There are thousands of indicators in the world. Some of these indexes are more useful and powerful to predict market movements than others. However, one of the most popular and used indexes used by traders and analysts is the VIX or the CBEO Volatility Index.

In this guide, we will be sharing with you which are the most important features of this index, how it can be used and how it can help traders and analysts understand the market in which we are operating.

Disclaimer: this guide shouldn’t be considered investment advice. All the information provided by AltSignals and its writers is not professional advice and was created for educational purposes only. Never invest more than what you are able to lose and always request help from a professional financial advisor.

What is the VIX?

The VIX is an index that was created by the Chicago Board Options Exchange (CBOE) and it provides information about the volatility the market is expecting for the next 30 days. The main goal of this index is to provide clear information about the risks of investing in specific assets and which is the sentiment of investors.

An interesting thing to mention about this index is related to its name, considering it is also known as the “Fear Index.” This is due to the fact many analysts take into consideration this index before they make important investment decisions. Portfolio managers are also analyzing the market stress with this index when they want to allocate the funds of investors and clients.

This tool can also be used by traders that want to get exposure to the variation of prices in the market. The VIX was introduced in 2004 and has been then used to measure the volatility in the U.S. Stock Market. In order to provide information to traders and analysts, the index gathers mid-quote prices of S&P 500 Index call and put options.

Since it was launched, the indicator has been used not only by analysts but also by financial media that want to provide valuable information to users in the market.

VIX Use Cases

There are many different use cases for the VIX index that would help traders and users understand how the market works and make investment decisions. One of the possibilities is to use the VIX index for Portfolio Hedging.

As reported by the CBOE, the VIX Index has had a strong inverse relationship with the S&P 500 Index. Thus, increasing exposure to volatility could have a positive impact on a portfolio if the stock market falls.

Furthermore, participants can also gain exposure to volatility buying or selling VIX futures. This could potentiate the earnings of advanced traders. This could be used by portfolio managers to make profits with the volatility in the market.

Another interesting thing about the VIX index is related to how it is structured. The CBOE informs that the VIX Index tends to move toward a long-term average that is considered to be the “mean-reversion.” This is certainly important because it provides clear information about the way the index can move when there are specific changes in the perceived risk.

Currently, there are several VIX futures contracts that are available to trade in the market and that would allow users to get exposure to volatility, hedge against certain movements in the stock markets and more.

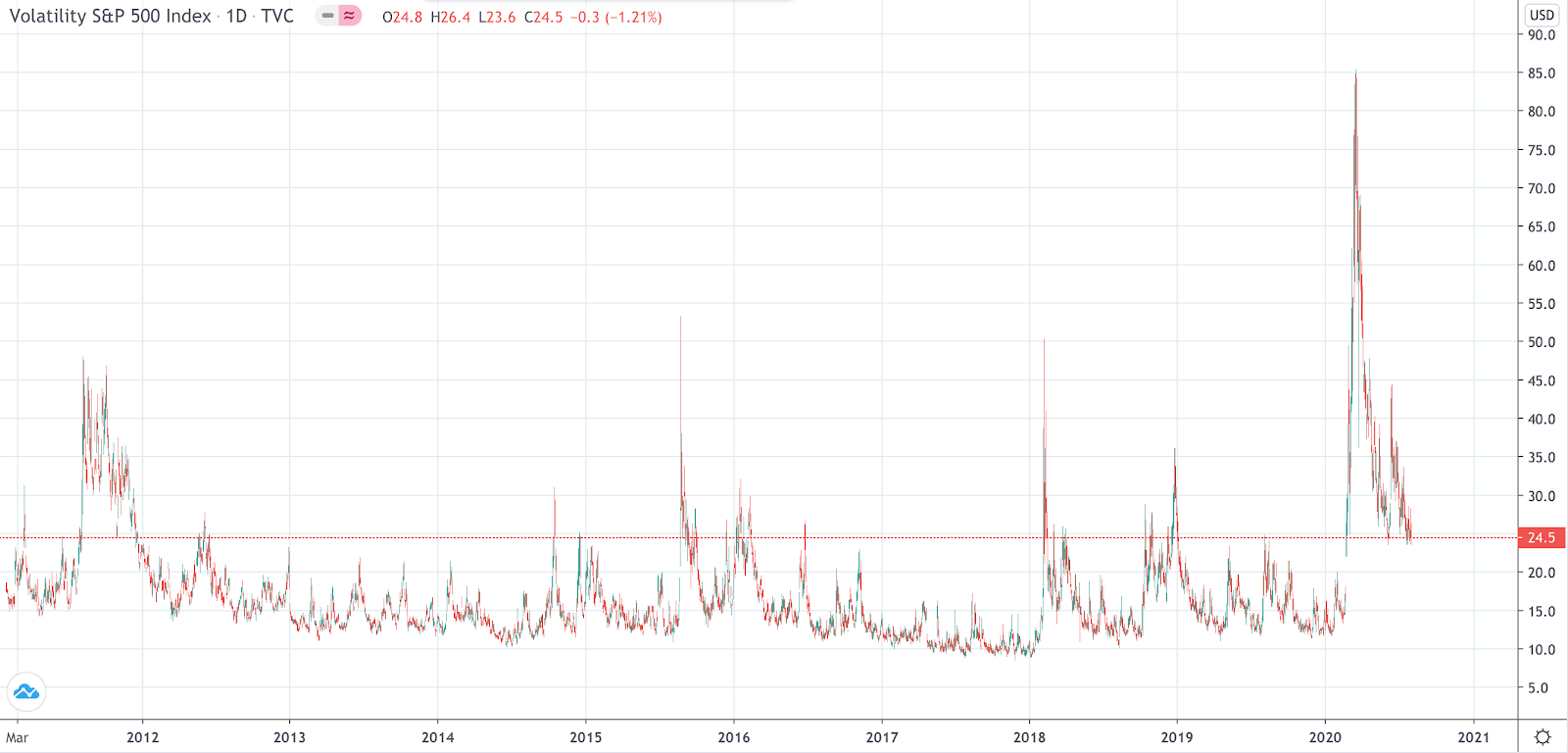

As you can see in the chart below, volatility surges and it moves back to previous levels. This is why it can certainly be used by investors to hedge against adverse movements in the stock markets and also to gain exposure to this volatile but repetitive market.

With the Coronavirus crisis that affected the whole world, the VIX reached one of the highest points in history. The last time the VIX reached such high levels was in the crisis of 2008 and 2009. During the Euro crisis in 2011 and 2012, we can see the VIX also reacted to it.

Conclusion

The VIX is one of the most advanced indexes in the financial markets that is currently used by thousands of investors all over the world to understand how the market behaves and where it could be headed.

There are several uses cases for this index and it can provide investors and analysts with valuable information to increase their profits in the market. Furthermore, the VIX tends to converge at the same level after sudden spikes in the volatility in the market.