The first Bitcoin ETF (exchange-traded fund) in the United States (US). ProShares Bitcoin Strategy ETF was launched to the market on Thursday, October 19 after receiving official approval from the U.S. Securities and Exchange Commission (SEC) last week.

During the first trading session, the ETF became the second-highest ETF in terms of volume. This was also one of the largest debuts on the New York Stock Exchange (NYSE) and it is expected to become one of the most traded instruments in the coming years.

Disclaimer: the information shared by AltSignals and its writers should not be considered financial advice. This is for educational purposes only. We are not responsible for any investment decision you make after reading this post. Never invest more than what you are able to lose. Always contact your professional financial advisor.

Bitcoin ETF Approved, What Does it Mean for BTC?

After several years with projects and companies proposing an ETF to the U.S. SEC, the first one (ProShares Bitcoin Strategy Fund (BITO)) was finally approved. It was not only the first Bitcoin ETF to be approved but it was also the second-largest in terms of volume during the opening day.

There have been 23,103 million shares traded worth $950 million during the first Tuesday session. It is worth mentioning that the share closed at a price of $41.89 after being released at a price close to $40.

The ETF is a futures-based product that does not rely on the price of the spot market. Usually, Bitcoin futures have a different price compared to the spot price. Despite that, the sentiment seemed to be positive as seen in the trading volume for this instrument.

Thanks to it, investors in the United States will be able to get exposure to Bitcoin and the cryptocurrency market without having to hold the underlying product and think about custody and how to protect it.

According to Chen Arad, COO of Solidus Labs, the futures ETF performed well and attracted a large number of investors. About it, Arad stated:

“As could be expected from a highly anticipated and highly discussed new product, the futures ETF is performing well, and attracting many investors who are looking for prudent ways to get more exposure to crypto. But the bigger significance is the strong signal it gives for increased regulatory approval and adoption of Bitcoin and crypto as a whole, indicated by the general price increases.”

Bitcoin Price

Of course, the official launch of the first Bitcoin ETF to be released in the United States had a positive impact on the Bitcoin price (spot). Investors were very bullish about the official approval of a Bitcoin ETF and it finally happened.

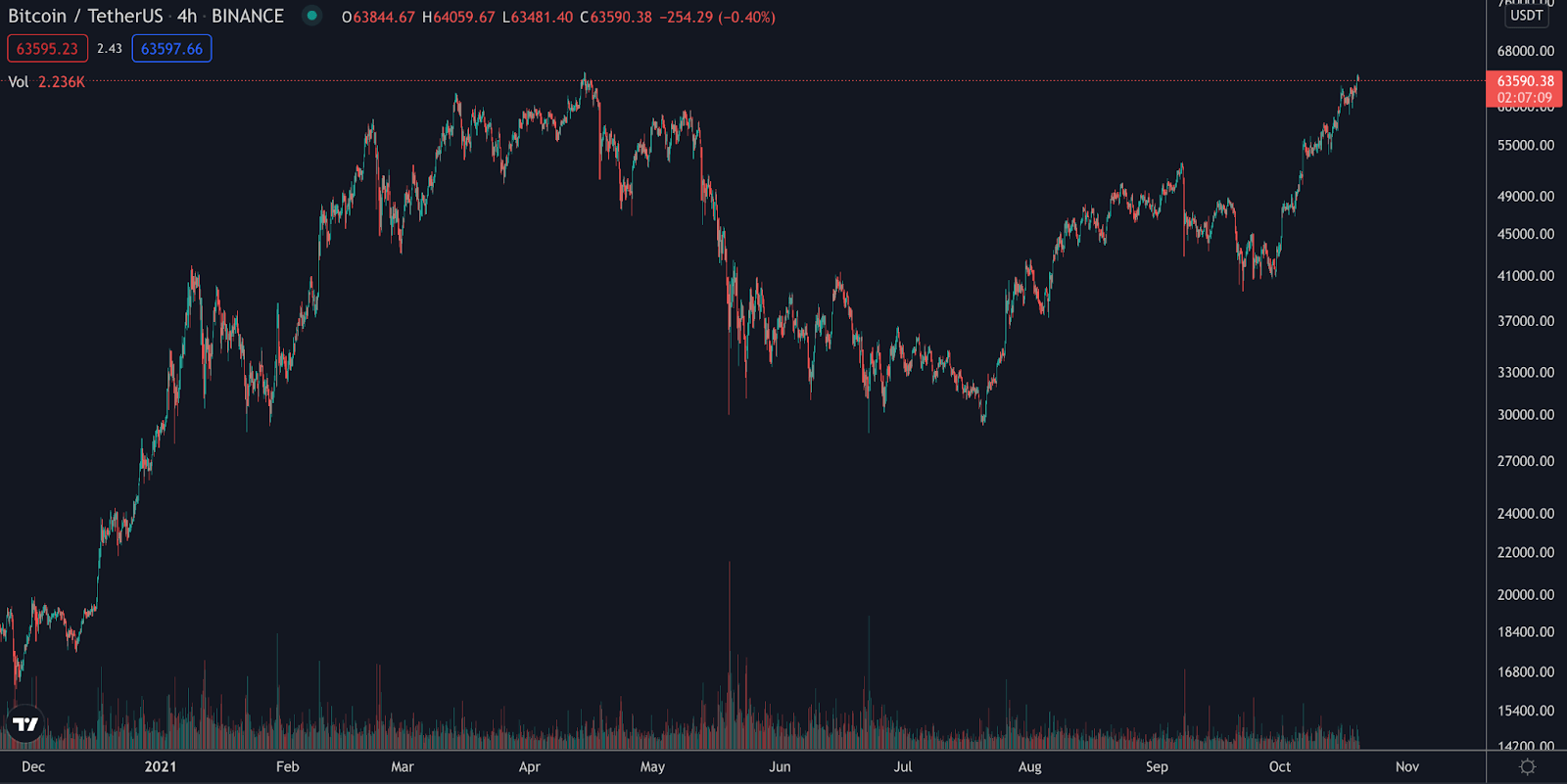

As we can see in the chart above, the 4-hour BTC/USDT trading pair has been moving higher in recent weeks (October). This shows that there has been a strong positive sentiment about a possible approval of a Bitcoin ETF. Several analysts and experts were already talking about this possibility and it finally happened.

Bitcoin’s price is now close to an all-time high as it has been very close to surpassing $64,500. Indeed, the virtual currency has surpassed new all-time highs when compared to other major currencies such as the Euro (EUR) or the Australian Dollar (AUD). This shows that Bitcoin could continue growing in the coming days and weeks.

According to PlanB’s Stock-to-Flow model, Bitcoin was poised to hit $47,000 in August, $43,000 in September and $63,000 in October. This is indeed what happened in recent months. But the most interesting thing is what could happen in the coming weeks.

As per PlanB, Bitcoin could go to $98,000 in November and surpass the $100,000 barrier after reaching that milestone. In December, Bitcoin could eventually hit $135,000 per coin. Although this might not happen, the Stock-to-Flow model seemed to have properly predicted Bitcoin’s price action in recent months.

What’s Next?

It is just a matter of time to see what will happen with Bitcoin’s price in the coming months. However, one thing is clear. Bitcoin is now available for investors that want to get access to Bitcoin’s exposure and do not want to carry with the responsibility of custody of the coins themselves.

Moreover, with a Bitcoin ETF, investors operate in a heavily regulated market where financial regulations apply and where investors are protected. In terms of price, we can only wait and see what could happen in the next months and years.