PancakeSwap is an AMM decentralized cryptocurrency exchange that runs on top of the Binance Smart Chain (BSC). Traders can exchange (swap) their coins, get access to liquidity pools and enjoy a wide range of other features supported by this platform.

This guide will share with you the most important information about PancakeSwap, how you can use it and what are its advantages. Moreover, we will compare it with other crypto DEX such as Uniswap that run on top of other blockchain networks.

What is PancakeSwap?

PancakeSwap is an automated market maker (AMM) DEX that runs on the Binance Smart Chain blockchain network. It allows investors to buy and sell digital assets without using a traditional order book.

PancakeSwap is part of the decentralized finance (DeFi) market. It does not depend on a single authority and it helps users exchange their coins in a decentralized and efficient manner. The platform offers users a trading platform, farming, pools, a lottery system and also an Initial Farm Offering (IFO) system.

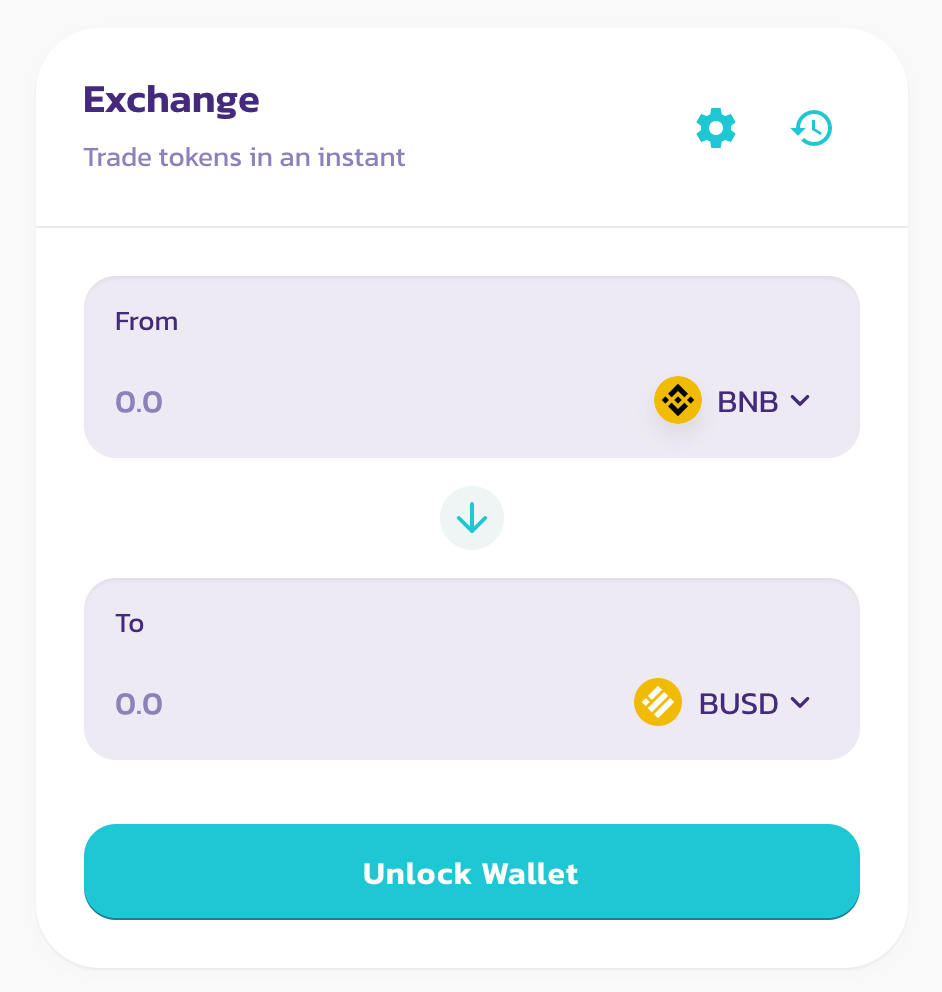

The most popular service is the exchange.

Swapping Cryptocurrencies

PancakeSwap works in a similar way as Uniswap on the Ethereum network. Users can start trading on the platform different digital assets without relying on an order book. For example, you can trade Binance Coin (BNB) for Binance USD (BUSD) in seconds.

This is just an example. Traders can exchange dozens of virtual currencies. There are hundreds of trading pairs. Moreover, the fees per trade are very small (around $0,04 per trade).

This can be achieved using a very simple interface and a system that provides liquidity from mining pools. This brings us to the second solution offered by this platform, the liquidity pools.

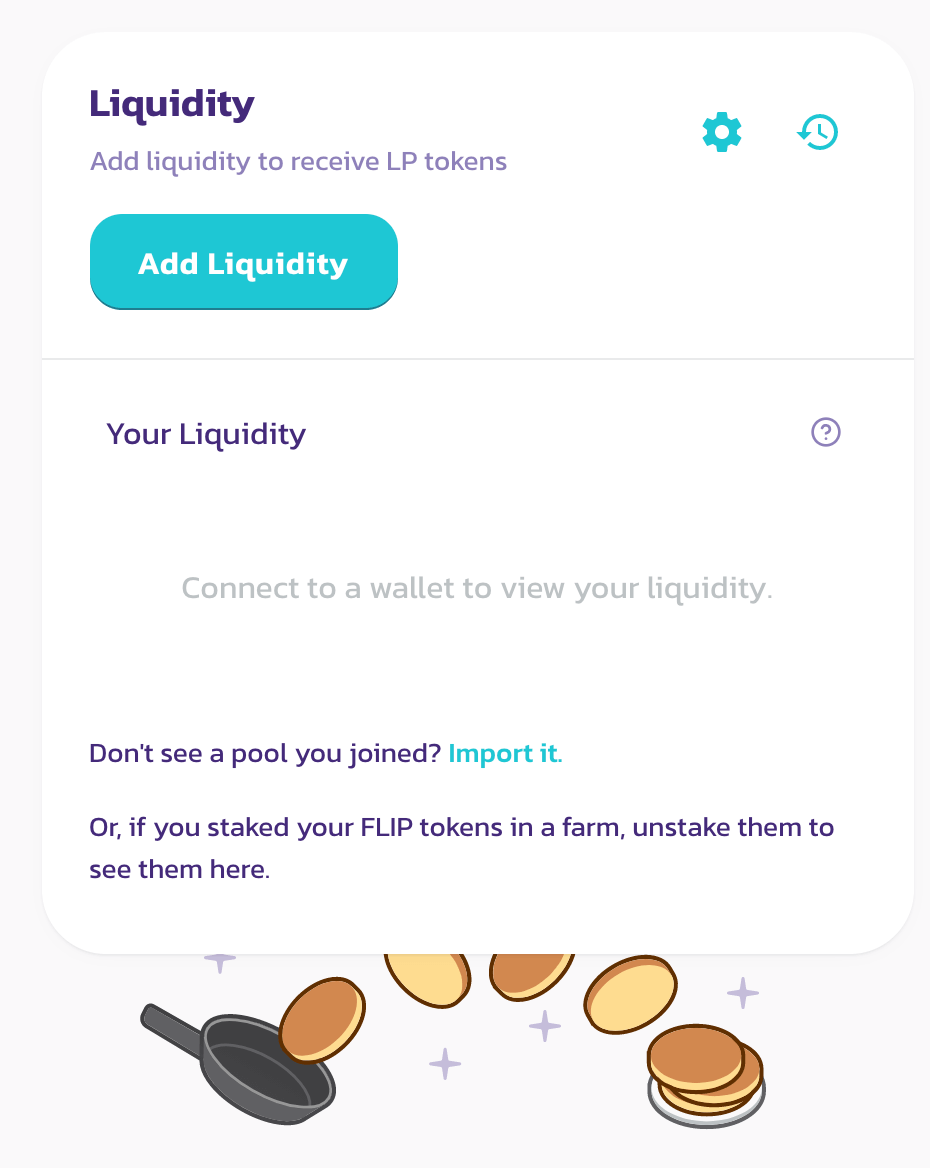

Liquidity Pools

In order for the exchange to have the necessary liquidity for traders, it works with liquidity pools. Each of these pools rewards users with part of the fees paid by users. In this way, investors deposit funds on the liquidity pools allowing traders to easily exchange their coins.

It is important to mention that liquidity pools require users to deposit two different virtual currencies. For example BNB and BUSD. Each time that a trader exchanges BNB for BUSD or vice-versa, users in the pool get rewarded with the fees paid by the trader.

Users will receive their rewards according to the share they have in that specific liquidity pool. If they have 20% of the funds in a liquidity pool, they are expected to receive 20% of the rewards.

Farms

As soon as you provide liquidity to one of the trading pools, you receive LP tokens. These tokens are linked to the trading pool you are using. With these LP tokens, you can earn rewards by farming other tokens.

For example, you can search for the BUSD/BNB farm and earn extra rewards by harvesting cake (CAKE) coins. CAKE is the digital asset that powers the PancakeSwap ecosystem alongside Binance Coin.