Binance is one of the most popular and largest exchanges in the market. It has been offering services to users since 2017 and it became a recognized company in the crypto market. During the last years, this platform has been expanding the services that it was providing to users. Nowadays, it also offers crypto futures trading.This article will explain how to use Binance futures and how it is possible to improve our trading strategies by using AltSignals crypto trading signals group on Telegram.

What Is Futures Trading?

Futures are contracts related to specific assets that allow individuals and companies to buy or sell an asset at a predetermined price and date in the future. This is usually used by traders to hedge risk in different markets and also by companies to hedge against speculation in the market. A company could simply purchase commodity futures if they need these assets in the future and don’t know what could happen in the coming months. Virtual currencies can also be traded through futures contracts that are provided by different parties in the market. Binance is an exchange that gives this opportunity to users from all over the world.

Open a Binance Futures Account

If you want to start trading crypto futures, one of the best things you can do is to open an account on Binance. If you already have Binance account, this would make things even much easier considering you will just need to follow simple steps. Nonetheless, if you do not have a Binance account, you can follow our complete guide about how to open a Binance account. If you want to open an account for trading Binance futures, you will have to be logged in to the exchange with your username and password. Once you are on the main screen you will have to select the Trade section and press in Futures.

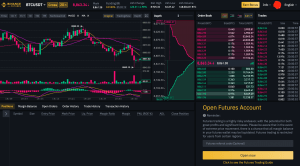

Once you have pressed there and you are in the Futures screen, you will see the option that would allow you login to the futures trading services offered by Binance. It is worth mentioning that users from certain regions may encounter some restrictions. In the Open Futures Account, you can click on Open now in order to move forward and start using this service offered by the Binance exchange.

Once you click in “Open now” you will have the chance to fund your Binance Futures account, which can take a few seconds. You can use funds from other wallet or just move the digital currencies you had on your normal Binance account.

Binance Futures Interface

As you can see in the image above, the Binance futures will offer you a chart with all the information about the price of the asset you are trading, a depth chart, an order book and the last trades posted on the market. In addition to it, you will get the information about your trading activity and the trades you process on the platform. This is going to be very useful to track your performance and understand the trades that you executed in the past. In the “Open Futures Account” section, you will see the information about the trades. (See image below).

Binance Futures And Leverage

It is worth mentioning that Binance Futures will also allow you to trade with leverage for each of the contracts you open. You can adjust the leverage from 1x to 125x. This is going to allow you to make larger profits if your trade moves in the right direction.

Nonetheless, your trade could eventually be closed if you have don’t have enough funds to keep the position open.

Mark Price and Last Price

We already know that the cryptocurrency market is a very volatile space. Indeed, Bitcoin and other virtual currencies can fluctuate a lot during periods of volatility. This is why it is important for traders to understand what Mark Price and Last Price mean. The Last Price makes reference to the last price at which a specific contract was traded. This would calculate the realized profits and losses (PnL) you have. Meanwhile, the Mark Price would be useful in order to avoid price manipulation in the market. Liquidation prices and unrealized PnL are calculated using the Mark Price, which gathers data from a wide range of data providers in the market. You can select in your account which price you would like to use as the trigger, whether the Last Price or the Mark Price.

Orders Available For Traders

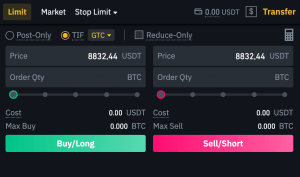

There are different orders that traders can place while trading with Binance futures. This is going to make it easier for traders to find the solutions they need and to perform the trade that they are looking for. Some of the orders available and offered by Binance include Limit Orders, Market Orders, Stop-Limit Orders, Stop-Market Orders, Take-Profit-Limit Orders, and Take-Profit-Market Orders.Limit orders make reference to the ones in which a trader sets a price for the asset he wants to buy or sell and waits until the trade gets filled. It can take a long time or be done in just a few seconds after the order it is placed. This will depend on the price established. Market orders allow traders to buy or sell an asset (in this case a contract) at the current market price. It is worth mentioning that these orders tend to have higher fees than limit orders due to the fact that the trader will be taking the current liquidity from the order book. Stop limit orders would allow you to place a limit order as soon as the price reaches a stop price that you previously select. Once the price of the asset reaches that stop order, the limit order will be placed in the order book. Stop market orders work in a similar way to stop limit orders. This option help users place a market order once a stop price is reached by the asset. Take-Profit-Limit orders are those that need a trigger price and a limit price. This kind of order can be used to reduce open positions. This can be very useful to manage risk and lock in profits as soon as the asset reaches specific levels in the market. In a similar way, the take-profit-market order will offer users the possibility to get a trigger for their order using a stop price.

Binance Future Additional Features

As we have shown you in this guide, the goal was to introduce you to the main features offered by Binance Future and how it is possible to easily get an account on this exchange. In this section, we will share with you some other features and characteristics of the Binance Futures platform that may be interesting for you.The Binance Futures Calculator will allow you to get more precise information about the trades you are entering, specific long and short positions. At the same time, you will have to provide the leverage level that you are using while trading through this platform. There are three tabs that would help you handle the Binance Futures Calculator, including the PNL tab, the Target Price tab and the Liquidation Price tab. The first one will be used to calculate the initial margin, profit and loss, and return according to the entry and exit prices. Of course, this will also take into account the number of funds that you are transacting. The Target Price will be using the tab to calculate the price that you will need in order to exit your position. That would give you a percentage return on the investment you have done. Finally, the liquidation price tab will be calculating the estimated liquidation price according to the balance you have and the position you are managing. Auto-deleveraging is also an important thing that Binance is offering to users. With it, users can be protected when there is increased volatility in the crypto market. While Binance works with an Insurance Fund, in some cases, the most exposed traders (those with large positions and high leverage) can get their positions reduced.

Trade With AltSignals

AltSignals will provide you with crypto trading signals that would allow you to better trade in the cryptocurrency market. By using AltSignals’ services, you will receive great information about when to enter the crypto market, open a position or exit a trade. In the last months, they have given great profits that can be seen in their monthly reports. For example, BitMex trading signals sent by AltSignals allowed users to get a profit of 6.777% in January 2020.

Conclusion

Binance continues to expand in the cryptocurrency market and now it is offering Futures Trading for users. In this article, we aimed at showing you how to better trade virtual currencies and how to use these new solutions provided by Binance. At the same time, we have explained to you the basics about Futures trading and how it is possible to improve your trading strategies while using AltSignals crypto trading signals.