There are several indicators and trading tools that are allowing us to trade stocks, cryptocurrencies and in the forex markets. One of these technical indicators includes the Ichimoku Cloud, which shows important information about support and resistance levels as well as momentum in a specific trend.

While using this trading tool can be very useful, it is always worth adding further tools to perform our technical analysis. There is no perfect technical tool that would allow us to understand the markets. However, if we use several of them we could have a more accurate situation of what the price of an asset is trying to show us.

The indicator was created by Goichi Hosoda, a Japanese Journalist that was analyzing charts and the price of stocks.

Disclaimer: the information provided in this guide shouldn’t be considered investment advice. This is just for educational purposes only. Never invest more than what you are able to lose and always request information from a professional advisor.

Read More: top 3 RSI Strategies you MUST Know

What is the Ichimoku Cloud?

The Ichimoku Cloud, as previously mentioned, is a trading indicator that helps individuals and traders better understand how the price of an asset can work. The main features of this indicator include the formation of a Cloud which show two different lines. These lines make reference to the 26-MA and 56-MA. At the same time, it includes a lagging line that will be sharing the closing price of an asset.

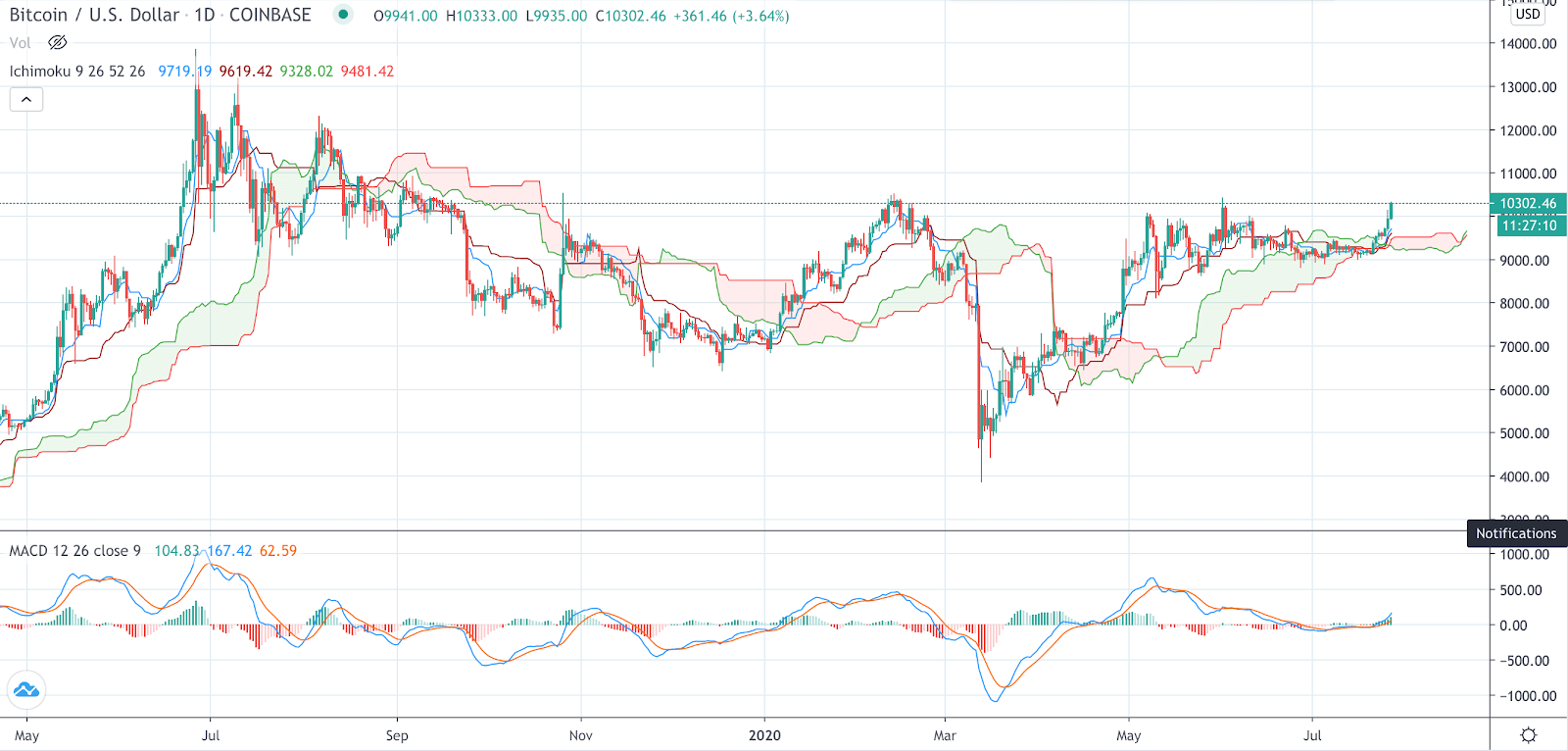

The main information that this indicator provides to us is the possibility to understand whether the trend is bullish or bearish. At the same time, it helps us to understand momentum. When the price of an asset is above the Ichimoku Cloud, the market is in an upward trend. If the upper line moves upwards in a bullish period, then we can conclude the momentum continues to be positive.

In a similar way, if the price of an asset is below the Ichimoku Cloud, we can say we are in a bear trend. If the bottom line continues moving downward, then the momentum remains for the bear side of the market.

You can see in the following image how the different features of the Ichimoku Cloud allow us to understand trends and their momentum.

In addition to it, the Base Line (which is shown in red in the above image) would provide valuable information about trend continuation. If we see the price falling below this Base Line, finding support in the cloud and moving higher in a few hours, we could consider that the trend will continue in the same direction rather than changing.

Thus, this can be very useful to understand whether a trend is ending or not. Moreover, it can help us get the best signals on how the trends will continue. If instead, the price is not able to come back to the previous levels, then we should start thinking about a trend reversal or at least a pause in the trend.

Due to this reason, it can give information about the momentum that there is in a specific trend and not only information about the direction of the trend. Of course, there are more advanced use cases of the Ichimoku Cloud that are too complex or long to be explained in this basic and introductory guide.

Resistance and Support Levels

The Clouds that get formed are going to be regions where the price will find both resistance and support. This is going to be very important considering that in many occasions, the price of an asset wants to break through the cloud and it cannot do so. Thus, understanding these things would help traders make better decisions in the long run.

When the price of an asset is falling and it tries moving higher and finds itself getting inside the cloud, then we could expect to see some resistance. The same would happen if the price of an asset is falling and it founds itself trying to break through the cloud.

Conclusion

The Ichimoku Cloud is one of the most advanced tools users can use to trade cryptocurrencies, stocks and also in the forex market. With all the information provided by the Ichimoku Cloud, users will be able to get information about trends, momentum and also support and resistance levels.

All this data can be well combined with different charts such as bars or candles. Traders will find it also very useful when they need to create their trading strategies using other indicators.