a cryptocurrency to go long or short on, and then put up a collateral amount. After signing a smart contract transaction, the trade is then created. The margin trading functionality is powered by Kyber Network.

The liquidation price for margin trading is not fixed and is dependent on the volatility of the digital asset that was used as collateral – the more volatile the collateral, the more volatile the liquidation price.Lending applications such as Nuo are attempting to decentralize and democratize a core function of the financial economy. Instead of an individual going to a bank to secure a loan, lending applications may be a viable alternative. These applications democratize the entire loan-seeking process by giving individuals access to a much wider pool of willing lenders.

Conclusion

To conclude, Nuo Network is a decentralized finance application that allows for peer-to-peer lending through its debt marketplace. Individuals can use Nuo Network either to lend, borrow or margin trade. With $10.7 million of value currently on the platform, Nuo presents a viable solution for those seeking to make a return via lending or get access to capital via borrowing.Nuo joins other lending DeFi platforms such as: Compound, Dharma Protocol and Ethlend currently operating in the digital asset space. It is currently the 5th largest DeFi lending platform with the mission to enable financial services to work for everybody.