The commodities market is recognized for its strong fluctuations, especially in the case of gold. Since placing an order at the wrong time could lead to a negative trade, we must analyze the best time of day to expect the best results.

The good news is that if the XAU / USD pair shows a lot of volatility, it means that there is liquidity in the market and there can be many trading opportunities. Remember that trading in periods of low liquidity will limit our options to place orders and could put the market against us.

Disclaimer: this article shouldn’t be considered investment advice. This has been written for educational purposes only. Never invest more than what you are able to lose and always request professional advice.

When should I trade gold?

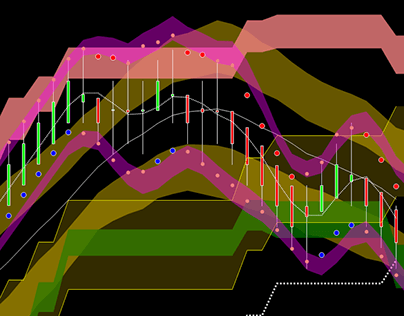

We can denote lack of liquidity in the chart because (apart from the fact that the volume is low) the sails are more squared and the shadows always reach the same points. Moving in liquid assets is dangerous because with “little” money they can easily sweep us away and the slips between the price we want and the one we obtain can be brutal.

On the other hand, we can target possible entry points when the market presents high liquidity indices, which we can notice due to a high volume and prominent candles with a marked trend. Although gold is almost a 24-hour active market, the most liquid period to enter trades is during New York time, from 7:00 to 17:00 GMT.

Typically, the XAU/USD pair sits in a range and fluctuates from support to resistance until it breaks one of these levels and starts a solid trend. A good trading opportunity is to wait for the price to bounce off a resistance and drop to a support. If this support is exceeded and the price marks strong bearish candles, it is a good indication to place a short order.

If the price fails to search for support points and breaks resistance instead, it is an excellent opportunity to place a long order. As we have mentioned, as long as there is high volume, the opportunities in the market will be more solid and trends can continue their course.

Recommendations

- The most important trading centers in Europe and the United States overlap in a specific period, which can also be used to find opportunities. Generally, from 1:00 p.m. to 5:00 p.m. is when we can see the most gold activity.

- Overlapping the Asian and European markets from 7:00 to 9:00 can also form strong candlestick patterns, supported by strong volume acting in response to European market data.

- The extent of your gold earnings will depend on your target. If you are looking to make a juicy profit with short courses you should analyze possible opportunities during these overlapping periods, although if you want a long course (100 pips or more) you will have to pay attention to the chart at a higher timeframe, in order to plan your target to through the most liquid hours.

We must emphasize that in times of crisis, the price of gold is heavily affected by fundamentals, so it is necessary to educate yourself on the latest events and news to shield ourselves against possible unforeseen trends. On the other hand, we have to be careful when executing our operations, since under no circumstances can we skip the stop loss or change our risk management to continue betting on a position.

The best plan to follow if the price of gold turns against us is to let the market take its course, assume losses (which will be limited by our stop loss) and wait for a new opportunity, which will not be difficult considering how much that gold fluctuates on a daily basis.